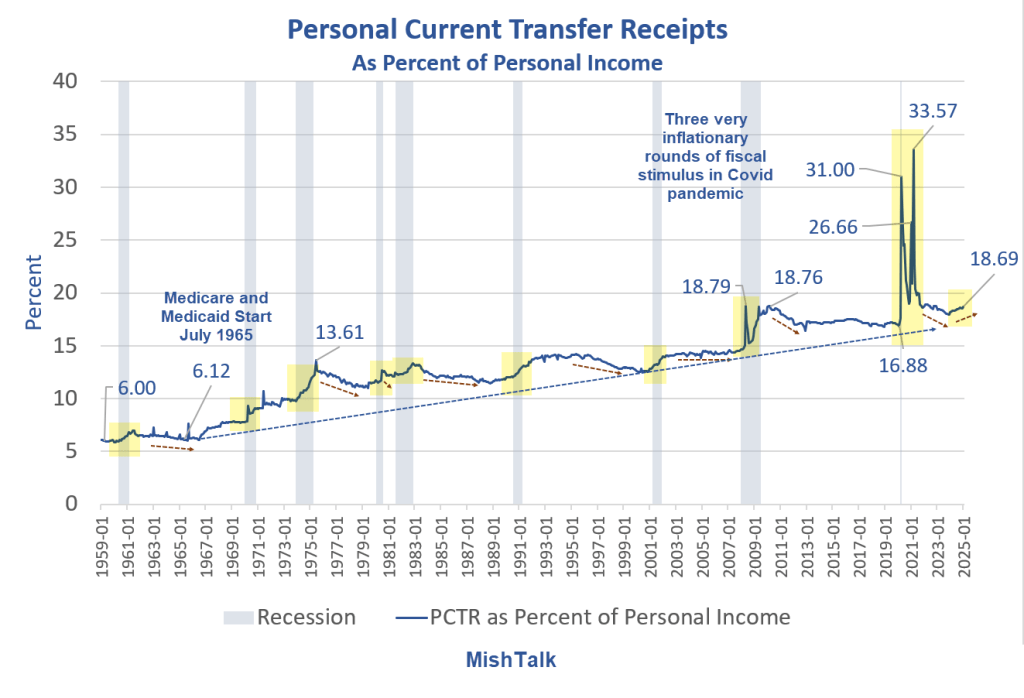

US consumers are increasingly dependent on Medicare, Medicaid, SNAP and Social Security.

Q: What are Personal Current Transfer Receipts?

A: The Bureau of Economic Analysis (BEA)explains PCTR consists of income payments to persons for which no current services are performed. It is the sum of government social benefits and net current transfer receipts from business.

Medicare, Medicaid, SNAP (food stamps), housing subsidies, and Social Security are examples.

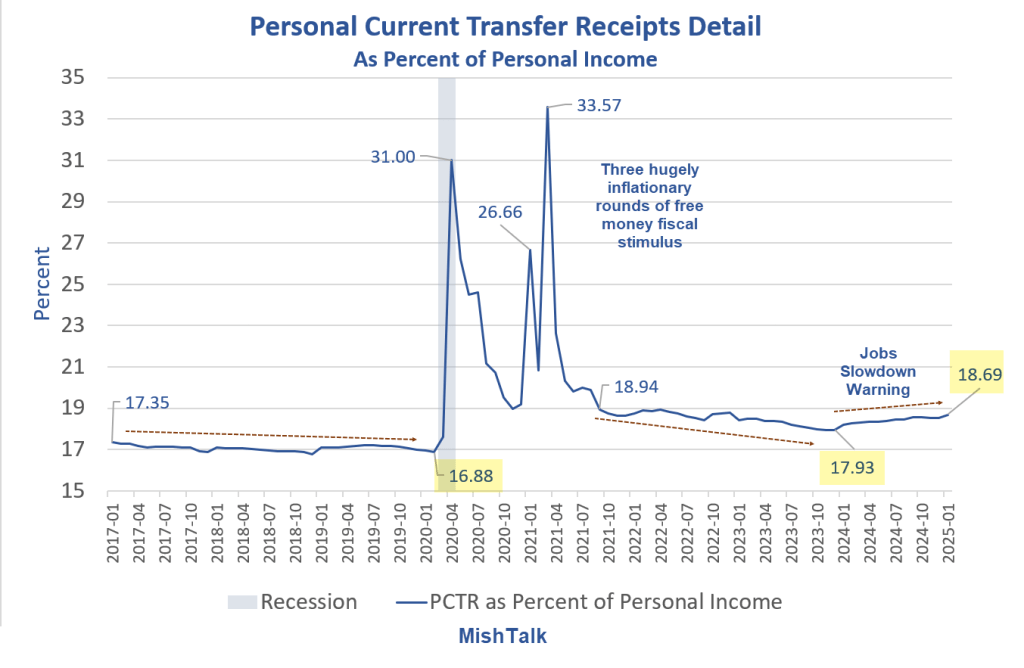

PCTR Percent Detail

PCTR Observations

- PCTR tends to rise in recession the fall back some, but not to the previous level.

