Mark Zandi is the near-perfect contrarian indicator. I am wondering if anyone is better.

Take Heart Republicans

Congratulations to WSJ Op-Ed writer Allysia Finley for compiling an amazing list of Mark Zandi’s stunningly wrong predictions.

Mark Zandi is Chief Economist, Host of the Inside Economics podcast, and co-founder of Economy.com.

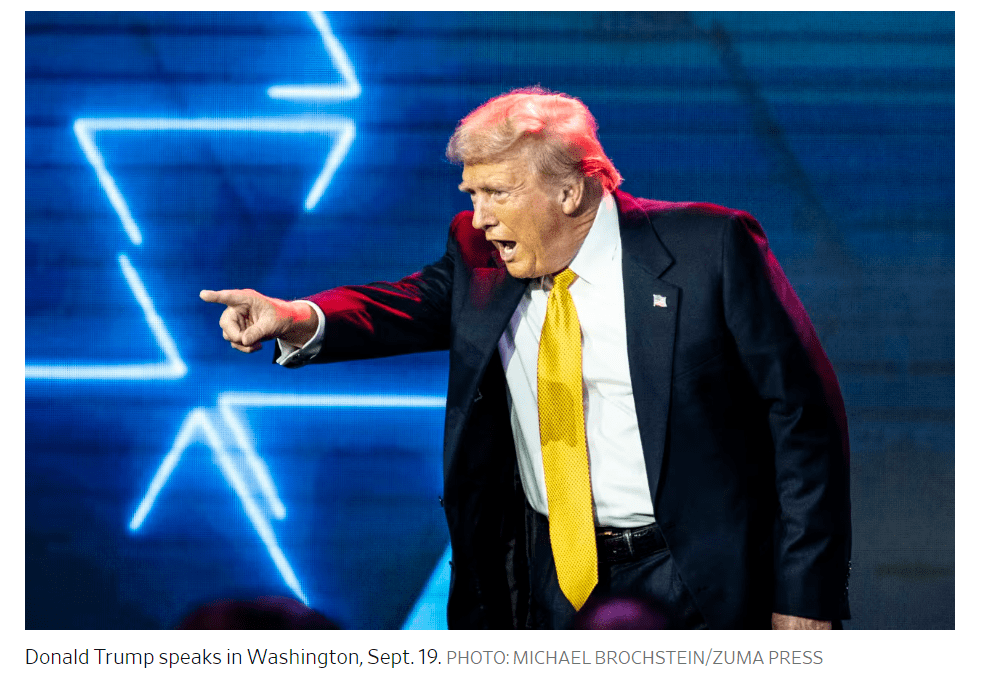

Please consider Trump Can Take Heart: Mark Zandi Says Harris Will Win

“The economy’s performance is an increasingly strong tailwind to the presidential election bid of Kamala Harris,” Mr. Zandi tweeted last week. According to his model, “Harris is expected to win 286 electoral votes by winning the swing states of Wisconsin, Michigan, Pennsylvania, and North Carolina.”

Mr. Zandi also called the Federal Reserve’s 50-basis-point interest-rate cut an “economic tailwind behind the Harris campaign.” That’s far from reassuring for the vice president. It isn’t an exaggeration to say that Punxsutawney Phil has a better predictive record than he does. Let’s rewind the tape.

Stunningly Wrong Calls

- In October 2006, Mr. Zandi predicted that the shaky housing market would “bottom out” in a year. It took five.

- In July 2007 he said “the economy isn’t going to weaken any further.” Mere months later, it began to plunge into the “Great Recession.”

- Mr. Zandi later devised the economic models the Obama administration used to claim that its stimulus spending would create economic “multiplier” effects, with each dollar spent on unemployment benefits and food stamps producing more than $1.60 in output. The Obama stimulus, Mr. Zandi forecast, would result in 141.4 million jobs in 2012. There were only 135 million by the end of that year, fewer than his model predicted if the Democrats’ stimulus hadn’t passed.

