WASHINGTON — Companies that operate radar satellites for imaging and intelligence collection are accelerating the introduction of technologies aimed at military and defense agencies, responding to heightened global demand for detailed, precise surveillance of ground targets.

Synthetic aperture radar (SAR) satellites, which can capture high-resolution imagery in all weather conditions and at any time of day, are seeing increased deployment as defense customers seek more accurate insights from space, industry executives said.

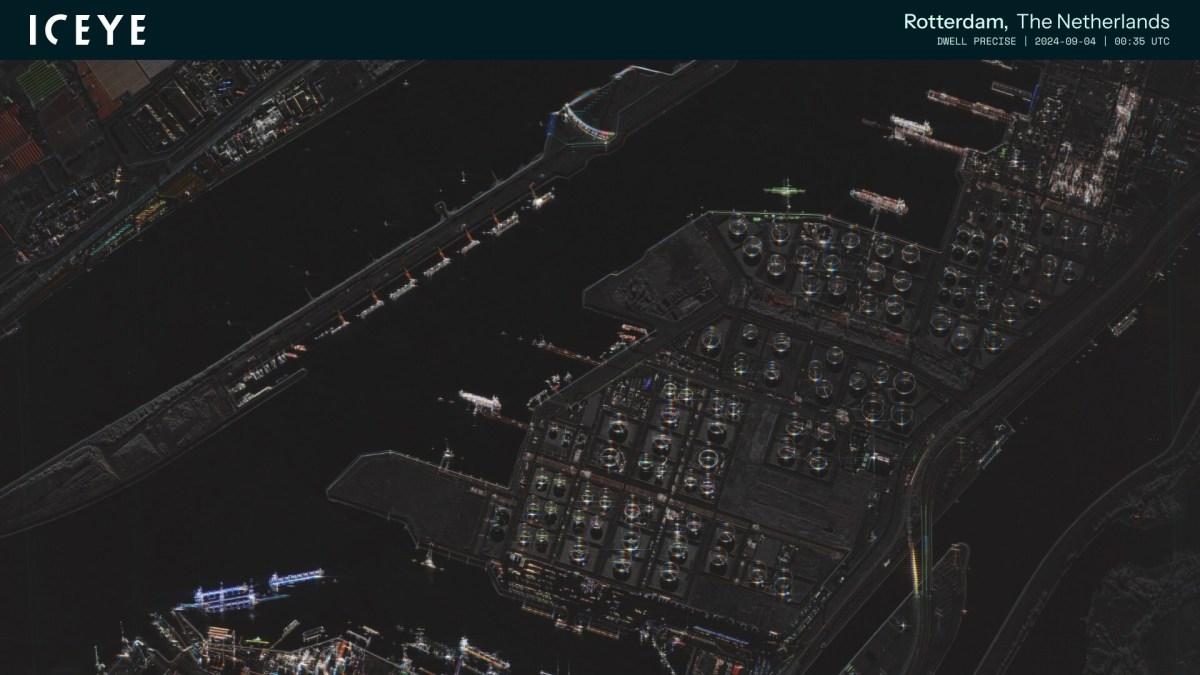

One of the rising players in the industry, Finnish company Iceye, announced Oct. 2 that its SAR satellites — designed to be able to see objects on the Earth’s surface that are at least 25 centimeters in size — can identify specific types of military equipment, and even detect targets hidden beneath tree cover or dense foliage.

Eric Jensen, CEO of Iceye US, the company’s U.S.-based subsidiary, told SpaceNews the company has added new imaging features to its 25-centimeter SAR satellites to meet the demands of defense and intelligence customers that need to monitor fast-moving geopolitical situations. “Regional conflicts around the world have really emphasized the need for commercial SAR,” Jensen said.

There is strong demand for high-resolution SAR for border security, maritime safety and disaster response, said Jensen. “I think over time we’re going to see the scientific community also start to harness the power of 25 centimeter X band SAR. It hasn’t been available to them to date.”

Global SAR raceA report released Oct. 1 by the Center for Strategic and International Studies (CSIS) analyzed the current state of the global remote sensing satellite market, noting that U.S.-based SAR companies have surged ahead of European and Canadian competitors. According to the report, regulatory reforms over the past few years have allowed U.S. firms to become top performers in the SAR sector. Companies like Umbra Space and Capella Space have leveraged these reforms to advance their SAR technologies for commercial and defense applications.

The CSIS report ranked Iceye third in X-band SAR imaging, trailing Umbra and Capella. However, the Finnish firm was credited with leading the industry in revisit rate — the frequency with which satellites can reimage the same area. This capability is used for near-real-time monitoring of trends and activities on Earth.

Interest in sovereign systemsTodd Master, chief operating officer of Umbra Space, commented on the growing interest from foreign governments in establishing their own sovereign SAR constellations. “A lot of sovereign foreign allies desire to have their own systems,” Master said Oct. 1 at the rollout of the CSIS report. “There’s a lot of really interesting dynamics there.”

Umbra, which has been developing commercial SAR solutions tailored for defense, is also venturing into international markets. The U.S. government was historically the primary provider of SAR imagery, but the commercial sector is now stepping in to fill a demand for independent SAR capabilities.

“Commercial SAR is really new to the scene, and particularly new in the United States,” Master added, underscoring the sector’s rapid rise in the private market as governments seek alternatives to traditional electro-optical satellite imagery.