Caution. Every time I suggest consumers may throw in the towel, it hasn’t happened. Counter caution, real (inflation-adjusted) spending is negative year-over year for 12 out of the last 17 months.

Please consider the Advance Retail and Food Services Sales report for April 2024.

Retail Sales Key Points

- Advance Estimates of U.S. Retail and Food Services Advance sales for April 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $705.2 billion, virtually unchanged from the previous month, but up 3.0 percent above April 2023.

- Total sales for the February 2024 through April 2024 period were up 3.0 percent from the same period a year ago.

- The February 2024 to March 2024 percent change was revised from up 0.7 percent to up 0.6 percent.

- Retail trade sales were virtually unchanged om March 2024, but up 2.7 percent above last year.

- Nonstore retailers were up 7.5 percent from last year, while food services and drinking places were up 5.5 percent from April 2023.

The key phrase is “adjusted for seasonal variation and holiday and trading-day differences, but not for price changes.”. Adjusted for inflation (real) sales are much lower than three years ago.

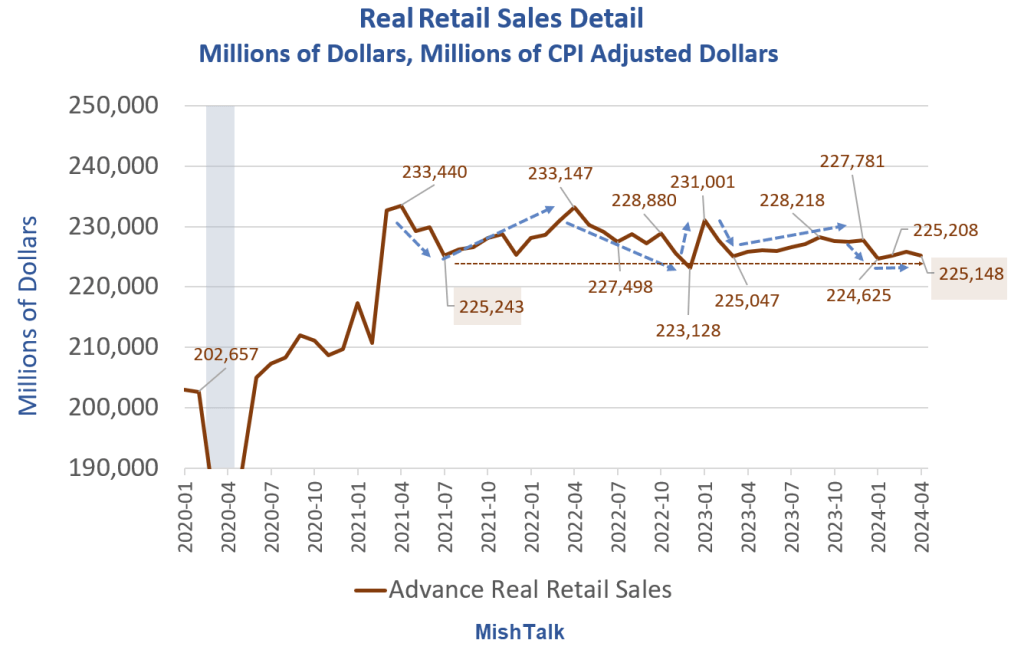

Real Retail Sales Detail Millions of Dollars

Real retail sales are down 3.6 percent from April of 2021, three years ago.

But if we ignore the spike peak, real sales have been flat since July of 2021. Every time it appears customers were about to throw in the towel, they instead opened their wallets, or charge cards.

This is not strong spending as typically portrayed by mainstream media.

Advance Retail Sales Select Categories

The clear winner since the pandemic is nonstore retailers, led by Amazon.

In 2015, nonstore sales topped gas station sales and by early 2020 topped everything but motor vehicles and parts.

Eventually, nonstore sales will top motor vehicle sales.

Real vs Nominal Advance Retail Sales Percent Change From Year Ago

On a year-over-year basis, real retail sales have been negative 12 out of the last 15 months.

This is sign the vaunted consumer is much less than portrayed.

Is there another consumer spending surge coming or not?

Real Advance Retail Sales Percent Change Month-Over-Month

We have seen some big swings this year especially in motor vehicles and nonstore retailers.

This month, real sales overall fell 0.3 percent with nonstore sales down 1.5 percent and motor vehicles down 1.1 percent.

CPI Up 0.3 Percent With Rent Still Rising Steeply

Rent rose another 0.4 percent in April. Food and beverages were flat with food at home declining but food away from home rising.

for discussion, please see CPI Up 0.3 Percent With Rent Still Rising Steeply, Food a Bright Spot

If the CPI weakens more than sales, real sales will go up.

Nominal retail sales were flat this month but real sales fell 0.3 percent because the CPI rose 0.3 percent.

Eventually, consumer spending will give way. Whether the time is now remains to be seen.