Let’s discuss some sobering projections on the cost of Medicare and Medicaid.

Long Run Projections

The American Enterprise Institute (AEI) discusses a Unified Long-Run Macroeconomic Projection of Health Care Spending and the Federal Budget.

MPW stands for AEI authors Mantus, Pang, and Warshawsky.

CMS stands for Centers for Medicare & Medicaid Services, which has every incentive to understate costs.

The AEI projections start on page 24.

Base Model Projections

As shown in Figure 11, the projected ratio of national health expenditures to GDP increases from around 18 percent in 2021 to 20.8 percent in 2032, 26.2 percent in 2052, and 41.5 percent at the end of the horizon.

The total government share of health care spending (not shown) is projected to increase from 61 percent to 65 percent, largely as a function of the larger role of public spending in the health care provision for the aged, holding current policy constant. CMS has a lower share of health spending in GDP in the out-years, even without government price controls (illustrative alternative).

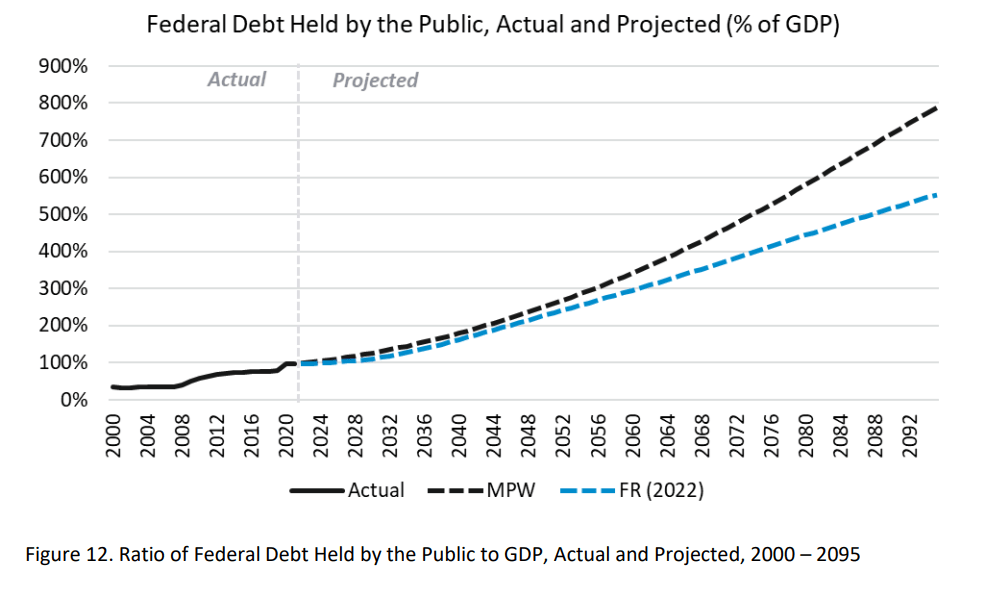

Federal Debt as a Ratio to GDP

Figure 12 shows projected federal debt as a ratio to GDP. It increases from about 100 percent currently to 135 percent in 2032, 268 percent in 2052, and 785 percent at the end of the projection period; the Financial Report (FR) reports a projected level of debt of around 570 percent of GDP in 2095. These levels are unprecedented for the US and even for other large countries with currently high ratios, such as Italy, at around 150 percent, and Japan, at around 250 percent. It is also worth noting that Japan has an exceptionally high domestic savings rate. Whether the bond market and foreign and domestic investors would support such high federal debt for the US, rising steadily over time, even with no financial crises, is unlikely in our opinion, but it is unknowable in advance when break points will occur. According to our model, these debt levels increase interest rates and thus depress investment and capital stock formation and, as we will see below, consumer welfare. Although there is assumed to be an increase in private savings, that is not enough to offset the effect of deficits.

Ratio of Government Health Spending to GDP

Official projections include the impact of an assumed relative price increase, but it is smaller than produced by our model and trends downward, whereas we find the relative price increases, on average, at 1.2 percent per year with this annual rate of growth increasing from about 1 percent to 1.5 percent, as shown in Figure 18. The underlying low productivity growth in the health care sector plays a role in this trend. The main driving factor, however, is the increasing scarcity of labor. Future demographic conditions lead to both a slowdown in the growth of the labor force and an increase in the demand for health care. With the lack of substitution of capital for labor, on top of low productivity growth, the health care sector takes a larger and larger share of the economy’s labor, drawing from the “all other” sector where labor could have been substituted for capital, whose stock is being starved by the growing deficit. The labor share for health care services rises from just under 10 percent in our base year to 27 percent by the end of the period. This absorption of labor increases the rate of growth in the relative price of health care. This is a prime example of Baumol’s cost disease but with a vicious dynamic twist given future demographic conditions.

Comparison of Official Projections

CBO is the Congressional Budget Office. OECD stands for the Organization for Economic Cooperation and Development.

