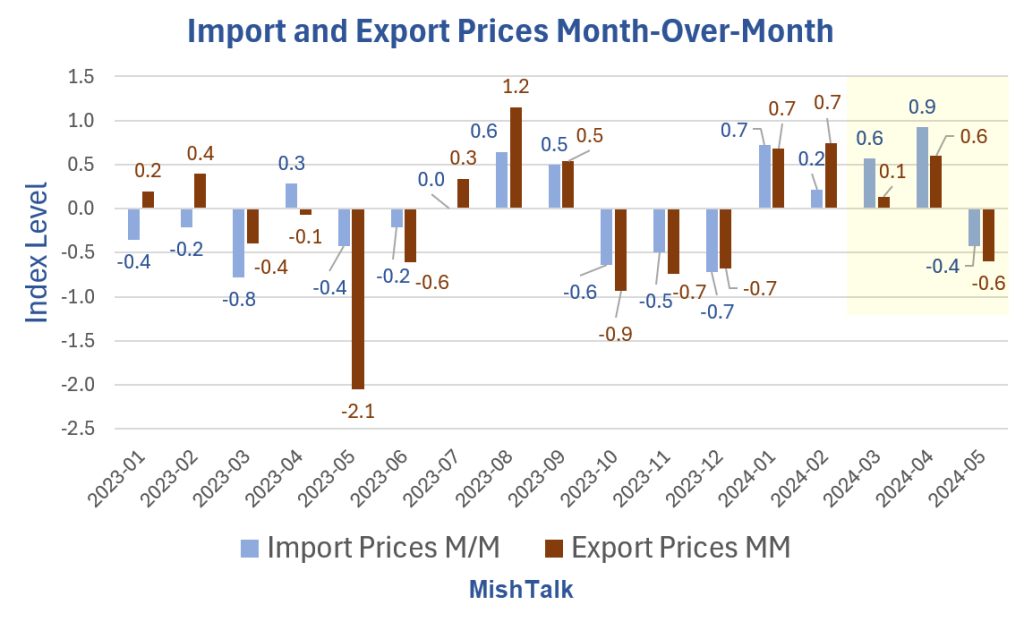

For the third straight month, import prices are stronger than export prices. In isolation, this rates to be net negative on the next GDPNow forecast.

The US Import and Export Price Indexes unexpectedly took a hit in May as reported by the BLS.

The Bloomberg Econoday consensus was for import and exports prices was unchanged. The Fed will appreciate price declines, but with export prices dropping more than import prices, this is net negative to GDP.

Month-Over-Month Import Details

- U.S. import prices declined 0.4 percent in May following a 0.9-percent increase in April and a 1.5-percent advance for the first quarter of 2024. The May decrease was the first monthly drop since the index fell 0.7 percent in December 2023.

- Fuel Imports: Prices for import fuel fell 2.0 percent in May, after increasing 4.1 percent in April. The May decline was the first 1-month decrease since the index fell 8.0 percent in December 2023.

- All Imports Excluding Fuel: The price index for nonfuel imports decreased 0.3 percent in May, after increasing 0.7 percent the previous month. The May decline was the first 1-month drop since October 2023. Lower prices in May for foods, feeds, and beverages; nonfuel industrial supplies and materials; consumer goods; capital goods; and automotive vehicles all contributed to the overall decline in nonfuel import prices. In spite of the May decline, nonfuel import prices advanced 0.5 percent over the past 12 months.

- Foods, Feeds, and Beverages: Prices for foods, feeds, and beverages declined 1.6 percent in May following a 1.3-percent advance the previous month. The decline in May was the largest monthly decrease since November 2020. The May drop was led by a 10.9-percent decrease in vegetable prices and a 4.6-percent decline in fruit prices.

- All Imports Excluding Fuel: The price index for nonfuel imports decreased 0.3 percent in May, after increasing 0.7 percent the previous month. The May decline was the first 1-month drop since October 2023. Lower prices in May for foods, feeds, and beverages; nonfuel industrial supplies and materials; consumer goods; capital goods; and automotive vehicles all contributed to the overall decline in nonfuel import prices.

- Finished Goods: Prices for each of the major finished goods import categories decreased in May. The price index for consumer goods declined 0.2 percent following a 0.1-percent decrease the previous month. Lower prices for household goods in May more than offset higher prices for medicinal, dental, and pharmaceutical products. Prices for import capital goods edged down 0.1 percent in May, after ticking up 0.1 percent the previous month. Automotive vehicles prices fell 0.1 percent in May, the first monthly decline since November 2023.

Month-Over-Month Export Details

- Exports Prices for U.S. exports declined 0.6 percent in May, after rising 0.6 percent the previous month. The May decrease was the first monthly decline since the index fell 0.7 percent in December 2023. Lower prices for nonagricultural exports in May more than offset higher agricultural prices. Despite the drop in May, prices for U.S. exports rose 0.6 percent from May 2023 to May 2024, the first 12-month advance since January 2023.

- Agricultural Exports: Agricultural export prices advanced 0.5 percent in May following a 0.4-percent decline in April. Higher prices in May for wheat, fruit, corn, and meat all contributed to the increase in export agricultural prices. Despite the May increase, export agricultural prices decreased 6.6 percent over the past 12 months.

- All Exports Excluding Agriculture: The price index for nonagricultural exports decreased 0.8 percent in May, the first monthly decline since December 2023. Lower prices for nonagricultural industrial supplies and materials in May more than offset higher prices for capital goods, consumer goods, and nonagricultural foods. In spite of the May drop, nonagricultural export prices rose 1.5 percent over the past year, the largest 12-month increase since January 2023.

