Trump and Biden are each their own worst enemy. This post is about Trump’s latest tariff gaffe. But he has made similar nonsensical claims before.

The Math Doesn’t Add Up

Trump proposed 10 percent tariffs across the board with 60 percent on China.

The Tax Foundation thoroughly trashes Trump’s latest proposal in its report, Five Things to Know about Trump’s Tariff and Income Tax Proposals

Last week, former President Trump took his affinity for tariffs much further, floating the possibility of entirely replacing the federal income tax with new tariffs. He also raised other ideas like eliminating taxes on tipped income and lowering the corporate tax rate by one percentage point. Rather than constituting a fiscally responsible and coherent tax reform plan to boost growth and competitiveness, the latest ideas lack seriousness and merit. If pursued, they would fall well short of fundamental tax reform while hurting American workers and businesses.

1: The Math Doesn’t Add Up

The individual income tax raises more than 27 times as much revenue as tariffs currently do, but it’s not the gap in revenue levels that makes replacement impossible.

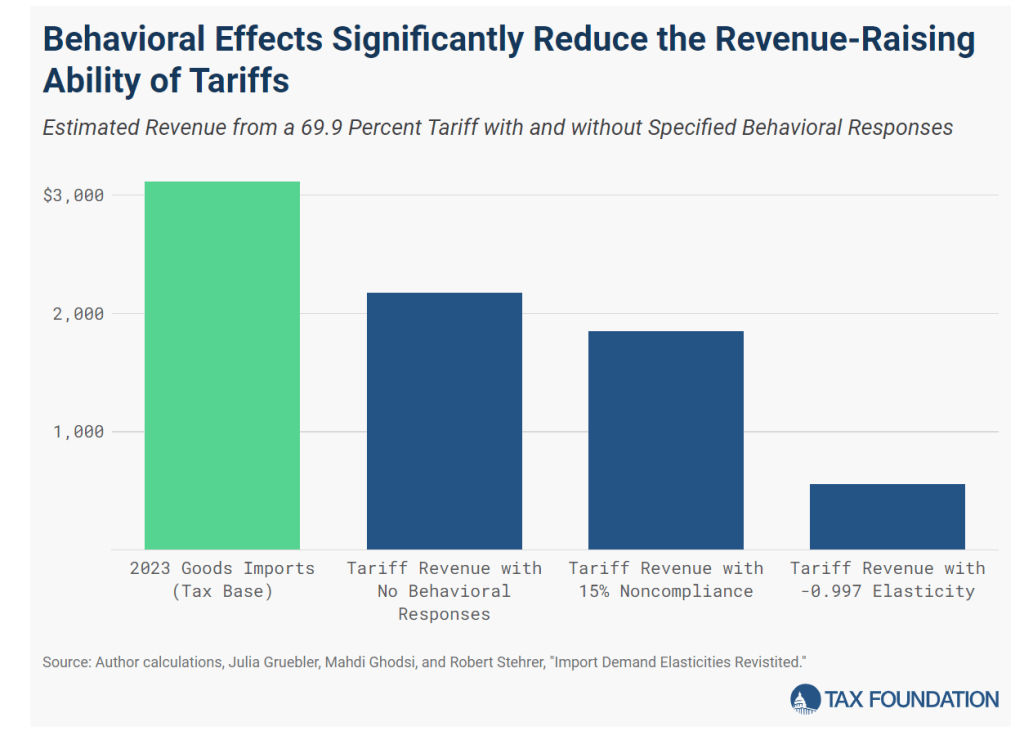

An across-the-board tariff hike of 69.9 percent [not just China] on the level of goods imports from 2023 ($3.1 trillion) seems like it could fully replace individual income tax revenues. But that calculation is a significant understatement. It fails to account for several factors that would reduce how much revenue the tariff would raise, including noncompliance and the behavioral response of people reducing how much they import.

- Assuming 15 percent noncompliance, revenue from a 69.9 percent tariff falls to $1.8 trillion

- Assuming an elasticity of -0.997 percent, revenue drops to about $560 billion (imports drop by slightly less than 1 percent for a 1 percent price increase)

Replacing the individual income tax with tariffs is thus completely unrealistic—and the above illustration doesn’t even account for additional factors that would further reduce the revenue raised, like holding the price level constant (which requires the calculation to use the inclusive tax rate), tax offsets, and the negative economic effect of higher tariffs.

2: Tariffs Were a Main Source of Revenue for a Drastically Smaller Government

Former President Trump has pointed to the tariff in American history as a motivation for his idea, but the federal government of a century ago is much different from the federal government of today—as is the American economy. Economists Chad Bown and Douglas Irwin have previously explained that tariffs have not been a main source of federal revenue since 1914, and it would be impossible to rely on tariffs for current spending levels.

