In another sign of economic weakness, the amount of “looking for greener pastures” job hopping is below pre-pandemic levels especially in key sectors, 5 charts.

The BLS Job Openings and Labor Turnover report shows continued weakness in opening, hires and separations.

Recent data is for May 2024 thus lags the payroll report by about a month.

Job Openings

- On the last business day of May, the number of job openings changed little at 8.1 million. This measure was down by 1.2 million over the year.

- Job openings decreased in accommodation and food services (-147,000) and in private educational services (-34,000). The number of job openings increased in state and local government, excluding education (+117,000), durable goods manufacturing (+97,000), and federal government (+37,000).

The state and local opening are directly related to handing the surge in immigration Weakness in accommodation and food service is pronounced.

Hires

- Hires In May, the number of hires was little changed at 5.8 million.

- Over the year, hires were down by 415,000.

Separations

- Se[arations include quits, layoffs and discharges.

- Quits are voluntary separations initiated by the employee.

- Layoffs and discharges are involuntary separations initiated by the employer.

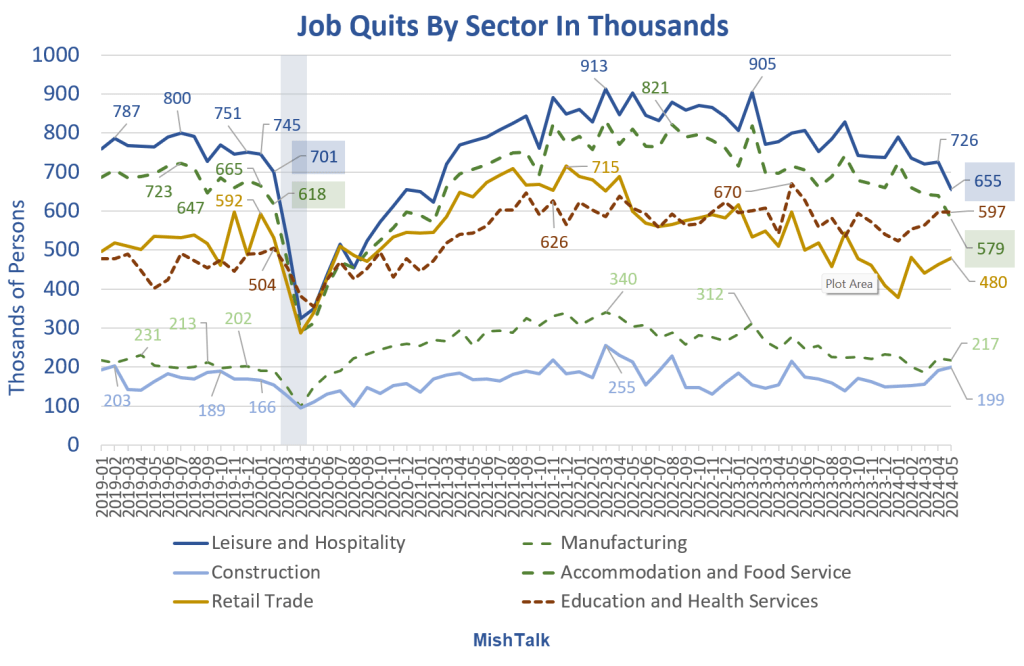

Job Quits by Sector in Thousands

Two if the biggest sources of jobs in the recovery were in accommodation and food service, and Leisure and Hospitality.

The number of quits in those areas are below pre-pandemic levels. Otherwise, things are back to normal or nearly back to normal.

Job Openings, Hires, Separations, Quits

Job openings have crashed from a peak of 11.8 million in April of 2022 to 8.1 million in May of 2025.

In just over two years, opening plunged by 3.6 million, a decline of 30.1 percent.

However, openings are up about 1.2 million from February of 2020. This assumes you believe the numbers.

It costs nothing to leave an online posting posting and some of these positions have been filled, some are spoofs, and some are along the lines of “If the perfect person comes by, we may be interested.”

In contrast, layoffs and quits are hard data.

Labor Leverage Ratio

The quits rate is a measure of workers’ willingness or ability to leave jobs.

The labor leverage ratio (LLR), defined as quits divided by the sum of layoffs and discharges, shows whether labor or employers are setting the pace. The indicator is currently in neutral.

LLR is a very lagging measure that tends to plunge well after a recession has started. That’s when people are more fearful of loosing their job than any desire to look for greener pastures.

The ratio now shows a topping pattern, just as one might expect when overall economic data is weakening.

A String of Very Weak Economic Data Sinks the GDPNow Forecast

Key Point on Real Final Sales

Nearly everyone focuses on the headline number of 1.7 percent. But its Real Final Sales (RFS) that matters. The difference between the numbers is inventory adjustment, Change in Private Inventories (CIPI), which nets to zero over time.

RFS is the real bottom line estimate for the economy and that’s what the NBER will use to call a recession.

At 1.1 percent and falling fast, RFS looks very recessionary.

What Happened?

On July 1, I noted A String of Very Weak Economic Data Sinks the GDPNow Forecast

July 1: In response to ISM and the construction spending, the contribution for Gross Private Domestic investment fell from from 1.51 percentage points (PP) to 1.20 PP.

June 27: The GDPNow contribution for net exports fell from -0.56 PP to -0.95 PP.

Those two items account for 70 basis points, 0.70 PP of the decline in the GDPNow forecast.

Elsewhere, new home sales, housing starts, existing home sales, new durable goods orders, and even real (inflation-adjusted) consumer spending are very weak.

I am increasingly confident a recession has started or soon will.