The Mises Institute has a shockingly bad assessment as to how money is created.

Please consider “Playing With Fire”

But before wasting 39 minutes, I advise first reading my take on the video. You may not wish to bother.

A Very Bad Start

At the 2:40 mark, Jonathan Newman, a Mises economist wrongly explains “Fractional reserve banking is the idea that banks keep a fraction of deposits in reserve so that somebody walks in and makes a deposit. What they [the banks] actually do is take that money and they use it to finance loans that they make to other people, business loans, mortgages.”

Continuing at the 2:58 mark, Joseph Salerno, Professor Emeritus at Pace University responds to Newman with “Let’s say they lend out 90 percent. They are comfortable keeping one dollar for every ten dollars that people will deposit. So you can write checks up to $1,000 on that checking deposit. At the same time there is 900 more dollars in circulation than there was before you made that deposit.”

No Reserves on Deposits

The above paragraphs are shockingly bad, and outright false.

For starters, there are no reserve requirements on deposits. None.

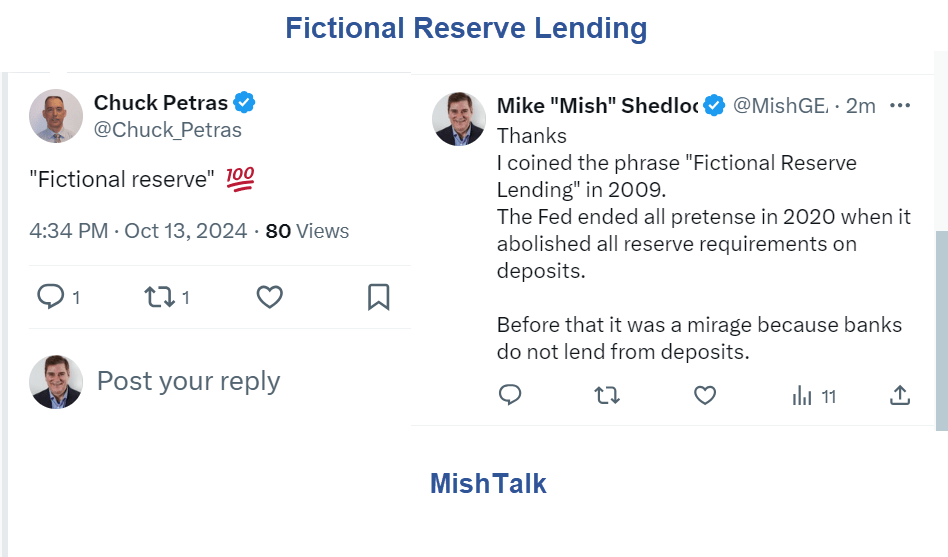

Fictional Reserve Lending Is the New Official Policy

With little fanfare or media coverage, the Fed made this Announcement on Reserves.

As announced on March 15, 2020, the Board reduced reserve requirement ratios to zero percent effective March 26, 2020. This action eliminated reserve requirements for all depository institutions.

I discussed the above on March 27, 2020 in Fictional Reserve Lending Is the New Official Policy

More fundamentally, neither Salerno nor Newman understands how money is created.

Banks do not lend deposits. Rather, loans are the result of deposits. [I said banks never lent deposits. If you go back long enough they did.]

I commented:

Amusingly, a few days ago yet another article appeared explaining how the Money Multiplier works. The example goes like this: Someone deposits $10,000 and a bank lends out $9,000 and then the $9,000 gets redeposited and 90% of the gets lent out and so an and so forth.

The notion was potty. That is not remotely close to how loans get made.

What’s Changed Regarding Lending?

Essentially, nothing.

The announcement just officially admitted the denominator on reserves for lending is zero.

When Do Banks Make Loans?

- They meet capital requirements

- They believe they have a creditworthy borrower

- Creditworthy borrowers want to borrow

Point two is worthy of discussion.

Banks may not have a creditworthy borrower, they just have to believe it, or they have an alternate belief that applies. In 2007 banks knew full well they were making mortgage liar loans.

So why did banks make liar loans?

Because banks bought into the idea home prices would not go down. If home prices appreciated, banks were covered.

BIS Working Papers No 292 Unconventional Monetary

In 2009, I referred to BIS Working Papers No 292 Unconventional Monetary

The article addresses two fallacies

Proposition #1: an expansion of bank reserves endows banks with additional resources to extend loans

Proposition #2: There is something uniquely inflationary about bank reserves financing

From the BIS

The underlying premise of the first proposition is that bank reserves are needed for banks to make loans. An extreme version of this view is the text-book notion of a stable money multiplier.

In fact, the level of reserves hardly figures in banks’ lending decisions. The amount of credit outstanding is determined by banks’ willingness to supply loans, based on perceived risk-return trade-offs, and by the demand for those loans.

The main exogenous constraint on the expansion of credit is minimum capital requirements.

Read those points over and over until they sink in. I discussed that article in 2009 and again in 2020.

Fictional Reserve Lending

The fact of the matter is loans create deposits not the other way around.

Yet here we are, with zero reserves on deposits (not that any were ever needed even when there were reserve requirements) discussing absurd money multiplier theory.

I started skipping around in the video and found some accurate statements by Jim Grant.

The rest is spotty. Ponder this amusing but false idea at the 9:30 mark: “In 1971 they [the Fed] might have done other things like raise the price of gold.”

The comment was in reference to Nixon ending gold redeemability.

The video authors somehow seems unaware that you cannot fix the price of gold. Rather money should represent a fixed quantity of gold, not gold valued in dollar terms.

At the 12:30 mark we see some intelligent comments on who the loser is. “The average working person pays the price during the cycle of boom and bust.”

But many of us have been making that comment for decades. Mises.Org has not offered anything new.

At the 27:00 mark the video has a reasonable discussion of the risks of central bank digital currencies.

Stop the Madness

At the 30:00 mark, Mises discusses how to stop the madness, supposedly. But for five minutes the video droned on with obvious why discussion as opposed to how.

At the 35:00 minute mark there’s a discussion on ending the Fed. Finally, at the 37:35 mark Ron Paul stated “Economically, you just get rid of the Fed if you want to have sound money and a healthy economy.”

That was it. There is no more.

Conclusion

For decades, I have been saying we need to end the Fed and let the market set interest rates. My fear is we end the Fed and let politicians control money supply.

Trump, who appointed Jerome Powell, now wants to fire him. Trump said he personally could do a better job.

Trump would be worse. Even if Trump wouldn’t be worse, what about the next president?

The idea that a group of central planners can manage the economy is proven false by the increasing amplitude of boom-bust cycles over time.

But the idea a politician or Congress whose main goal is to get reelected can do a better job is ridiculous.

We need to end the Fed but only if we replace the Fed with nothing instead of politicians. The free market can set rates nicely.

Not only was the video loaded with factual errors, it offered no discussion of how to end the Fed or what the consequences would be.

The Fed controls interest rates but politicians control deficit spending. There was no mention of that key idea in the video.

Now was there any discussion (other than false), on how banks create money. If we were to have a 100 percent gold-backed dollar, then many things have to change.

There was no discussion of this critical idea. Nor could there be. The authors have no idea how money is created.

Grade F.