The PPI was hotter than expected, and that was on top of huge positive revisions. But long-term bond yields dropped. Why?

On top of a hot CPI report, the BLS Producer Price Report was even hotter after accounting for revisions.

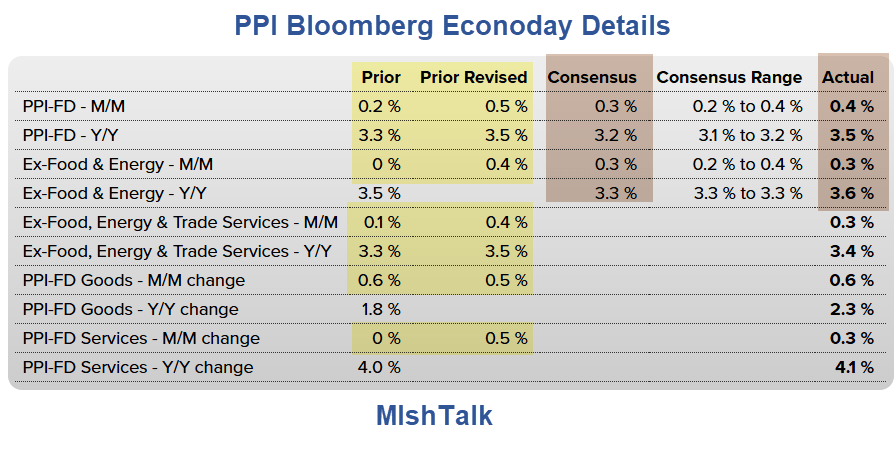

Revisions and Expectations

Discounting the positive revisions, the PPI rocketed 0.9 percent. The core PPI (excluding food and energy) rocketed 0.7 percent.

PPI Final Demand Key Detail Month-Over-Month

- PPI: +0.4 Percent

- Services: +0.3 Percent

- Goods: +0.6 Percent

- Excluding Food and Energy: +0.3 Percent

- Food: +1.1 Percent

- Energy: +1.7 Percent

Final demand services is about 67 percent of the index.

The services component is also what the Fed is most concerned about.

PPI Final Demand Services

Things are seriously headed in the wrong direction starting January 2024.

December 2023 marked the low in year-over-year services at 1.8 percent.

PPI Final Demand Year-Over-Year

PPI Year-Over Year Details

- Final Demand: 3.5 percent up from low of 0.3 percent in June 2023.

- Final Demand Goods: 2.3 percent up from low of -4.3 percent in June 2023.

- Final Demand Services: 4.1 percent up from low of 1.8 percent in December 2023.

Things are not headed in the right direction.

Bond Market Reaction

The most interesting thing today is the bond market reaction. Yields at the long end of the curve dropped.

For example, the 10-year note declined 12 basis points from 4.64 percent to 4.52 percent.

A plausible explanation is Trump delayed reciprocal tariffs. I will discuss this separately.

CPI Much Hotter than Expected, Core CPI Hotter than Expected

Yesterday, I noted CPI Much Hotter than Expected, Core CPI Hotter than Expected

CPI Hotter than Expected

- CPI: Bloomberg Consensus 0.3% v Actual 0.5%

- Core CPI Excluding Food and Energy: Bloomberg Consensus 0.3% v Actual 0.4%

- CPI Year-Over-Year: Bloomberg Consensus 2.9% v Actual 3.1%

- Core CPI Year-Over-Year: Bloomberg Consensus 3.1% v Actual 3.3%

The Fed will not be cutting rates anytime soon at this pace.

Of course, tariffs and a huge global trade war could crash the economy.