The Census Department shows huge across-the-board declines in multiple categories, down 0.9 percent overall.

The U.S. Census Bureau announced advance estimates of U.S. retail and food services sales for January 2025.

Advance estimates of U.S. retail and food services sales for January 2025, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $723.9 billion, down 0.9 percent (±0.5 percent) from the previous month, and up 4.2 percent (±0.5 percent) from January 2024. Total sales for the November 2024 through January 2025 period were up 4.2 percent (±0.5 percent) from the same period a year ago. The November 2024 to December 2024 percent change was revised from up 0.4 percent (±0.5 percent) to up 0.7 percent (±0.3 percent).

The key phrase above is “adjusted for seasonal variation and holiday and trading-day differences, but not for price changes.”

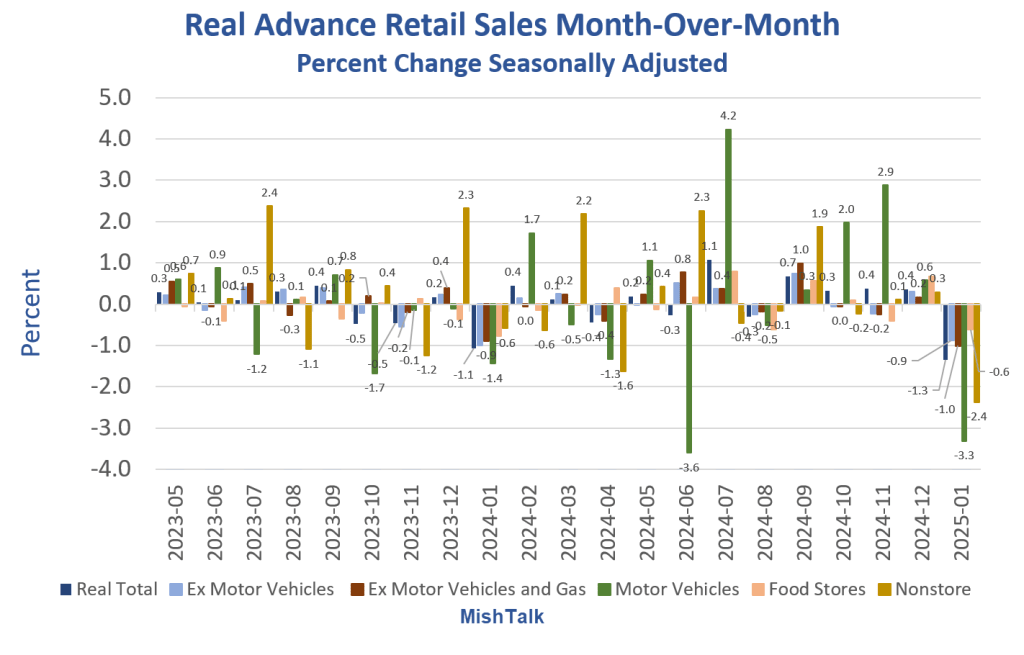

The inflation adjusted declines were enormous.

One positive aspect was the upward revision for December, but that will accrue to 2024 Q4, subtracting from 2025 Q1.

Real Advance Retail Sales Percent Change Month-Over-Month

Real means adjusted for inflation using the CPI Index 1982-1984=100 as the deflator.

Nominal Month-Over-Month Declines

- Total: -0.9 percent

- Excluding Motor Vehicles and Parts: -0.4 percent

- Excluding Motor Vehicles and Parts, and Gasoline: -0.5 percent

- Motor Vehicles: -2.8 percent

- Food Stores: -0.1 percent

- Nonstore Sales (e.g. Amazon): -1.9 percent

To arrive at real sales, subtract the month-over-month increase in the CPI of 0.5 percent. Rounding errors account for any differences.

Declines in motor vehicle sales account for over half of the decline. But even ignoring motor vehicles, sales were very weak with nonstore sales down 1.9 percent.

Real vs Nominal Advance Retail Sales

A Mirage of Inflation

The chart of Real vs Nominal Advance Retail Sales shows notion of “strong consumer spending” is nothing more than a mirage of inflation.

Related Posts

February 13, 2025: Producer Price Index (PPI) Soars Led by a Surge of Positive Revisions

The PPI was hotter than expected, and that was on top of huge positive revisions.

CPI Much Hotter than Expected

On February 12, I noted CPI Much Hotter than Expected, Core CPI Hotter than Expected

CPI Hotter than Expected

- CPI: Bloomberg Consensus 0.3% v Actual 0.5%

- Core CPI Excluding Food and Energy: Bloomberg Consensus 0.3% v Actual 0.4%

- CPI Year-Over-Year: Bloomberg Consensus 2.9% v Actual 3.1%

- Core CPI Year-Over-Year: Bloomberg Consensus 3.1% v Actual 3.3%

The Fed will not be cutting rates anytime soon at this pace. Of course, tariffs and a huge global trade war could crash the economy.

Fortunately, Trump Fails to Pull the Trigger on Reciprocal Tariffs, Will Study the Issue

To answer the lead question “Did the Consumer Finally Throw in the Towel?” I don’t know, nor does anyone else.

Also, we do not know what if anything will happen with the budget. But Trump is angling for something very inflationary that will add to the deficit.

I will have some detailed analysis of the budget shortly.