Consumer Confidence plunged at the sharpest pace in 3.5 years. Inflation was the big worry but the bond market believes otherwise.

US Consumer Confidence Drops at Sharpest Pace in 3-1/2 Years

Earlier today, I commented US Consumer Confidence Drops at Sharpest Pace in 3-1/2 Years

Consumers are concerned over inflation. Recession should be the bigger fear.

Conference Board Key Comments

- “Average 12-month inflation expectations surged from 5.2% to 6% in February. This increase likely reflected a mix of factors, including sticky inflation but also the recent jump in prices of key household staples like eggs and the expected impact of tariffs. References to inflation and prices in general continue to rank high in write-in responses, but the focus shifted towards other topics. There was a sharp increase in the mentions of trade and tariffs, back to a level unseen since 2019. Most notably, comments on the current Administration and its policies dominated the responses.”

- “For the first time since June 2024, the Expectations Index was below the threshold of 80 that usually signals a recession ahead.”

The first comment is meaningless, the second may not be.

Bond Market Reaction

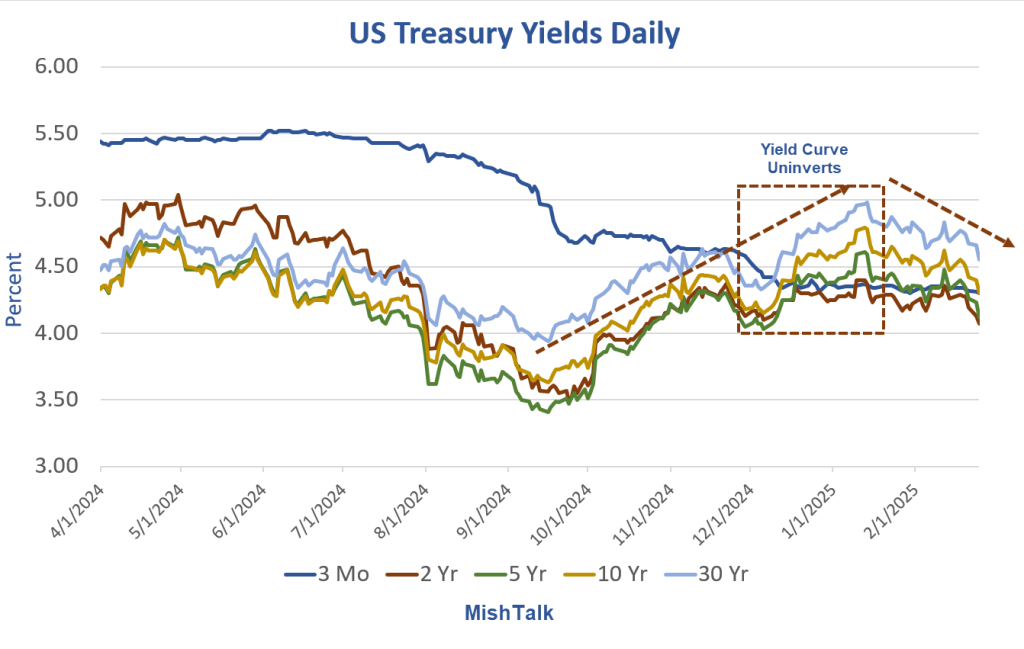

- Yield on the 30-year long bond fell from 4.66 percent to 4.55 percent.

- Yield on the 10-year note fell from 4.40 percent to 4.30 percent matching the 3-month T-Bill yield.

- The Yield on the 5-year and 2-year notes inverted sharply (yielding less) than the 3-month T-Bill yield

US Treasury Yields Daily

Trump’s Policies

- Tariffs: Recessionary and Inflationary

- Deportations: Recessionary and disinflationary

- Border Shutdown: Recessionary and disinflationary

- Layoffs: Recessionary and disinflationary

- Student Loan Repayments: Recessionary and disinflationary

Related Posts

February 4, 2025: Job Openings Drop by 556,000 in December, Quits Show Job Finding Stress

Job openings have collapsed. And the number of quits confirms people are staying put.

February 5, 2025: ADP Payrolls Better than Expected But Two-Thirds of the Economy Has Stalled

ADP reported a better than expected 183,000 jobs in January, but small business trends are unsettling.

On February 14, I noted Retail Sales Crash – Did the Consumer Finally Throw in the Towel?

The Census Department shows huge across-the-board declines in multiple categories, down 0.9 percent overall.

February 19, 2025: Housing Starts Drop 9.8 Percent, Unable to Retain Any Traction

Housing starts have mostly been rangebound since late 2022 as high prices and high mortgage rates dampen demand.

February 20, 2025: How Will 77,000 DOGE Terminations Impact Unemployment and Jobs?

As of Feb. 13, 77,000 employees accepted the offer, according to White House press secretary Karoline Leavitt.

February 22, 2025: Trump Signs Order Cutting Off All Federal Benefits for Illegal Immigrants

Trump’s executive order is definitely legal. But what does it mean in practice?

The above related posts all have one thing in common: They are recessionary.

And that is the message from the bond market despite consumer worries over inflation.

For discussion of the silliness of inflation expectations, please see US Consumer Confidence Drops at Sharpest Pace in 3-1/2 Years

Note: Believing inflation expectations are meaningless does not imply no chance of inflation. It simply means expectations don’t matter.

The Fed has great faith in expectations. It’s absurd. For 3 years consumers had expectations of 3-4% while the Fed struggled to hit 2%. That would be impossible if expectations mattered.

Of course, the Fed does not understand inflation or expectations.

Importantly, the bond market reaction today was a recession + disinflation reaction rather than a “so what?” That’s how the data looks to me as well.