- This makes sense because of the decrease in jobs during recession followed by an increase in jobs after recession.

- When the decline in PCTR following a recession turns into an increase you have a recession warning but with a variable time lag.

Boomer Demographics and Immigration

Demographics, especially aging baby boomers, increase the reliance on Medicare and Social Security.

Immigration plays into Medicaid for children. But Trump has shut off all benefits for illegal immigrants.

Social Security and Medicare are the big issues. Fewer workers support a growing need by dependents.

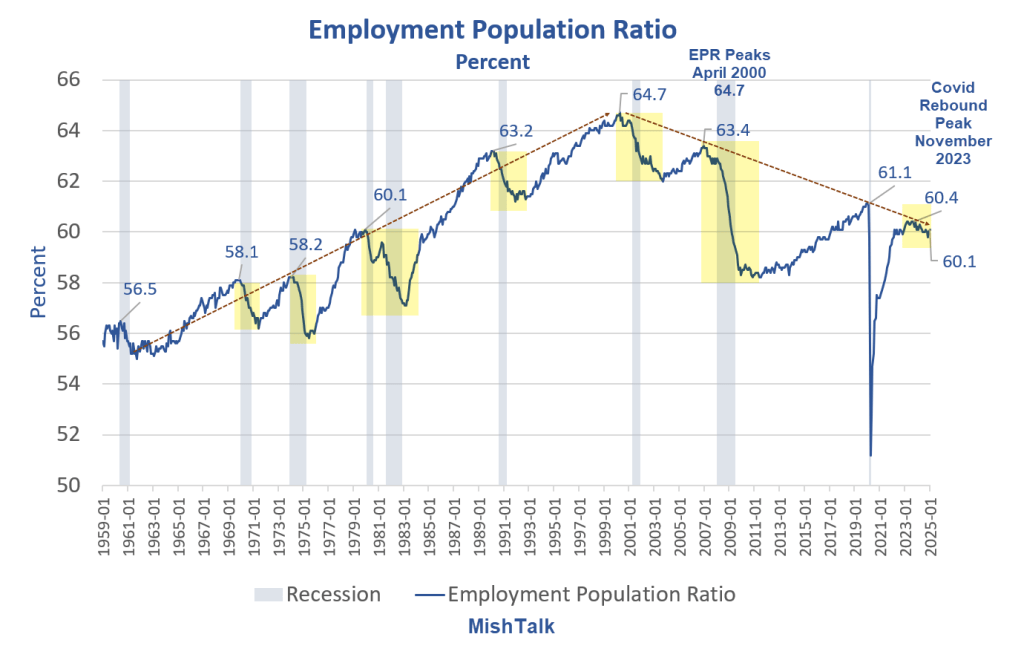

Employment-Population Ratio

What is the Employment-Population Ratio?

The employment-population ratio is a statistical measure that represents the percentage of a country’s working-age population that is currently employed.

It shows the proportion of people within a population who are actively working.

EPR is calculated by dividing the number of employed people by the total civilian non-institutional population aged 16 and over.

How Does Inflation Play Into This?