3: Higher Tariffs Would Raise Costs for Americans

When the U.S. imposes a tariff, the person or business that imports the good is responsible for paying the tariff—not a foreign country or a foreign business. Depending on different factors, different people in the economy could bear the ultimate economic burden of a tariff. For example, suppose the U.S. places a tariff on dinnerware. If a U.S. retailer imports dinnerware, it must physically make the payment for the 25 percent import tariff on the plates it purchases. But the burden could fall elsewhere. If the foreign seller lowers its own prices to offset some of the tariff cost, it bears part of the burden. If the U.S. retailer raises its own prices, the people who buy plates and bowls from the store bear the tariff burden.

Recent studies on U.S. tariffs have found near 100 percent pass-through of the 2018-2019 trade war tariffs to U.S. importers. That means foreigners have not, directly or indirectly, paid U.S. tariffs—instead, the billions in import taxes raised by the U.S. government have been paid by U.S. businesses and consumers. The economic evidence leaves no dispute that even higher tariffs would further increase costs for American consumers and businesses.

4: Higher Tariffs Would Harm American Workers and Businesses

Even though tariffs cause higher prices for businesses and retail consumers, policymakers might argue that tariffs are worth it because they benefit some sectors of the economy enough to outweigh the harm of higher prices. That sentiment is mistaken. Tariffs have a net negative impact on the economy, which can happen through different channels.

For example, Federal Reserve economists Aaron Flaaen and Justin Pierce estimated the effects of the 2018-2019 tariffs on the U.S. manufacturing sector accounting for both the benefits of tariffs to protected companies and the costs of tariffs to companies that faced higher input prices or other distortions. On net, they found a decrease in manufacturing employment due to the tariffs.

5: Tariffs and Income Tax Exclusions Are Not Tax Reforms

Tax policy changes should aim to boost growth and competitiveness. Fundamental reform efforts to transform the U.S. income tax system to a flatter consumption tax system in that vein should be applauded. Unfortunately, Trump’s tariff and tax proposals are a far cry from that.

Policymakers drawn to Trump’s tariff and tax ideas should go back to the drawing board. Otherwise, they might squelch the opportunity for fundamental tax reform by pursuing unprincipled, economically harmful, and nonsensical ideas.

End Tax Foundation, Begin Mish

Everything above is from the Tax Foundation. Thanks! There is much more in the report but I clipped the essential pieces.

I am glad the foundation used the phrase “nonsensical ideas” because that is exactly what I knew to be true even before reading their report.

Mother of All Stagflations

“This is a prescription for the mother of all stagflations,” Summers said on Bloomberg Television’s Wall Street Week with David Westin in regard to replacing a major amount of income-tax revenue with tariffs. It would also create “worldwide economic warfare.”

I don’t often agree with Larry Summers, but that is my take as well.

It’s not the first time Trump has spouted tariff nonsense.

Trump Tweets “Trade Wars are Good and Easy to Win”

Flashback March 2, 2018: Trump Tweets “Trade Wars are Good and Easy to Win”

OK, If trade wars are good and easy to win, someone please ask Trump “Why didn’t you win them then?”

Flashback September 19, 2012

Since Trump raised tariffs massively, and Biden increased them, would someone please ask Trump “Why didn’t that reduce our deficit fast?”

Trump on Mexico, January 2017

Trump renegotiated NAFTA to his liking, calling it USMCA. Let’s discuss Trump’s success.

The US trade deficit with Mexico went from 78 billion to 152 billion since 2017.

In 2020, Trump’s USMCA went into effect. Since then the trade deficit went from 111 billion to 152 billion.

Is this winning easy or what?

For discussion of the above chart please see The Futility of the US Trade War With China in Two Pictures

OK, the US trade deficit with China is down a bit. But the deficit with just three countries (Mexico, Taiwan, and Vietnam) went from 132 billion to 305 billion.

Clearly, this is still more winning. And shades of Smoot-Hawley, Trump is willing to wreck the entire global economy to the tune of 10 percent across the board an 60 percent tariffs on China.

Nonsense Like This Could Cost Trump the Election

I have posted many times that renters (blacks and young voters hammered most by inflation) will decide the election.

That is still my base case provided Trump does not go overboard with nonsense.

Two Issues

Trump is clobbering Biden on two key issues, inflation and illegal immigration.

However, Trump’s tax proposal would be highly inflationary. Anyone with a bit of common sense, and even many dunces should be able to see that.

The average fence sitter or independent voter that Trump needs to win won’t buy into this scheme.

Trump needs to walk this issue back saying it’s just part of his plan or make some other excuse.

I Repeat, Two Issues

Trump desperately needs to keep the political debate as focused as possible on inflation and illegal immigration.

Instead, he made a tariff proposal even loonier and more inflationary than Biden’s. This isn’t good.

Why Angry Renters Will Decide the Election, Take II

On June 19, I repeated my base case Why Angry Renters Will Decide the Election, Take II

Unfortunately, my thesis may require Trump to stick to a reasonable message or for Biden to flat out keel over.

The way this is headed, we may need the latter.