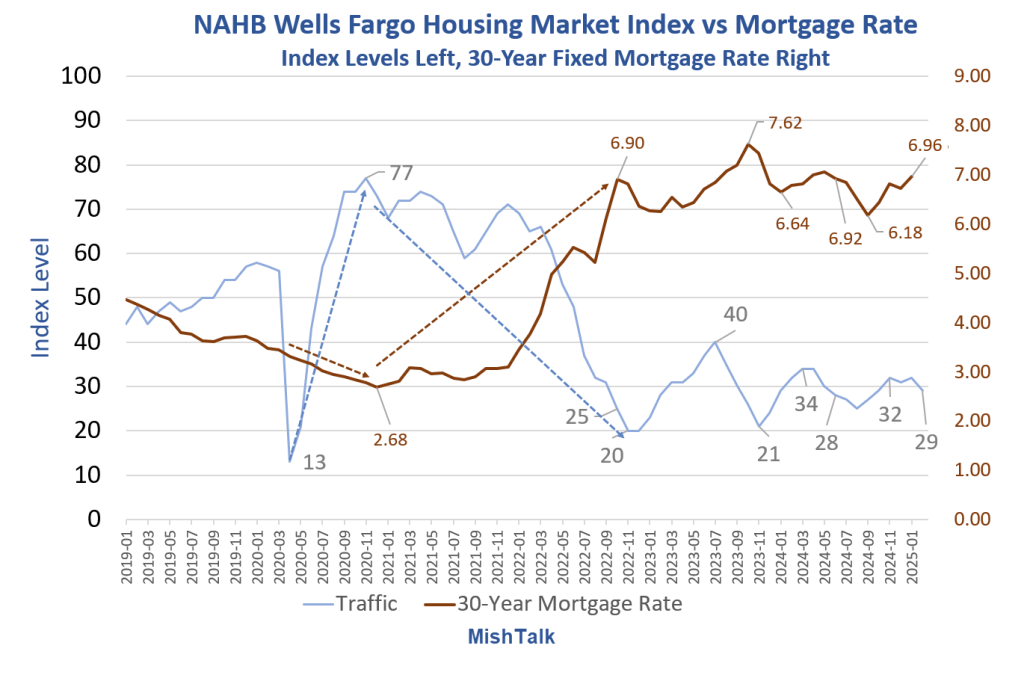

Homebuilder sentiment has been low since mid-2022. Buyer traffic is dismal.

The NAHB/Wells Fargo Housing Market Index (HMI) has been stuck in a wide range since mid-2022.

Key HMI index Components for February

- Builder confidence in the market for newly built single-family homes was 42 in February, down five points from January.

- Current sales conditions fell four points to 46.

- Sales expectations in the next six months plunged 13 points to 46.

- Traffic of prospective buyers posted a three-point decline to 29.

Builder Incentives

The latest HMI survey also revealed that 26% of builders cut home prices in February, down from 30% in January and the lowest share since May 2024.

The average price reduction was 5% in February, the same rate as the previous month. The use of sales incentives was 59% in February, down from 61% in January.

NAHB Wells Fargo Housing Index vs Traffic

It’s no secret what the problems are.

Mortgage rates are high and so are home prices. Once mortgage rates hit 5 percent traffic plunged.

Builders offered incentives and price reductions but we are at the end of things that can be done. And fewer builders are offering incentives this month.

What About Labor Costs?

It will be interesting to see the impact on construction costs and the price of skilled labor if there are mass deportations.

Deporting skilled labor will be a huge mistake. How many are afraid to show up for work right now?

Neither businesses nor people cheering “deport them all” will like the result if Trump acts foolishly, not only for construction costs but also agriculture, hotel staff, and restaurants.

Related Posts

February 17, 2025: DOGE Makes Huge Mistake Firing Nuclear Workers, Now Seeks to Rehire Them

When you fire people without understanding what they even do, you make big mistakes.

February 17, 2025: The CPI Is Deeply Flawed and the Fed Feeds those Flaws

The Fed makes horrendous policy decisions because it does not understand inflation.

On January 23, I noted Trump “Will Demand Interest Rates Drop Immediately”

Trump repeated that call after the disastrous CPI report. Instead, he should have blamed the Fed for cutting rates before the election.

Deporting skilled labor would be a serious stagflationary mistake.