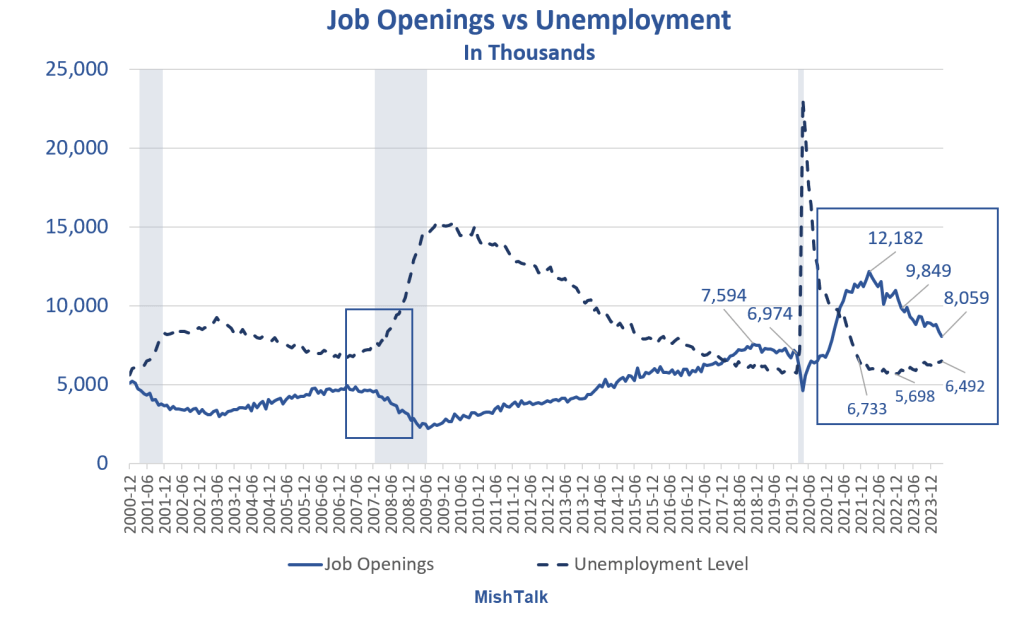

Unemployment is rising and job openings have crashed. It looks recessionary. Let’s investigate with a series of pictures.

Job openings have plunged from a peak of 12.2 million in March of 2022 to 8.1 million in April of 2024. Openings data is current through April.

Unemployment is up from 5.7 million in December of 2022 to 6.5 million in April of 2024. The May unemployment level is 6.6 million

The levels don’t match the Great Recession, but the pattern is strikingly similar.

I picked up this idea from Bespoke.

