The economic slowdown continues led by income and consumer spending.

The BEA made significant revisions to Gross Domestic Product (GDP) and Gross Domestic Income (GDI) data for 2024 Q1 and 2023 Q4 respectively.

GDI is not reported in in the first release of GDP so the revision for GDI pertains to 2023 Q4.

GDI reporting lags GDP reporting by a month in the first three quarters of the year and by two months for the fourth quarter.

Due to lags, GDP gets all the media writeup, but many analysts, me included, think GDI is a better number to watch.

Significant Negative Revisions

- 2024 Q1 GDP went from 1.6 percent to 1.3 percent.

- Based on updated data from the Bureau of Labor Statistics Quarterly Census of Employment and Wages program, Wages and salaries are now estimated to have increased $58.5 billion in the fourth quarter, a downward revision of $73.0 billion.

- Real gross domestic income is now estimated to have increased 3.6 percent in the fourth quarter, a downward revision of 1.2 percentage points from the previously published estimate of 4.8 percent.

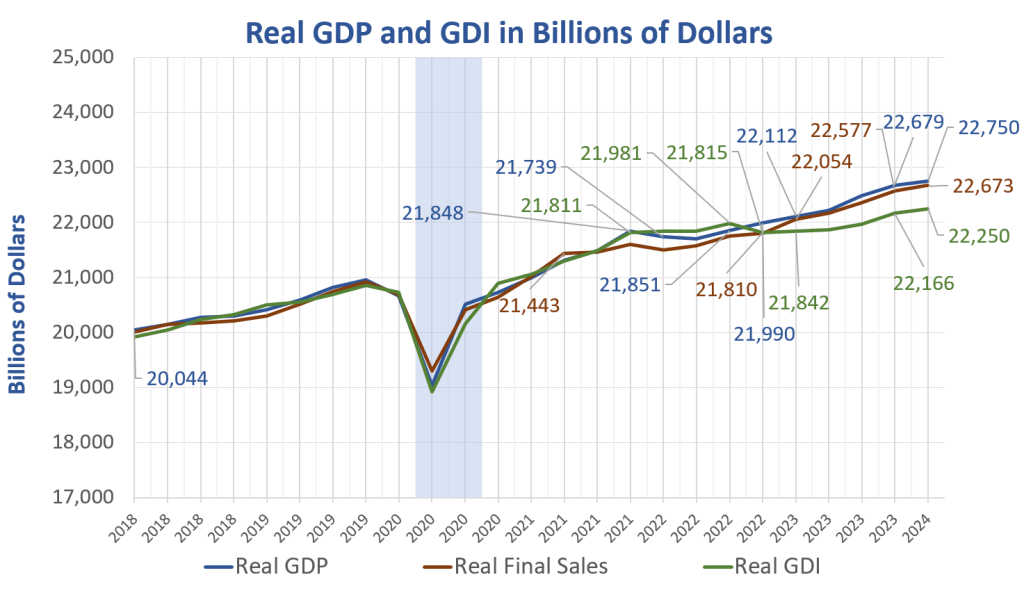

Real GDP and GDI in Billions of Dollars

Chart Notes

- Gross Domestic Product (GDP) and Gross Domestic Income (GDI) are two measures of the same thing. Product produced should match sales and income. They do over time, but this is a large ongoing discrepancy.

- Real Final Sales is the bottom line estimate of GDP. The difference between GDP and Real Final Sales is inventory adjustment which nets to zero over time.

- Real means Inflation adjusted using the GDP deflator as calculated by the BEA as the adjustment.

GDP Details

- Real gross domestic product (GDP) increased at an annual rate of 1.3 percent in the first quarter of 2024.

- In the fourth quarter of 2023, real GDP increased 3.4 percent.

- In the advance estimate, the increase in real GDP was 1.6 percent. The update primarily reflected a downward revision to consumer spending.

Personal Income

- Disposable personal income increased $266.7 billion, or 5.3 percent, in the first quarter, an upward revision of $40.5 billion from the previous estimate.

- Real disposable personal income increased 1.9 percent, an upward revision of 0.8 percentage point.

- Personal saving was $796.6 billion in the first quarter, an upward revision of $96.6 billion from the previous estimate. The personal saving rate—personal saving as a percentage of disposable personal income—was 3.8 percent in the first quarter, an upward revision of 0.2 percentage point.

Income rose 5.3 percent. Adjusted for inflation, income rose 1.9 percent. Those are annualized numbers. Good luck if you are looking to buy a house.

Gross Domestic Income and Corporate Profits

- Real gross domestic income (GDI) increased 1.5 percent in the first quarter, compared with an increase of 3.6 percent (revised) in the fourth quarter.

- Profits from current production (corporate profits with inventory valuation and capital consumption adjustments) decreased $21.1 billion in the first quarter, in contrast to an increase of $133.5 billion in the fourth quarter.

- Profits of domestic financial corporations increased $73.7 billion in the first quarter, compared with an increase of $5.9 billion in the fourth quarter. Profits of domestic nonfinancial corporations decreased $114.1 billion, in contrast to an increase of $136.5 billion. Rest-of-the-world profits increased $19.3 in contrast to a decrease of $8.9 billion. In the first quarter, receipts increased $29.8 billion, and payments increased $10.5 billion.

Data Weakening Continues

The two key points in this release are the downward revision of 1.2 percentage points in GDI in 2024 Q3 and the BEA comment “The update primarily reflected a downward revision to consumer spending.”

Flashback April 25, 2024: Expect Big Negative Revisions to BLS Monthly Jobs in 2023, GDP Too

Yesterday, the BLS released a little-read jobs report that shows reported jobs in 2023 may be wildly overstated. In turn, that means GDP is likely overstated as well.

The BLS says that the BLS monthly job reports for 2023 Q2 and Q3 are overstated by a total of 1.321 million jobs.

Jobs were overstated by 1.3 million. Mainstream media totally missed this. Now we see Income revised lower with a downward revision to consumer spending.

Note that those revisions are for Q2 and Q3. What will Q4 revisions be?

Discretionary Spending Tumbles at Target

On May 22, I noted Discretionary Spending Tumbles at Target, Shares Drop 10 Percent

Target CEO Brian Cornell said the results show “continued soft trends in discretionary categories.”

The interesting word above is “continued”.

Walgreens Cuts Prices on 1,500 Items as Did Amazon and Target

Yesterday, I noted Walgreens Cuts Prices on 1,500 Items as Did Amazon and Target

Who’s Next at the Confessional?

So its “continued soft trends” at Target and a “challenging retail environment” at Walgreens coupled with lower guidance. Who is next at the confessional?

EVs Hit Brick Wall

The Inflation Reduction Act provided stimulus for a while, but it also caused the auto manufacturers to gear up for cars that few want now.

EVs have hit a brick wall. IRA stimulus has gone into reverse.

On April 2, I commented Tesla’s Deliveries Drop for First Time Since 2020, It’s Demand Not Supply

On April 15, I noted Elon Musk Fires 10 Percent of Tesla Workforce, Prepares for “Next Phase of Growth”

New Home Sales Huge Negative Revisions

New Home Sales plunged in April. And the Census Department completely revised away the fictional 8.8 percent rise in March.

For discussion, please see New Home Sales Sink 4.7 Percent on Top of Huge Negative Revisions

This economy is weakening much faster than economists realize.