Unemployment claims jumped but it’s not Federal in nature.

Today, the US Department of Labor released Unemployment Claims for the week ending February 1.

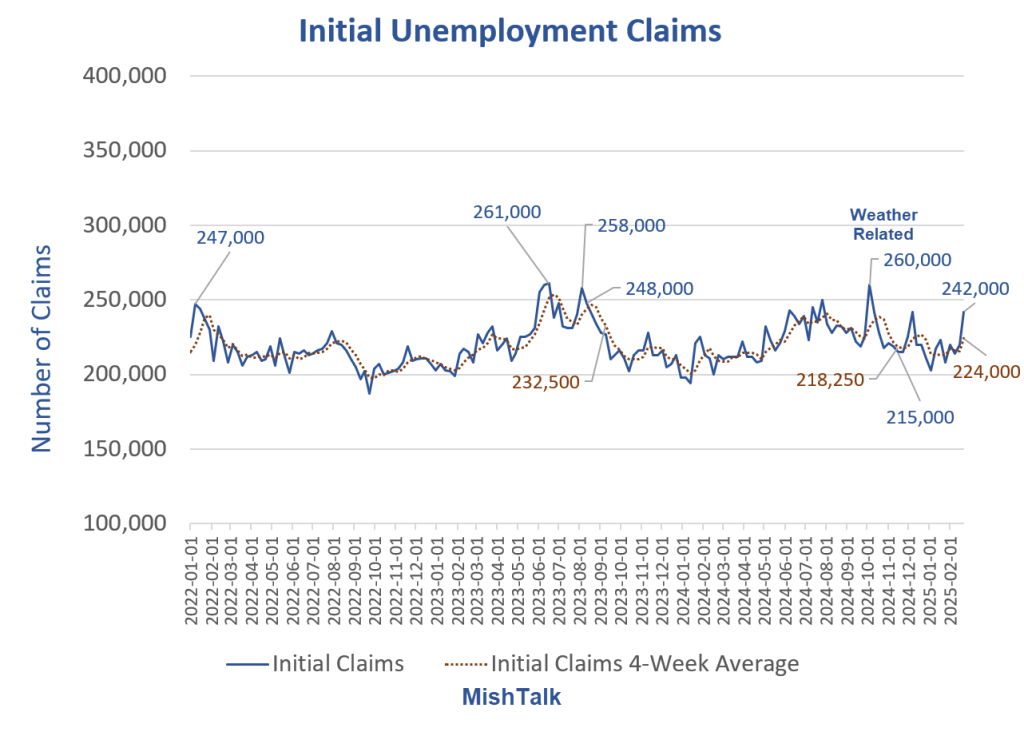

Initial Unemployment Claims

- In the week ending February 22, the advance figure for seasonally adjusted initial claims was 242,000, an increase of 22,000 from the previous week’s revised level. The previous week’s level was revised up by 1,000 from 219,000 to 220,000.

- The 4-week moving average was 224,000, an increase of 8,500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 215,250 to 215,500.

Initial Claims and 4-Week Average

DOGE, Random, or Something Else?

The Department of Labor data rules out DOGE.

“Initial claims for UI benefits filed by former Federal civilian employees totaled 614 in the week ending February 15, an increase of 1 from the prior week. There were 353 initial claims filed by newly discharged veterans, a decrease of 46 from the preceding week.”

77,000 Federal Employees accepted buyout offers but they will be paid for 8 months.

Musk is discussing up to 200,000 on probation may be let go but that has not started.

Continued Unemployment Claims

Continued Claims

- The advance seasonally adjusted insured unemployment rate was 1.2 percent for the week ending February 15, unchanged from the previous week’s unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending February 15 was 1,862,000, a decrease of 5,000 from the previous week’s revised level. The previous week’s level was revised down by 2,000 from 1,869,000 to 1,867,000.

- The 4-week moving average was 1,865,000, an increase of 3,000 from the previous week’s revised average. The previous week’s average was revised down by 500 from 1,862,500 to 1,862,000.

Combined Picture

The combined takeaway is that companies are not letting a lot of workers go, but when you do lose your jobs it is increasing harder to find a new one.

Continued claims have held steady since mid-October. However, that is a mirage.

Once a person uses all their benefits, they lose their unemployment benefits.

Expiring Unemployment Benefits

- Most states offer 26 weeks of unemployment benefits.

- Many states with a maximum of 26 weeks use a sliding scale based on a worker’s earnings history to determine the maximum number of weeks they qualify

- Arkansas, Iowa, Oklahoma, South Carolina, Missouri, North Carolina, and Kentucky have a lower number of week.

- Massachusetts allows up to 30 weeks depending on conditions. Montana allows 28 weeks of benefits.

Those are maximum benefits. People who have job-hopped don’t start out with 26 weeks of unemployment.

So at a bare minimum, we need to think of continued claims plus those unemployed 27 weeks or longer.

Continued Claims and 27+ Weeks Unemployed

Data in the above chart is through January. 27+ weeks unemployment is from the BLS, not the Department of Labor.

Net Negative Business Creation

Please consider The BLS Confirms US is Now Losing Jobs in Net Business Creation

The BLS BED report provides further confirmation the BLS Birth/Death jobs model is seriously screwed up.

Small businesses are struggling like mad. This is something the ADP reports also show.

On February 5, 2025, I noted ADP Payrolls Better than Expected But Two-Thirds of the Economy Has Stalled

ADP reported a better than expected 183,000 jobs in January, but small business trends are unsettling.

Small and medium-sized businesses account for over 70 percent of all jobs. Growth has stalled. Most job creation is now from companies with 500 or more employees.

For more details, click on the above link.

Claims Synopsis and Looking Ahead

For now, the initial claims spike appears random, but I suspect it isn’t. The economy is weakening on many fronts.

Since continued claims follow initial claims with a one-week lag, there rates to be a spike in continued claims next week.

When we see probation firings at the Federal level we will see more spikes in both continued and initial claims.

DOGE has yet to hit. And DOGE will not impact the next jobs report, on March 7 for February.

Due to BLS sampling methodology, we may not get a hint of DOGE in the jobs reports for two or perhaps even three months depending on the timing of layoffs.