Christmas is usually a time for family, food and frivolity.

But are forcing many Australians to reconsider how much they spend during the festive season — or if they can afford to celebrate at all.

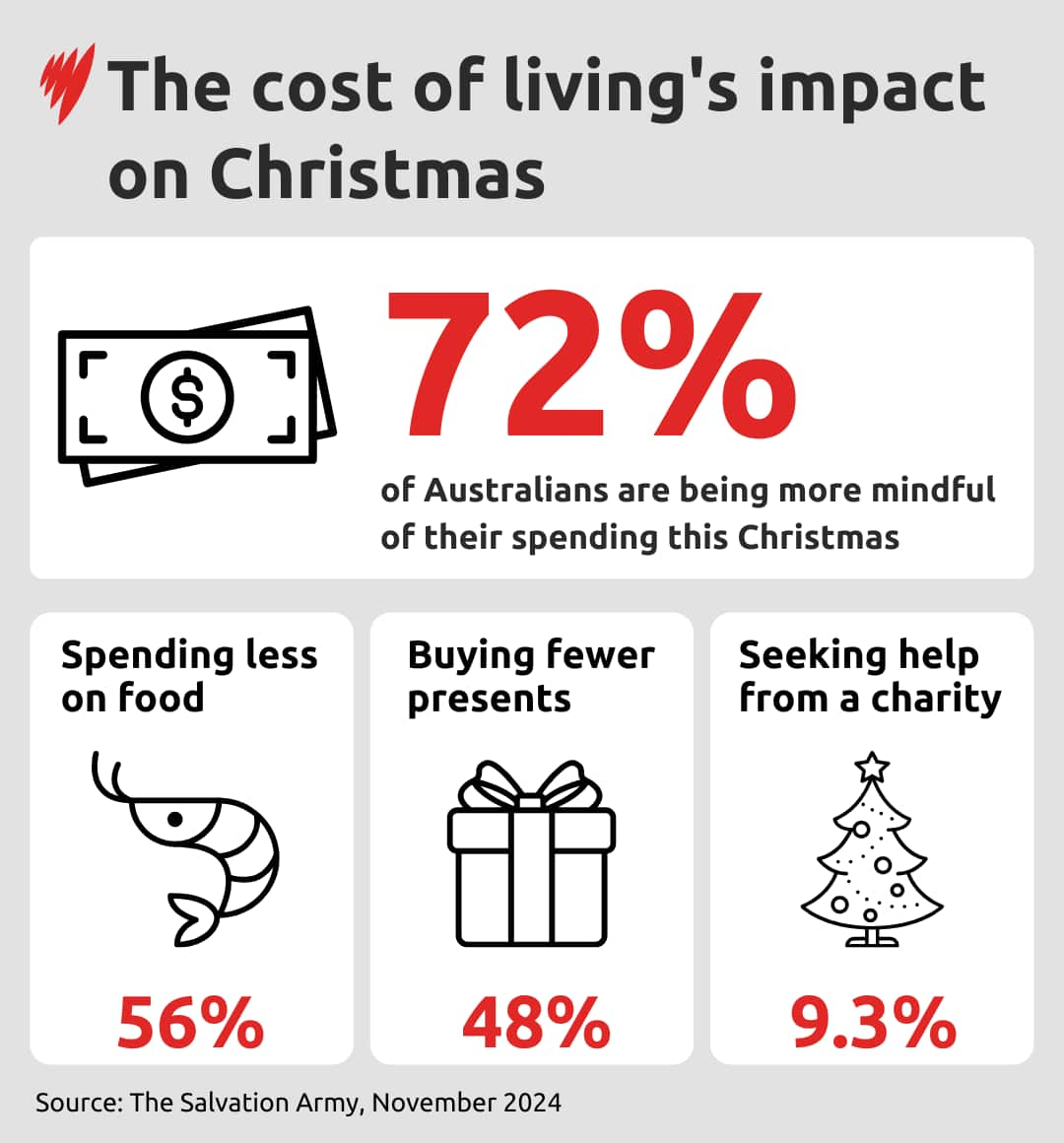

Recent research from The Salvation Army found 72 per cent of Australian adults are being more mindful of their spending this Christmas than in previous years, with the cost of living negatively impacting the celebrations of more than four in 10 (42 per cent).

A majority (56 per cent) of respondents said they would spend less on food, while just under half (48 per cent) said they would buy fewer presents for their children and loved ones.

Almost one in ten (9.3 per cent) said they intended to seek help from a charity this Christmas — more than half (55 per cent) of them for the first time.

Similarly, a study commissioned by St Vincent de Paul Society NSW found that more than two-thirds (68 per cent) of Australians were worried Christmas expenses would put a strain on their finances.

Over half (58 per cent) said they were concerned about being able to buy food and essentials over the holiday period, while 62 per cent felt stressed about being able to afford gifts for family and friends.

St Vincent de Paul Society NSW chief executive Yolanda Saiz said many Australians were experiencing “real economic pain”.

“Every time they go to the supermarket, they see what they can put in their shopping basket get smaller, while at the same time prices are continually rising,” she said.

“I worry that as bleak as the cost of living crisis has been in recent years, we may not have hit rock bottom yet.”

Annual inflation rose to 2.8 per cent in the September quarter, with food prices increasing by 3.3 per cent during the same period, according to the Australian Bureau of Statistics.

