There will be no Christmas mortgage repayment relief for home loan holders after the Reserve Bank of Australia (RBA) kept the official cash rate on hold in what was a widely-expected move.

In the post-meeting statement, the RBA’s board said underlying inflation remains “too high”, as it kept rates unchanged at 4.35 per cent for the ninth consecutive meeting.

“The November statement of monetary policy forecasts suggests that it will be some time yet before inflation is sustainably in the target range and approaching the midpoint,” the board said in its statement.

The RBA wants to curb inflation so it sits within its target band of 2-3 per cent.

Headline inflation came in at 2.8 per cent for the September quarter, but the RBA’s focus has been on underlying price measures, which have been slower to moderate. Underlying inflation was 3.5 per cent over the same period.

But the board said it is “gaining some confidence that inflation is moving sustainably towards its target”.

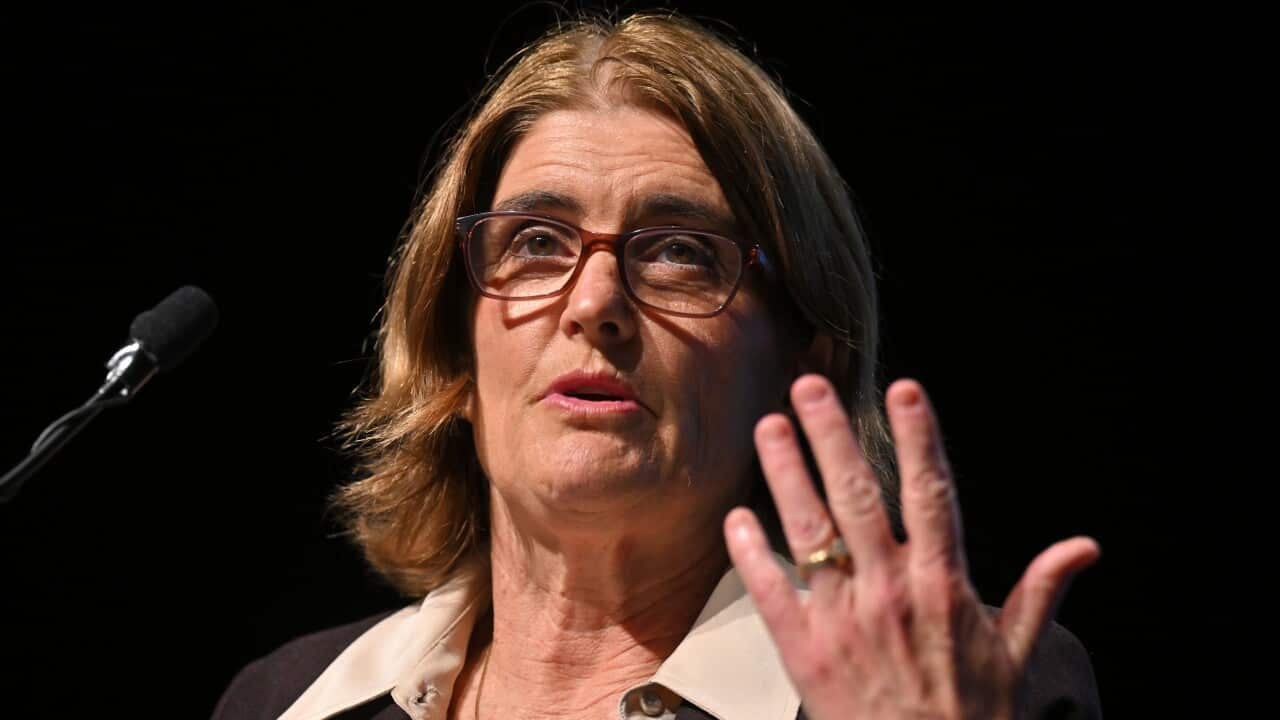

RBA governor Michele Bullock said this was reflected in the board’s statement on Tuesday after one reporter questioned why “vigilant” and “not ruling anything in or out” seen in previous statements had been removed.

November’s statement said it would be “some time yet” before inflation is sustainably within the RBA’s target band and that “reinforced the need to remain vigilant to upside risks to inflation and the Board is not ruling anything in or out”.

But Tuesday’s statement read: “It will be some time yet before inflation is sustainably in the target range and approaching the midpoint”.

Bullock said that was “deliberate” and that the board “wanted to give the message that they have noticed some of the data is a bit softer” — in some cases, softer than expected.

“We’re not saying what we might do but we are acknowledging that there is some softening and our forecasts see inflation coming back down gradually over the next year,” Bullock told reporters.

She added: “We are saying that we’ve got a bit more confidence that things are evolving as we think in our forecasts”

When can Australians expect a rate cut?

Mortgage holders have been keenly awaiting interest rate cuts and while economists and markets are in broad agreement the next move will be down, speculation over the timing of easing continues.

Financial comparison site Canstar’s data insights director Sally Tindall said this year has been incredibly tough for households with a mortgage, “particularly those that had very little in the tank to start with”.

“While there has been a small amount of relief from the stage three tax cuts and government electricity rebates, for many families that extra cash has barely touched the sides,” Tindall said.

NAB, Westpac and ANZ predicts interest rate cut won’t be until May, while the Commonwealth Bank tips February.

Tony Sycamore, market analyst at financial markets trading firm IG, said he is more optimistic.

“While it would be premature for the RBA to unroll its ‘mission accomplished’ flag, today’s dovish pivot has paved the way for a February rate cut,” Sycamore said.

Oxford Economics Australia’s head of macroeconomic forecasting Sean Langcake said the RBA’s board had become a little more hopeful on the outlook, observing some upside inflation risks had eased.

“Their statement noted that wage growth came in slower than expected in the September quarter, and that they are gaining confidence that inflation is moving sustainably toward target,” he said.

“But this does not mean rate cuts are imminent.”

Before lowering borrowing costs, the economist believes the central bank will want to see two more sets of quarterly inflation data showing easing underlying price pressures.

That brings the easing start date to May, in Langcake’s view.

The RBA noted that Australia’s economic growth has been at its weakest since the 1990s, outside the COVID-19 pandemic.

September quarter data shows the economy grew by only 0.8 per cent over the past year.

The RBA also says the labour market has been “tight” with unemployment lowering in the last three months and workforce participation rates at record highs, whilst wage growth has been softer than expected.

Tindall said the economy is on “life support”.

However, she said: “The continued strength in the labour market has given the central bank some much-needed time to get the inflation job done properly.”

“The RBA isn’t going to pass up this opportunity by cutting rates early,” Tindall said.

The RBA’s board will next meet in February, 2025.

With reporting by the Australian Associated Press.