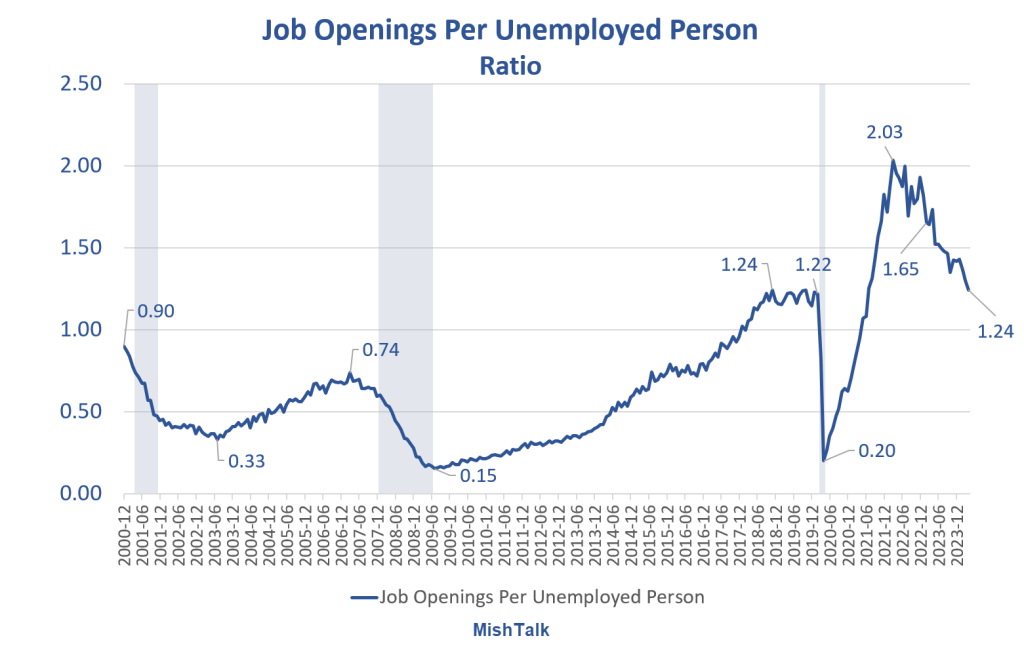

“Fed Chair Powell likes to cite the ratio of job openings per unemployed worker as an indicator of tight labor markets, but it’s now back to 2019 pre-COVID levels at ~1.2. This was at 2 to 1 when the Fed began tightening a couple years ago.”

Here is the Bespoke version of the data calculated to two decimal places.

Job Openings Per Unemployed Person

Does a ratio tell the better story or actual numbers? I think actual numbers as in the lead chart, but kudos to Bespoke for the idea.

Question of the Day?

Does anyone believe the current number of openings?

I think openings are hugely overstated. There is no cost to having an opening now. There was decades ago when it cost to list a hob with search firms.

Openings now are frequently along the lines “If the perfect candidate shows up, I will hire, otherwise not.”

Also, openings put up a front to make employees feel better. If there are no openings employees start to worry if cuts are around the corner.

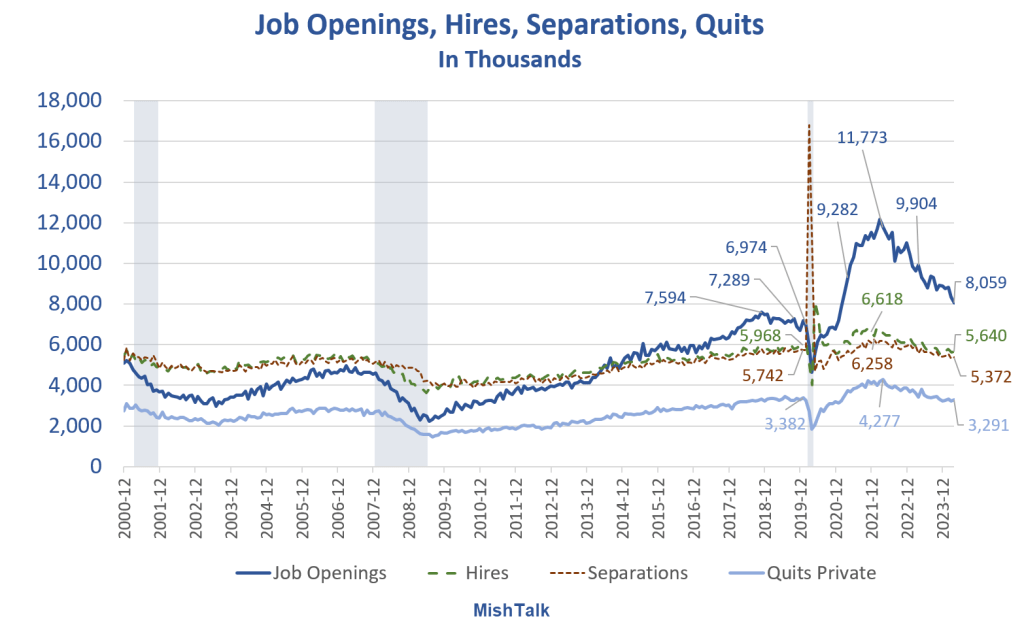

Job Openings, Hires, Separations, Quits

Hires, separations, and quits are all below the pre-pandemic numbers.

Quits are down from 4.3 million in April of 2022 to 3.3 million in April of 2024. Pre-pandemic quits were 3.4 million.

This is a sign of nervous employees unwilling to switch jobs and/or companies unwilling to pay increasing salaries to entice people to look.