CBO does short-term (10 year) and medium-term (30 year) projections of the budget (revenues and outlays and debt) of the federal government. In its annual projections of May (short-term) and July (medium-term) 2022, CBO notes that the projected deficit in 2022, at 3.9 percent of GDP, was smaller than the record amounts in 2020 and 2021, and projected it would decline again to 3.7 percent in 2023. (Note, however, that these projections assumed continued low interest rates and high asset prices – assumptions clearly belied by experience in the past year.)

Subsequently, deficits increase, so that deficits average 5.1 percent of GDP over the 2023-2032 decade. They further increase to 7.4 percent of GDP in the 2033-2043 decade and to 10 percent in the 2043-2052 decade; in 2052, the deficit is projected to be 11 percent. The projected growth in total deficits is driven in part by increases in interest costs, as net interest outlays more than quadruple, rising from 1.6 percent of GDP in 2022 to 7.2 percent in 2052. Social Security and Medicare are part of the cause too – Social Security’s spending increases from 4.9 percent in 2022 to 5.9 percent in 2032 to 6.4 percent in 2052 and its contribution to the deficit increases from – 1.0 to -1.5 to -1.8 percent of GDP over the three decades of the CBO horizon. Medicare’s contribution to deficits is even larger, increasing from -2.3 to -3.4 to -4.1 percent of GDP over the projection periods. Note that CBO has a more pessimistic view of the finances of Social Security and Medicare and the overall economy than the Trustees.

Baumol’s Disease

Please consider Revisiting Baumol’s Disease: Structural Change, Productivity Slowdown and Income Inequality

The growing importance of services has led to significant structural change in advanced economies, with the service sector now accounting for the largest share of employment in developed countries. In his seminal model of the so-called cost disease of services, William Baumol noted that the prices of services, especially in health, education, arts and culture, tend to rise faster than the prices of material goods. Central to his model is the disparity in labour productivity growth rates between stagnant and progressive sectors. Baumol’s model sheds light on the reasons behind the rising cost of services and provides a deeper understanding of its economic consequences. This article argues that Baumol’s model of the cost disease of services retains its explanatory power and relevance today. It refutes criticisms that productivity growth in services is mismeasured and underestimated and that the increasing importance of services as inputs in manufacturing renders Baumol’s model irrelevant. Instead, the article argues that Baumol’s model can highlight the overlooked consequences of rising income inequality, particularly the severe impact of the cost disease, which disproportionately affects the poorer segments of the population.

Simpler Explanation

Forget Baumol’s Disease. I have a much simpler explanation. Government and labor unions both add costs and inefficacies to anything they touch.

Look no further than the costs of education vs the cost of a chicken or round steak. When I started college in 1971, the cost of tuition at the university of Illinois was $250 per semester.

I worked at a grocery store at the time. Round steak on sale was a loss leader at $1.00 per pound. I bought it on sale a few weeks ago for $2.99 per pound.

Tuition is now $9,090 per semester.

The government has no idea how to run Medicare or Medicaid. The programs are rife with fraud.

The Corruption and Incompetence of Chicago’s Mayor Has No Bounds

Regarding the cost of public education, please see The Corruption and Incompetence of Chicago’s Mayor Has No Bounds

Chicago mayor Brandon Johnson stepped to new lows when his hand-picked board fired Chicago Public Schools (CPS) CEO Pedro Martinez without cause.

Public unions, mayoral graft, and gubernatorial graft have bankrupt the city, the state, and all the pension in the city and state.

Also note that In Chicago There’s Under a 50 Percent Chance Police Show Up If You are Shot

Good luck in Chicago getting the police to show up if you are shot, stabbed, a victim of domestic violence, or any number of other serious crimes.

Team DOGE

There is one heck of a lot of waste, fraud, and corruption. I sure wish DOGE success.

But unless they address Social Security, Medicare, and Medicaid, the most success they can have is picking around the edges of a massive deficit hole.

Importantly, DOGE has no power to do anything. And they haven’t really come up with anything that hasn’t already been proposed.

The problem is not lack of ideas. The problem will be getting those ideas to pass Congress with the slimmest of slim majorities.

Rude Awakening for Trump, No Business as Usual Applies to Him Too

Meanwhile, please note Rude Awakening for Trump, No Business as Usual Applies to Him Too

No business as usual applies to Trump as well. 36 reps refused to go along with Trump’s demand to eliminate the debt ceiling.

That’s a good thing. But I keep coming back to this: On December 18, I asked Do You Have Any Faith that Sheriff DOGE Will Reduce the Fiscal Deficit?

Trump’s own proposals would add trillions of dollars to the deficit. Democrats may go along with some of them. But they won’t go along with social budget cuts.

It is going to be very difficult to reduce the deficit, when Trump’s own proposals would add to it and Democrats are screaming “Medicare for All”.