Canada and Mexico plan precision responses to Trump’s tariffs. What about prices and GDP?

Modeling the Economic Damage

The PIIE says Trump’s threatened tariffs projected to damage economies of US, Canada, Mexico, and China

We examine what President-elect Trump’s threats, if carried through, might mean for the economies of the US, China, Mexico, and Canada using G-Cubed, a multi-country, multi-sector hybrid dynamic stochastic general equilibrium-computable general equilibrium model.

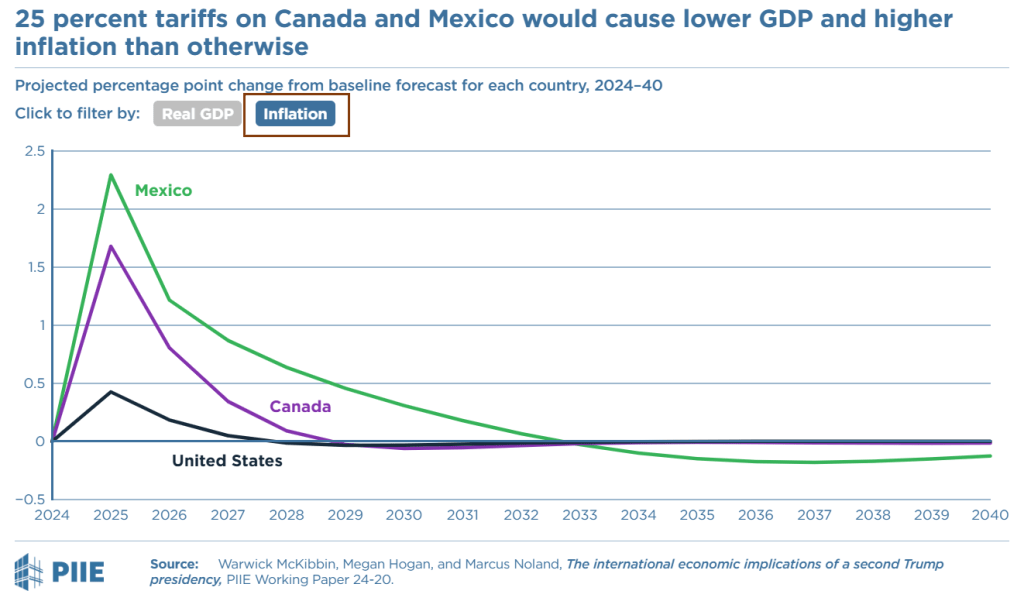

We begin with the threat to impose a 25 percent tariff on all goods from Mexico and Canada.

The [lead image] shows that the imposition of tariffs would slow growth and accelerate inflation in all three countries. For the duration of the second Trump administration, US GDP would be around $200 billion lower than it would have been without the tariffs. Canada would lose $100 billion off a much smaller economy, and at its peak, the tariff would reduce the size of the Mexican economy by 2 percent relative to its baseline forecast.

Higher Inflation

However, these figures likely underestimate the real damage to the three economies, which are highly integrated—but asymmetrically, with Mexico and Canada being much more dependent on trade with the US than the other way around. Intermediate goods—especially in motor vehicles—cross the borders multiple times before final assembly. The imposition of tariffs at each stage of fabrication would be disastrous.

In the case of Mexico, exports account for roughly 40 percent of its GDP, and roughly 80 percent go to the US. Approximately 16 percent of national value-added is sent to the US in the form of exports, the most of any major trading partner. In essence, Mexico ships one-sixth of its annual economic output to the US in the form of exports.

Many of those exports originate in maquiladoras within 30 miles of the border. This economic activity is geared to serve the US market, making Mexico far more vulnerable than say a large industrial country like Germany that operates globally and could more easily reorient its exports. For Mexico, a 25 percent tariff would be catastrophic.

Moreover, the economic decline caused by the tariff could increase the incentives for Mexican immigrants to cross the border illegally into the US—directly contradicting another Trump administration priority.

The PIIE said “But there are reasons to believe that Trump will not carry out his threats.”

That was my position as well. And some cooler heads in the administration tried to talk Trump out of action.

But here we are.