This data only dates to December of 2000, but the only other three times we have seen declines like these, the economy was in or headed to recession.

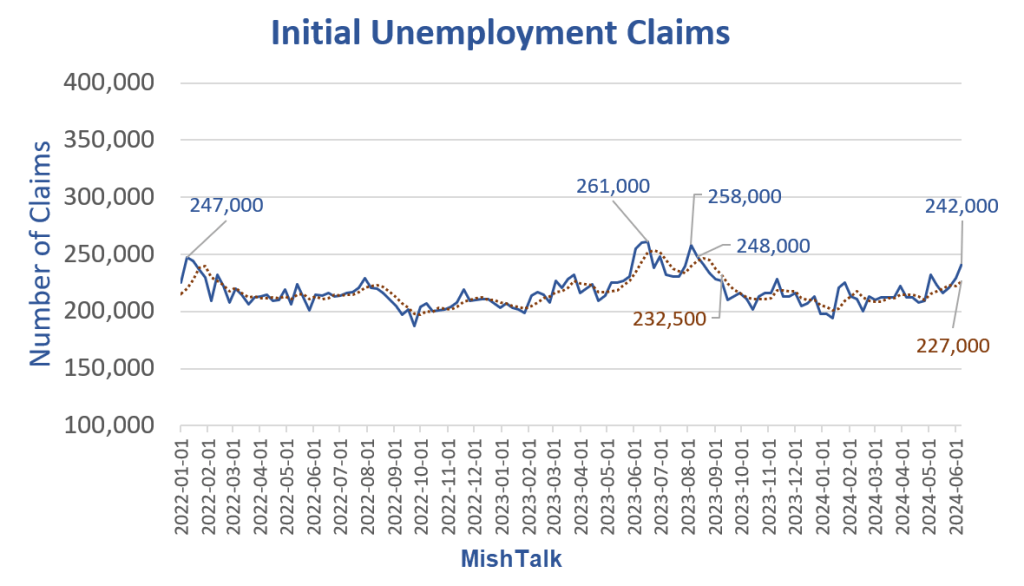

Initial Unemployment Claims Jump the Most Since August 2023

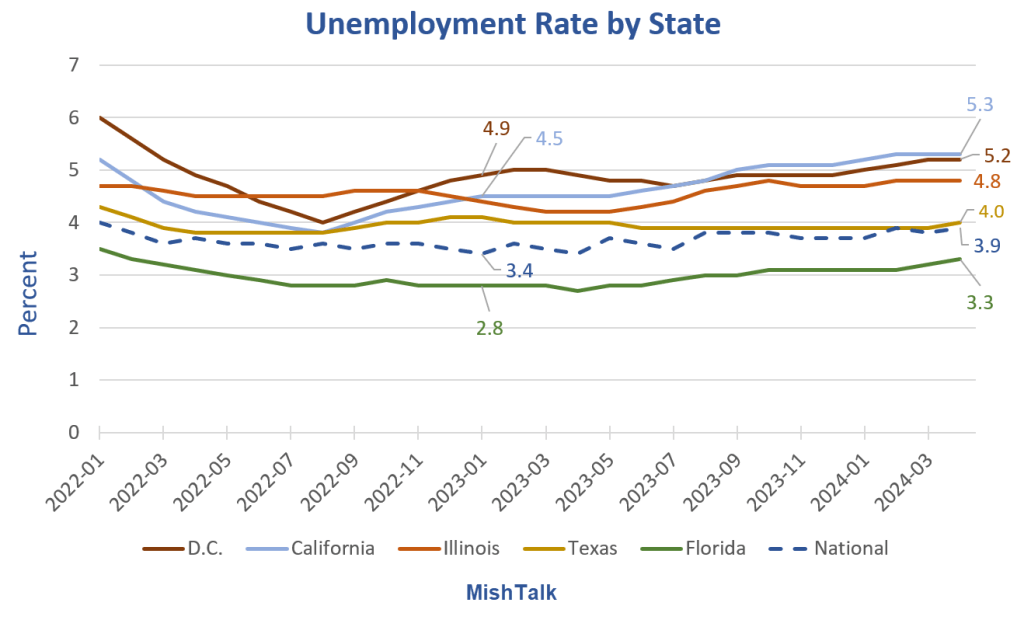

Continued claims also show rising economic weakness. Some say it’s just California. Let’s investigate.

