Job openings have collapsed. And the number of quits confirms people are staying put.

The Job Openings and Labor Turnover Summary (JOLTS) report from the BLS shows the labor market continues to weaken.

Job Openings

- The number of job openings decreased to 7.6 million (-556,000) on the last business day of December and was down by 1.3 million over the year. The job openings rate, at 4.5 percent, decreased over the month.

- The number of job openings decreased in professional and business services (-225,000), health care and social assistance (-180,000), and finance and insurance (-136,000).

- Job openings increased in arts, entertainment, and recreation (+65,000).

Hires

- In December, the number of hires changed little at 5.5 million but was down by 325,000 over the year.

- The hires rate remained unchanged at 3.4 percent over the month. Hires increased in finance and insurance (+48,000).

Separations

- Total separations include quits, layoffs and discharges, and other separations. Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs.

- Layoffs and discharges are involuntary separations initiated by the employer. Other separations include separations due to retirement, death, disability, and transfers to other locations of the same firm.

- The number of total separations in December was little changed at 5.3 million. The total separations rate remained unchanged at 3.3 percent over the month.

Openings and Quits

The number of job openings is still a bit higher than pre-pandemic but the numbers are inflated due to survivor bias and very poor response rates.

Strong and Weak Labor Markets

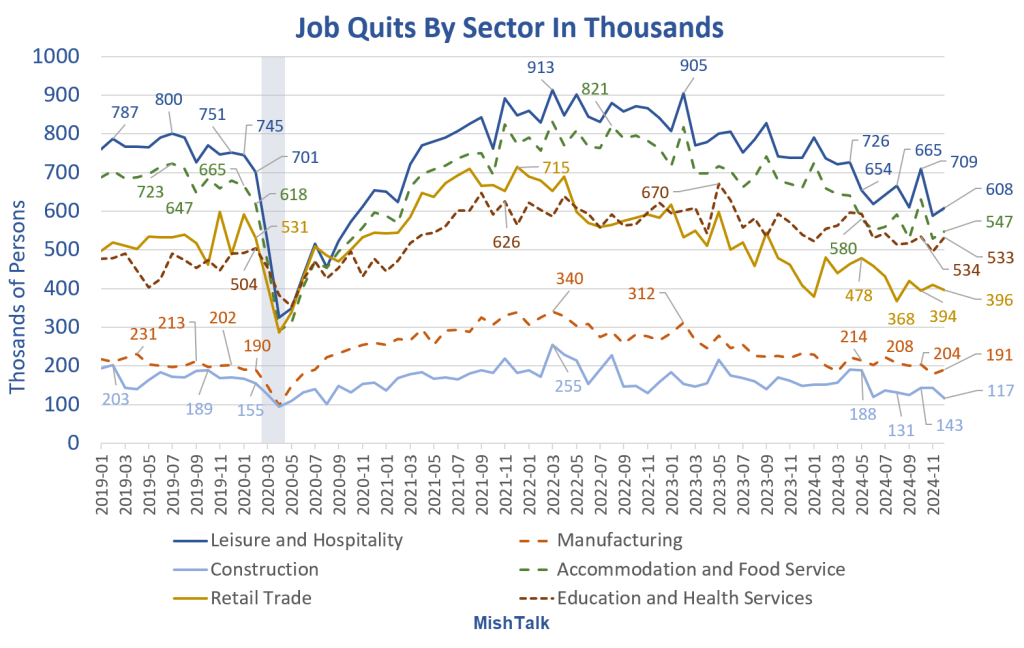

- Weak Markets: Job quits are lower than pre-pandemic numbers in Leisure and Hospitality, Accommodation and Food Service, Retail Trade, and Construction.

- Strong Job Market: Education and Health Services quits are higher than pre-pandemic, but steeply down from peak numbers. Demographics and illegal immigrants expanded the need for jobs in this sector.

- Neutral: Manufacturing is little changed from pre-pandemic numbers.

Across the board, every job category has weakened substantially since the peak, generally early 2022.

Hires vs Nonfarm and Private Quits

BLS Survey Response Rates

Response Rate Notes

JOLTS: BLS Job Openings and Labor Turnover Survey

CES: BLS Current Employment Statistics – The Monthly Nonfarm Payroll Establishment Survey

Response Rates and Survival Bias Issues

- First, firms that go out of business don’t respond. This is known as survival bias.

- Second, larger businesses are more likely to have someone who routinely answers such questions.

- Third, businesses of all sizes are deciding they have better things to do than answer BLS surveys.

- Fourth, businesses that are doing well are more likely to spend the time than businesses that are struggling or understaffed

BLS Sample Sizes

- Quarterly Census of Employment and Wages (QCEW) : 97 percent of bobs

- Business Employment Dynamics (BEDS): 92 percent of jobs

- Current Employment Statistics (CES): 27 Percent

The above numbers from CES FAQ

Four Things We Know

- QCEW and BEDS confirm the nonfarm payrolls are substantially overstated and have been for about two years.

- The BLS Birth-Death model assumptions are very flawed vs the hard data of BEDS and QCEW.

- The Fed and economists are using highly unreliable and overstated jobs data to make interest rate decisions.

- The BLS needs a serious overhaul of its data collection and modeling methods.

Major BLS Errors

Every month, economists and the Fed rely on very poor BLS monthly data to make decisions despite major modeling errors, data collection errors, and survival bias issues by the BLS.

The lagging QCEW and BEDS quarterly reports highlight the flaws.

Bad jobs data (very overstated monthly as shown by QCEW) likely explains the discrepancy between Gross Domestic Product (GDP) and Gross Domestic Income (GDI),

US is Now Losing Jobs in Net Business Creation

On January 31, I noted The BLS Confirms US is Now Losing Jobs in Net Business Creation

I hope you appreciate just how messed up this is. For many additional details and charts, please see above link.

And in case you have not figured this out, trade wars don’t help.