Retaliation from Mexico, Canada, and China

Whereas I was sure of retaliation from Mexico and Canada, the PIIE incorrectly thought otherwise.

Figure 2 [above] shows the damage that an additional 10 percent tariff could inflict on the Chinese and US economies. But unlike Canada and Mexico, for which retaliation would be inconceivable, China has retaliated in the past and would likely do so again. For analytical simplicity, we assume that retaliation is tit-for-tat, though China would obviously have other options. Figure 2 also shows the results of a retaliation scenario (dotted lines).

If the US imposed an additional 10 percent tariff on China and China responded in kind, US GDP would be $55 billion less over the four years of the second Trump administration, and $128 billion less in China. Inflation would increase 20 basis points in the US, and after an initial dip, 30 basis points in China. The initial fall in inflation in China is caused by a temporary tightening of Chinese monetary policy aimed at offsetting the depreciation of the Chinese currency.

The PIIE did not estimate the impact of retaliation from Mexico and Canada, so all of the above numbers are undertated.

Global Pain and Targeted Response

The Wall Street Journal reports Canada, Mexico Want America to Feel the Pain of Tariffs Too

America’s neighbors to the north and south are much smaller economies, with their combined gross domestic product equaling just one-seventh of the U.S.’s $27 trillion. The tariffs risk pushing the U.S.’s top trade partners into recession, as both nations send 80% of their exports to their bigger partner. The Canadian dollar and the Mexican peso are likely to weaken against the U.S. dollar.

“Shooting yourself in the foot!” Mexico’s Economy Minister Marcelo Ebrard wrote on X late Saturday, in response to the U.S. tariffs.

Late Saturday, Canadian Prime Minister Justin Trudeau said his country would impose 25% tariffs on more than $105 billion of U.S. goods. A first wave would hit $20 billion of imports from the U.S., including alcohol, coffee, clothing and shoes, furniture and household appliances. A second wave on another $85 billion of goods would include tariffs on cars and trucks, agricultural products, steel and aluminum and aerospace products.

Trudeau warned Americans that jobs in their auto and manufacturing industries were at risk.

“We’ll always do what’s necessary to defend Canada and Canadians,” he said. “We didn’t ask for this, but we will not back down.”

He said that he spoke with Mexican President Claudia Sheinbaum and that the two leaders agreed to work together to deal with Trump’s actions. Sheinbaum said Mexico’s response will include tariff and non-tariff measures, which aides said would be outlined soon.

Mexico’s government is considering so-called carousel retaliation, which would periodically rotate the U.S. products subject to retaliatory tariffs, one official said. This generates uncertainty in U.S. export sectors and has a political impact when hitting sectors such as agriculture that are likely to lobby Congress.

A senior Canadian government official said Canada felt it had to go big in response to Trump’s maximalist approach. The official noted that U.S. tariffs are in some ways like a 2022 border shutdown when truckers protested government Covid-19 measures by blocking border crossings. U.S. auto factories had to quickly halt production.

“The key to retaliation is that they don’t affect your country’s economy and consumer prices, and that your retaliatory duties have an economic and political impact on the U.S.,” said Kenneth Smith Ramos, a former top Mexican trade official.

“Trump is taking aim at Canada and Mexico, but it’s a direct hit on Michigan, Ohio, Indiana, Tennessee, any state where they make autos,” said Flavio Volpe, president of Canada’s Auto Parts Manufacturers’ Association. “It’s impossible to be profitable tomorrow with tariffs on Canadian and Mexican parts. And the only thing more impossible is to replace them within 18 to 24 months.”

Losing Less Is Not Winning

If you lose your right arm and your neighbor loses his left leg, that is not winning.

But some people seem to think so.

One reader commented “Roughly 75-80% of the things Canada and Mexico make come to the USA. Only 24-28% of the things we import come from Canada/Mexico. Can you say leverage?”

I responded “We lose 25% and they lose 75%. Fools label this winning”.

Will Trump Honor Any Deal He Signs?

Trump bragged that the USMCA trade deal he negotiated with Canada and Mexico was the best trade deal in history.