A California Anomaly?

The report shows the unadjusted level for California rose from 40,799 to 51,110. That’s an increase of 10,311.

So is this just California? Did it even happen in California?

For details, please see Initial Unemployment Claims Jump the Most Since August 2023

Hint: It did happen in California and it will spread.

Twenty Percent of California Lives in Poverty, What’s Going On?

For discussion, please see Twenty Percent of California Lives in Poverty, What’s Going On?

California leads the nation in the percentage of people living in poverty. Blame the Progressive oligarchs like Governor Newsom.

What About Jobs?

Please see Another Bizarro Jobs Report – Payrolls Rise 272,000 Employment Drop 408,000

Nonfarm Payrolls vs Employment Gains Since May 2023

- Nonfarm Payrolls: 2,756,000

- Employment Level: +376,000

- Full-Time Employment: -1,163,000

In the last year, jobs are up 2.8 million while full-time employment is down 1.2 million

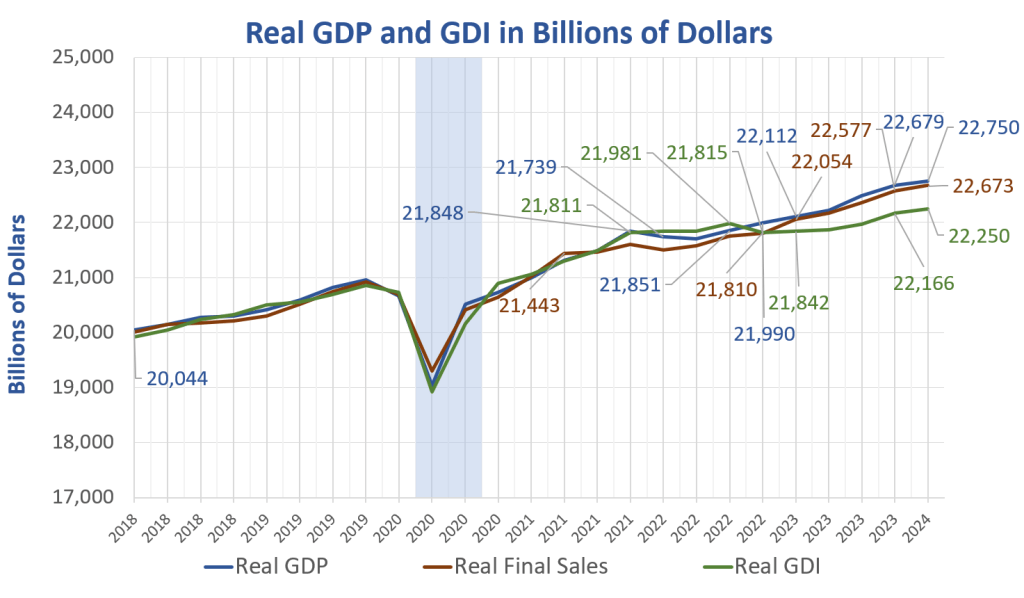

Similarly, there is a huge discrepancy between Gross Domestic Product (GDP) vs Gross Domestic Income (GDI)

Real GDP vs Real GDI

GDP and GDI are two measures of the same thing. Income received should match product produced.

However, income is historically low vs GDP.

GDI lends credence to the idea that the household survey (employment) is correct, not the CES establishment survey (nonfarm payrolls) with its assumed birth-death adjustments.

Recession When?

Weakening of data is now across the board except for a jobs report that many intelligent minds don’t believe.

Coupled with weakening trends in hard data, I repeat my unpopular opinion: A Second-Quarter Recession This Year Looks Increasingly Likely

Second quarter means a recession has started and few see it. If not second then third. We will see.

Danielle DiMartio Booth thinks a recession started last October. So, I am not the first to think so this time. For discussion, please see Is the US in Recession Now? Two Prominent Competing Views

The two views are Danielle DiMartio Booth and Jim Bianco.