Many Australians are struggling to afford their mortgage repayments. The official cash rate has been on hold at 4.35 per cent for the past 12 months and .

At the same time, . The situation is particularly dire for welfare recipients and students in sharehouses, according to the latest National Shelter-SGS Economics and Planning Rental Affordability Index.

Tips to cut costs at Christmas

Sarah Megginson, a personal finance expert at comparison site Finder, and Saskia Samuels, a financial counsellor at UnitingCare, gave SBS News their top tips for keeping costs and debt low at Christmas.

One way to ensure you don’t spend too much money over the festive season is to be organised.

Leaving everything to the last minute often results in impulse buying and overspending, Samuels said.

“When you plan ahead, that gives you that head start and can help alleviate a lot of pressure down the track,” she said.

Make a budget — and stick to it

A vital part of the planning process is making a budget — and sticking to it.

“Understanding where you stand financially is the key point here,” Samuels said.

Megginson said working out which traditions matter most to you can help to guide your spending decisions and reduce the temptation to crack out your credit card.

“Don’t overspend. Your family and friends do not want to see you go into debt to give them a Christmas present,” she said.

Megginson said buy now pay later schemes, in particular, should be avoided as they can lull you into “a false sense of security”.

“If you pay it back in time, you pay no fees,” she said.

“But it’s very easy to miss those payments when all of the expenses start to build up and suddenly you’re paying $10 fees on something that costs $50. That is a massive premium.”

It may seem obvious, but only buying food when it’s on sale, switching from name brands to home brands where possible, and even looking at unit pricing can save you a lot of money on your Christmas grocery bill.

“The half-price specials at the supermarket should be the first place you do your grocery shopping … and not just at Christmas,” Megginson said.

“If Christmas Day is at your house and you are going to be doing cheese and crackers and chips, start buying those things now when they’re half-price so that you’re not having a giant Christmas shop the week before and adding this huge expense.”

Buying a box of chocolates on sale and bundling it with a gift card can make for “quite an affordable” present, Megginson said.

“The half-price specials at the supermarket should be the first place you do your grocery shopping,” personal finance expert Sarah Megginson said. Source: Getty / sefa ozel/iStockphoto

Spread the financial load

Christmas lunch can be one of the most expensive parts of the festive season — but there is a way to ease the financial burden, Megginson said.

“Instead of hosting and paying for all of the food and drinks yourself, do a potluck dinner where everyone brings a plate.”

She said you can employ a similar strategy with friends.

“Instead of going out to have a celebration somewhere, what can you do at home where everyone brings a bottle of wine or something to add to the cheese plate?”

Consider doing a Secret Santa

Presents are another area where costs can really add up.

Instead of buying everyone gifts, Megginson suggests having a Secret Santa — something the adults in her family started doing a few years ago.

“In the past it had a budget of $200, but this year we made the budget $100,” she said.

“For a couple, that saves you $200 on Christmas shopping.”

With Secret Santa, you are assigned someone to give a gift to, and there is usually a price limit set on the value of the gift.

Opt for acts of service and quality time over physical gifts

Offering acts of service instead of physical gifts can not only cut costs but also have a positive environmental impact, Megginson said.

“A lot of people don’t need another thing; I’m certainly in that category,” she said.

“What I would love is one of my best friends’ slow-cooked lasagnes … I would value that far more than a pair of earrings she might buy me at the shop.”

For family or friends who have children, offering to babysit so they can go somewhere like the cinema can be a great gift — especially if you’re also able to pay for their tickets and popcorn.

Every Christmas present doesn’t have to be a physical gift. Source: Getty / Fly View Productions

“Those types of things I think can be so helpful, as well as reducing your financial burden at Christmas,” Megginson said.

“They actually give the gift of connection and thoughtfulness, which I think everyone appreciates, but also it allows you to spread out your costs.”

Samuel said going to the beach, having a picnic in the park, building a fort with the kids, and having a water pistol fight can be other great options.

“That doesn’t cost very much money. But those are emotional and very precious memories that we have with our families and loved ones.”

Make the most of loyalty programs

You might also be able to save some money through any shop, airline, health fund, bank, union, or other kinds of loyalty programs you’re a member of, Samuels said.

“Have you accrued any points across the year that you can redeem?”

“Can you convert those into gift cards or other spending that can give you that bit of a leg up for Christmas?”

Joining one of the major supermarkets’ paid membership programs was also something to consider given it “can pay for itself pretty quickly”, Megginson said.

“In my view, the value is there … it’s $7 a month with Coles or at Woolies, and for that you get 10 per cent off per month on one grocery shop up to $500,” she said.

“A lot of people can easily spend $500 around Christmas time, so that gives you $50 off straightaway.”

If you’re feeling overwhelmed, reach out for help

If you’re struggling to manage your money, Samuels advises calling the National Debt Helpline for free and confidential advice from a professional financial counsellor.

“It’s completely okay to reach out for help if you’re overwhelmed,” she said.

“I’ve had people say to me, ‘I don’t really know what to do because it’s completely new to me’, and I suppose that’s where we come in as financial counsellors.

“We know lots of people are doing it tough, and there’s absolutely no judgement.”

Readers seeking support for debt problems and other financial concerns can contact the National Debt Helpline on 1800 007 007 for free and confidential help, Monday to Friday between 9.30am and 4.30pm. More information is available at