- He projected the Obama stimulus would boost gross domestic product by 9.1%, between 2008 and 2012. GDP grew a mere 3.9%.

- Mr. Zandi forecast an economic Category 5 hurricane if Mr. Trump won. The Republican’s policies, he predicted, would tank the economy and create 7.4% unemployment, soaring interest rates, deficits and inflation. GDP would fall 2.4% in “an unusually lengthy recession,” and “the average American household’s after-inflation income will stagnate, and stock prices and real house values will decline.”

- Mr. Zandi predicted that a Democratic sweep in the 2020 election would supercharge economic growth, while interest rates would stay between 0.1% and 1.5%.

- When inflation heated up, in June 2021 Mr. Zandi said not to worry: “It is wrong to get all worked up over today’s high inflation. It will soon abate” and “moderate to between 2% and 3% by this time next year.” Inflation peaked at 9.1% in June 2022.

Zandi’s Presidential Election Model

Importance of Gasoline

How ridiculous. The price of rent, food, and especially the unemployment rate are all more important.

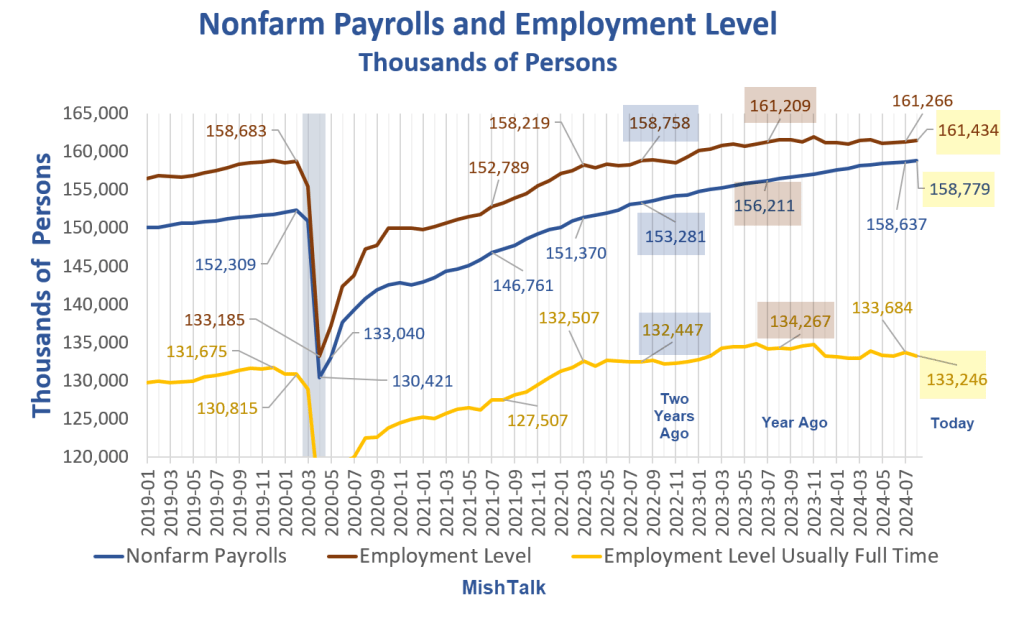

Manufacturing Sheds 24,000 Jobs, Government Adds 24,000, Big Negative Revisions

Dear Mr, Zandi, please note A Breakdown, by Sector, of the Negative 818,000 BLS Job Revisions

Dear Mr. Zandi, please note the September Payroll Report: Manufacturing Sheds 24,000 Jobs, Big Negative Revisions

Dear Mr. Zandi, please note the yellow line in the above chart shows full-time employment is -1,021,000 for the last year.

Dear Mr. Zandi, everyone makes bad calls on occasion, including me. But when the constant best use of your analysis is a contrarian indicator, it’s time to shut up.

Allysia Finley concludes, and I agree, Mr. Trump could very well lose, but Mr. Zandi would deserve as much credit for projecting his defeat as Punxsutawney Phil does when he predicts an early spring.