Despite improvement in rent, the CPI rose another 0.3 percent in November. Here are the key numbers.

CPI Month-Over-Month Details

- The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent on a seasonally adjusted basis.

- The index for shelter rose 0.3 percent. Rent of primary residence rose 0.2 percent and owners’ equivalent rent was up 0.2 percent.

- The food at home index increased 0.5 percent and the food away from home index rose 0.3 percent over the month.

- The index for all items less food and energy rose 0.3 percent.

- The energy index rose 0.2 percent.

- Medical care commodities fell 0.1 percent and medical care services rose 0.4 percent. This is another bit of bad news because services have a much bigger weight than commodities, 6.5 percent vs 1.5 percent.

It seems reports that the price of Thanksgiving dinner falling were more than a bit exaggerated.

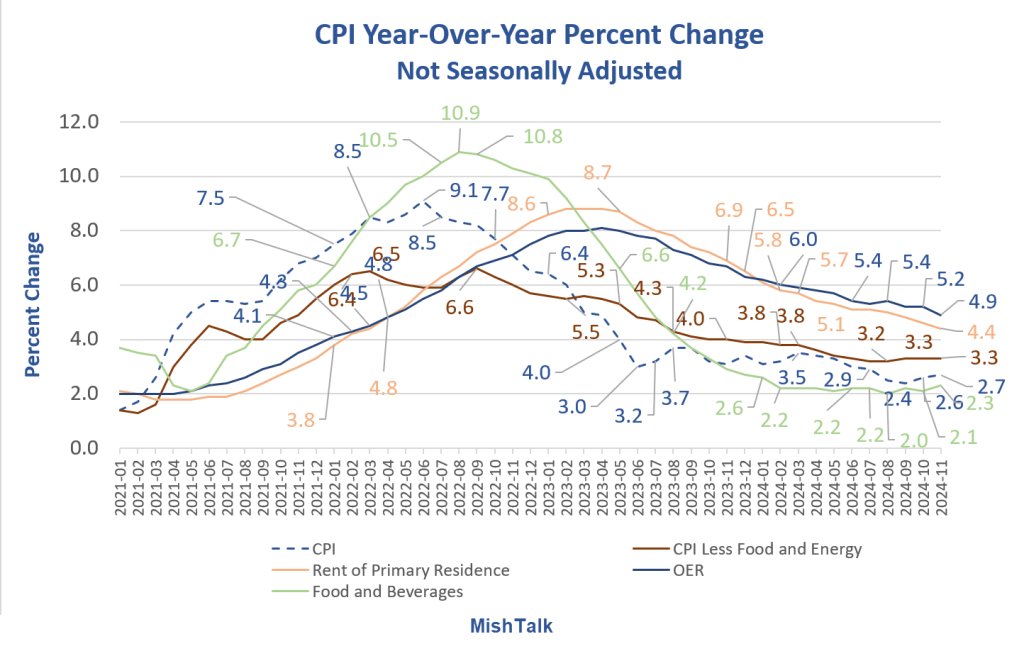

CPI Year-Over-Year Percent Change

Year-Over-Year Details

- CPI: 2.7 percent

- CPI Excluding Food and Energy: 3.3 percent

- Rent: 4.4 percent

- Shelter: 4.7 percent

- Food and Beverages: 2.3 percent

- Medical Care Services: 3.7 Percent

That’s roughly how the average economist views things. The next chart is how the average person views things.

CPI Indexes

Fed Mission Accomplished?

Apparently so.

Yesterday, I commented Fed Rate Cut Odds in December Are 85.8 Percent Despite CPI Estimates

The Bloomberg Econoday consensus CPI estimate is 0.3 percent month-over-month and 2.7 percent year-over-year, up from 2.6 percent.

Are We No Longer Data Dependent?

Looking ahead to March, the market expects two more cuts in January and March.

Based on current inflation data, the Fed should not be cutting at all. But tomorrow is another day.

If the data does not warrant these cuts, but the Fed cuts anyway, expect yields on the long end to rise in revolt.

The consensus estimates were spot on. Nonetheless, Rate cut odds for December rose from 85.8 percent yesterday to 94.7 percent today.

And the odds of two or more cuts by March of 2025 rose slightly as well.

Thus ….

3.0 Percent is the New 2.0 Percent

~2.7 percent year-over-year and monthly increases of 0.3 percent (over 3.6 percent annualized) are the new inflation targets. Let’s call that ~3.0 percent.

The Fed and the markets are perfectly fine with inflation running above the Fed’s long stated goals of 2.0 percent.