The July jump in small business optimism momentum lasted precisely one month.

Small Business Optimism Dips in August

The NFIB reports Small Business Optimism Dips in August

The NFIB Small Business Optimism Index fell by 2.5 points in August to 91.2, erasing all of July’s gain. This is the 32nd consecutive month below the 50-year average of 98. The Uncertainty Index rose to 92, its highest level since October 2020. Inflation remains the top issue among small business owners, with 24% of owners reporting it as their top small business operating issue, down one point from July.

Key NFIB Findings

- The frequency of reports of positive profit trends was a net negative 37% (seasonally adjusted), seven points worse than in July and the lowest since March 2010.

- Twenty-four percent of owners reported inflation as their single most important problem in operating their business, down one point from July.

- The net percent of owners expecting higher real sales volumes fell nine points in August to a net negative 18% (seasonally adjusted). Real sales volume expectations were the largest contributor to the decline in the Optimism Index along with earning trends and expected business conditions. [Mish note: real means inflation-adjusted]

- A seasonally adjusted net 20% plan to raise compensation in the next three months, up two points from July.

- The net percent of owners raising average selling prices fell two points from July to a net 20% seasonally adjusted.

NFIB Lead Comment

“The mood on Main Street worsened in August, despite last month’s gains,” said NFIB Chief Economist Bill Dunkelberg. “Historically high inflation remains the top issue for owners as sales expectations plummet and cost pressures increase. Uncertainty among small business owners continues to rise as expectations for future business conditions worsen.”

Commentary Snips

The last two months have been wrought with political turmoil in the U.S. But on Main Street, it seems to be business as usual. No major change in owner optimism as the Optimism Index remains well below the 50-year average. The outlooks for sales and business conditions are at historically low levels and continue to get worse. Consumer sentiment (Survey of Consumers, Univ. of Mich.) continues to drift lower, but consumer spending resists joining the “slowdown” parade. Manufacturing remains weak and housing and construction are catching its slowdown. Inflation is closer to 2 percent but not there. However, it is close enough for the Federal Reserve to commit to starting interest rates cuts. Reports of price and wage hikes are falling in frequency but remain historically on the high side with plenty of room to fall. Government spending and hiring remain strong, the “legs” of any fourth quarter growth that might occur.

The Uncertainty Index rose to its highest level since October 2020 (98), rising 2 points from July to 92, 19 points above the January reading and 10 points above June. Clearly, “uncertainty” has been on the rise! The Fed’s commitment to cut interest rates should have been a calming factor, so it’s probably not to blame. Aggregate spending and inflation have been fairly stable, but reports of the net percent with higher sales now rivals what was last seen in the 2020 and 2008 recessions. And the stock market is expressing some unease. Internal strife over foreign policy is strengthening, “family fights,” and the election is just weeks away. Expect more volatility in everything in the coming months.

Labor Markets

In NFIB’s August survey, 40 percent (seasonally adjusted) of all owners reported job openings they could not fill in the current period, up 2 points from July. Thirty-six percent have openings for skilled workers (up 4 points) and 15 percent have openings for unskilled labor (down 1 point). The difficulty in filling open positions is particularly acute in the transportation, construction, and manufacturing sectors. Job openings in construction were up 5 points from last month and over half of the firms (60 percent) have a job opening they can’t fill. Openings were the lowest in the agriculture and finance sectors. A seasonally adjusted net 13 percent of owners plan to create new jobs in the next three months, down 2 points from July. Overall, 62 percent reported hiring or trying to hire in August, up 5 points from July.

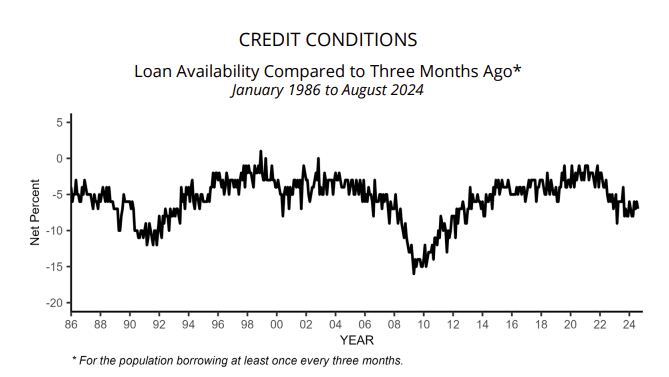

Small Business Credit Conditions

Small Business Real Earnings

This is interesting. It seems that real (inflation-adjusted) earnings are always going down.

That may be hard to believe, but 35 percent of small business startups fail every year. Most of the rest struggle with regulations, minimum wage hikes, and competition from Costco, and big chains.

Progressive states like California and Illinois add to the misery.

NFIB Single Most Important Issue

The three most important issues, in order, are inflation, quality of labor, and taxes.

This should play into Trump’s wheel.

Small Businesses Reducing Workers for the Last Four Months

On September 5, I noted Small Businesses Reducing Workers for the Last Four Months

ADP data shows small businesses with 1-49 workers have been reducing workers for four months. Those with 20-49 workers have shed workers for 7 straight months.

Q: Does the NFIB survey refute those numbers?

A: No, for two reasons

First, the NFIB survey shows intent, not results. If the quality of labor is deemed poor, businesses won’t hire just to fill a spot.

Second, and I believe more important, the NFIB survey is a diffusion index. One business hiring one person will offset another letting 5 workers go.

Using the above as an example, the diffusion index for four businesses hiring one person and a fifth letting five workers go would result in a +3 not a -1 score.

The McKelvey Recession Indicator Triggered, But What Are the Odds?

In case you missed it, please see The McKelvey Recession Indicator Triggered, But What Are the Odds?

Many eyes are on the McKelvey recession indicator. Too many? That would probably be the case if everyone believed it.

Heck, most of my own readers don’t seem to believe it. I have the odds well over 50 percent that a recession is underway. Click on the above link for discussion.