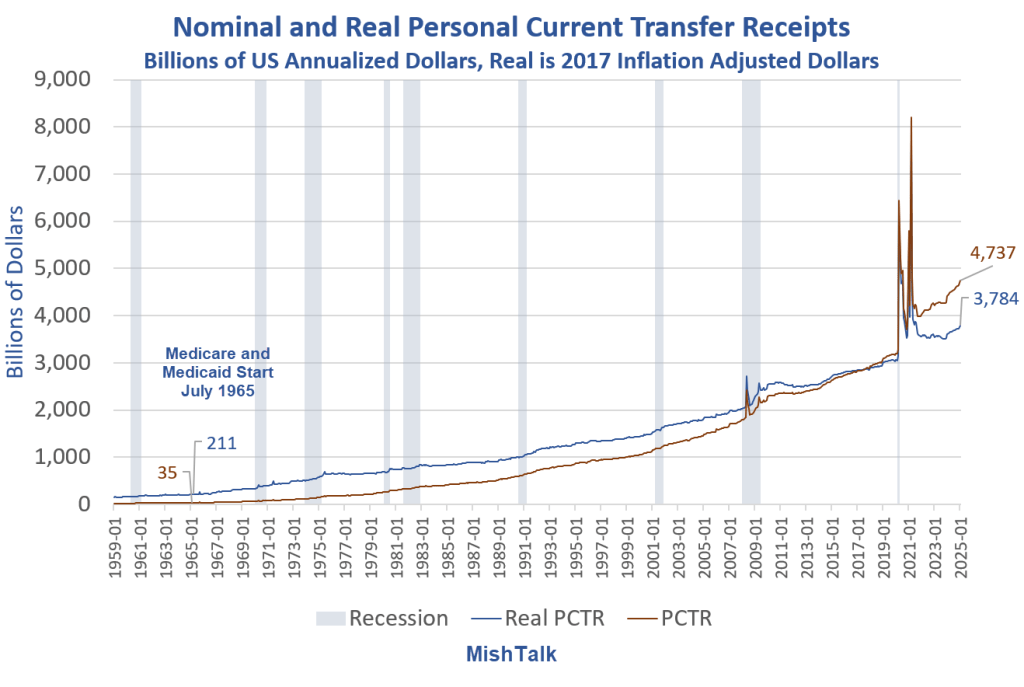

Real and Nominal PCTR

- Annualized PCTR were $4.74 trillion in January of 2025. This compares to $35 billion in July of 1965.

- Annualized Real PCTR were $3.78 trillion in January of 2025. This compares to $211 billion in July of 1965.

In January of 2025 people got $4.74 trillion but it felt like $3.78 trillion.

From a consumer standpoint, PCTR was overstated by $953 billion, 25.4 percent. However, the impact on the federal deficit was the full $4.74 trillion.

Thank You Fed and Congress

The Fed is not to blame for the three rounds of free money fiscal stimulus that fueled the massive post-Covid inflation.

However, the Fed is 100 percent to blame for its QE response to inflation that created asset bubbles and literally destroyed the housing market.

Inflationary and Deflationary Forces

- Free money and rising deficits are inherently inflationary

- The resultant rise in asset values is inflationary

- Boomer demographics and retirements are disinflationary but offset by rising asset prices and bubbles

- Inflation is punishing the non-asset holders who need PCTR to buy food and pay rent. This is deflationary.

- If asset prices sink, the entire mix becomes deflationary.

Government Dependence Synopsis

We have a growing dependence on government aid over time. The problem is exacerbated by rising benefit levels, inflation, and demographics.

Neither party will fix this. Neither party will fix anything because Congress is corrupt.

There are no fiscal conservatives to be found.

DOGE is a side-show relative to $4.74 trillion in PCTR and the entire budget.

Trump wants more money for defense and will get it by offering something to Democrats in return.

The Fed won’t fix anything either because fiscal policy will play an increasing role and the Fed does not even understand what inflation is.

Related Posts

February 21, 2025: Student Loan Borrowers Crushed by Appeals Court Ruling, Credit Scores Plunge

The courts are busy. This one goes against Biden. Economic repercussions are significant.

February 28, 2025: Subprime Auto Loan Delinquencies Hit Record High 6.56 Percent

As borrowers struggle to keep up with car payments, auto lenders offer payment extensions to keep those loans from going bad.

February 26, 2025: Homebuilders Have Most Speculative Unsold Inventory Since May of 2008

Homebuilder inventory of started and completed homes is soaring but sales are weak.

February 26, 2025: New Home Sales Plunge 10.5 Percent in January From Upward Revision

New home sales have been mostly sideways at a weak level, in a choppy fashion.

February 25, 2025: US Consumer Confidence Drops at Sharpest Pace in 3-1/2 Years

Consumers are concerned over inflation. Recession should be the bigger fear.

February 24, 2025: Top Ten Percent Account for Half of All Spending, Up From 36 Percent

The share of spending by the top 10 percent keeps rising.

Understanding Inflation

The Fed, Congress, and the White House have created a two-state economy that bails out the banks, the asset holders, and the wealthy time and time again.

The Fed does not recognize the result as inflation. Meanwhile, both parties support more spending on this in return for more spending on that fueling various bubbles.

Asset bubbles are by definition inflationary. Few understand that because the Fed and economists in general tout inflation as the CPI or PCE. The Fed repeatedly says “Inflation expectations are well-anchored”.

So what? Please consider Fedthink! The Fed Is Incompetent by Design and Can’t Be Fixed

Consumer inflation measures are a very poor measure of overall inflation. By failing to understand this simple point, the Fed has sponsored numerous bubbles of increasing amplitude over time.

Meanwhile, it takes more and more PCTR to keep the have-nots from revolting.

When the bubbles burst, the outcome will be very deflationary. Tariffs may easily be the proverbial straw.