Poof. Now he says otherwise on preposterous grounds. Thus, there’s no reason to believe Trump will honor any deal that he makes, and every reason to believe he won’t.

And it’s the key reason I was skeptical he would act as foolish as he is.

Losing Respect

Real Clear Politics says Trump’s Big Stick Strategy Will Make America Respected Again

What nonsense. One does not gain respect by breaking treaties and punching neighbors.

Similarly, the playground bully is not respected but is feared. RCP confuses respect with fear.

US Exports and Imports

How Should Canada and Mexico Respond?

If I was Mexico, I would respond by cutting off 100 percent of optical, photo, technical, and medical apparatus.

That’s a mere $22 billion in exports. This is something I know quite a bit about, and it would cripple US medical operations.

Alternatively, Mexico could try halting not all auto trade but rather some key part the US auto companies need.

If Canada shut off oil exports, that would cripple US refining operations. But it would also hit Canada hard. I have a detailed post on energy imports and exports coming up.

Note that imports from Canada are $412 billion and exports to Canada are $351 billion. The US imports $132 billion in energy products from Canada.

So, other than crude, the US actually has a trade surplus with Canada, making this aspect of the trade war all the more idiotic.

What About China?

China’s main imports from the US are agricultural products. Perhaps that is what Trump fears by going lighter on China than Mexico and Canada.

But grains are not China’s big threat.

China can easily halt exports globally of all rare earth elements.

China’s Puts Export Curbs on Minerals US Needs for Weapons and Technology

On November 21, I commented China’s Puts Export Curbs on Minerals US Needs for Weapons and Technology

In a warning shot to the Trump administration, China tightens export controls on some dual-use minerals.

China Halts Rare Exports Used by US Technology Companies and the Military

On December 3, I noted China Halts Rare Exports Used by US Technology Companies and the Military

This is China’s advance salvo at Trump tariffs. It comes one day after the Biden administration expanded curbs on the sale of advanced American technology to China.

Also consider a Critical Materials Risk Assessment by the US Department of Energy

According to the analysis, there are six critical materials in the short term, which include cobalt, dysprosium, gallium, natural graphite, iridium, and neodymium. The uses for these critical materials are spread across rare earth magnets, batteries, LEDs, and hydrogen electrolyzers.

There are nine near-critical materials, which include electrical steel, fluorine, lithium, magnesium, nickel, platinum, praseodymium, silicon carbide (SiC), and uranium.

Finally, there are seven noncritical materials including aluminum, copper, manganese, phosphorous, silicon, tellurium, and titanium.

There are 12 critical, six near-critical, and four noncritical materials in the medium term.

The US Department of Energy has placed some of the rare earth minerals we need for weapons systems, windmills, batteries, and aircraft on a critical materials list.

The US gets around those export curbs by importing rare earth elements from other countries.

However, nothing stops China from a complete shutdown of all rare earth elements, and China controls about 80 percent of global supply.

Related Posts

On January 31, I noted Seven Charts Show Tariffs Would Harm the US Auto Industry

The CATO institute does a great job explaining why tariffs on Canada and Mexico would be a very bad idea.

New Tariffs on Computer Chips and Semiconductors

Also note Trump Announces New Tariffs on Computer Chips and Semiconductors

It’s not like we can get advanced chips anywhere else. Thus, US customers will pay more than anyone else in the world for chips, and computers too.

How exactly is that supposed to help the US?

What PIIE Missed

The PIIE estimates of potential economic damage is best described as stagflationary. PIIE lowers GDP of every country and raises inflation in every country.

It’s worse than described because PIIE made the false assumption Canada and Mexico would not retaliate. Nor did PIIE factor in the impact of higher prices for microchips and computers.

Thus, the economic damage to the US is greater than PIIE assumes.

Importantly, the PIIE did not factor in the possibility that Mexico would shut off delivery of medical supply kits, that China would shut off rare earth exports, or that Canada would shut off supply of crude or lumber.

If any of those things happen, but especially a shutdown of rare earths, we are in the realm of instant global recession.

Finally, I do not know how to calculate, nor does anyone else, the global economic costs when signed deals are meaningless.

But don’t worry, I have it on good authority that “Trade wars are good and easy to win.”