- Nonagricultural Industrial Supplies and Materials: Prices for nonagricultural industrial supplies and materials fell 2.0 percent in May, the first 1-month decline since December 2023. The May drop was driven by a 5.1-percent decrease in export fuel prices. Despite the May drop, prices for export fuel increased 3.1 percent over the past year, the first 12-month advance since January 2023.

- Finished Goods: Prices for the major finished goods export categories mostly increased in May. Capital goods prices ticked up 0.1 percent following a 0.5-percent advance in April. The May increase was led by a 0.9-percent rise in semiconductor prices. Prices for export consumer goods rose 0.1 percent for the second consecutive month in May. Higher prices for household goods; recreational equipment; and coins, gems, jewelry, and collectibles all contributed to the increase in consumer goods prices. The price index for export automotive vehicles was unchanged in May, after a 0.8-percent advance the previous month.

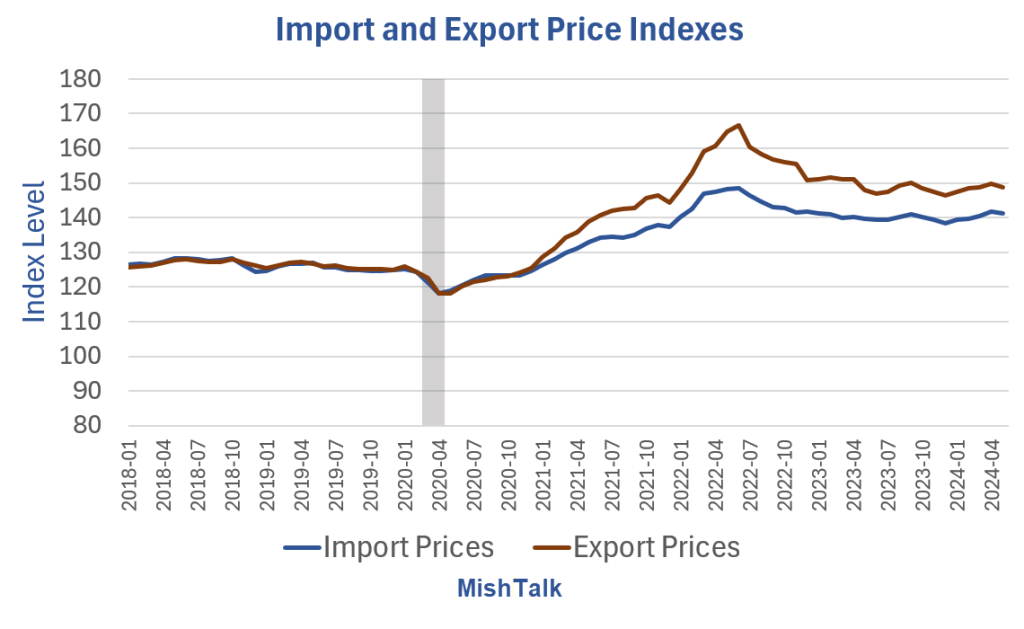

Imports and Export Price Indexes

A look at the import and export indexes shows a global economy that is still largely out of balance.

Imbalances remain but the data continues to weaken.

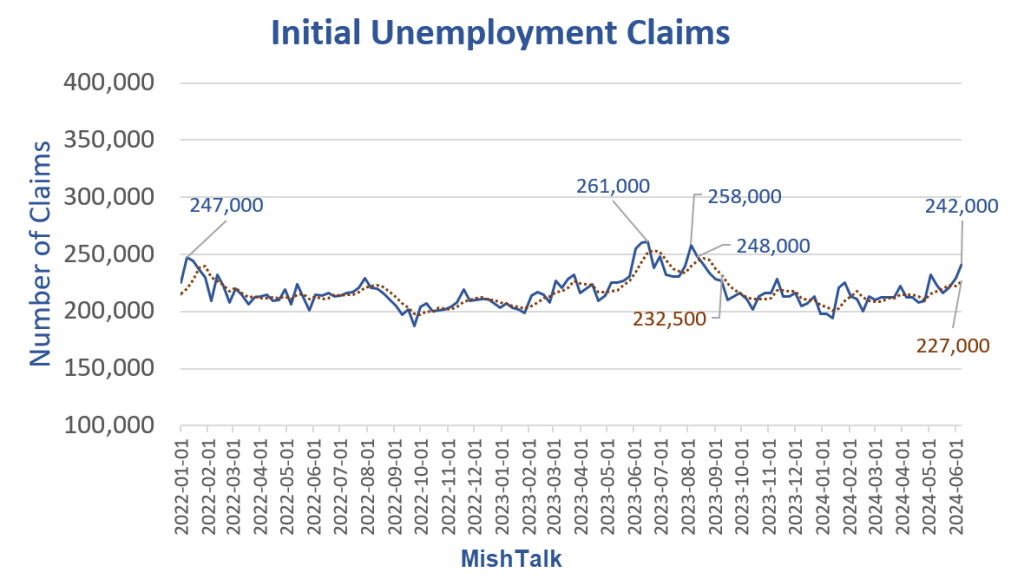

Initial Unemployment Claims Jump the Most Since August 2023

Yesterday, I commented Initial Unemployment Claims Jump the Most Since August 2023

More signs of economic weakness are showing up in the allegedly strong jobs market.

Payrolls Rise 272,000 Employment Drop 408,000

The data is confusing and conflicting in many ways.

For discussion, please see Another Bizarro Jobs Report – Payrolls Rise 272,000 Employment Drop 408,000

Nonfarm Payrolls vs Employment Gains Since May 2023

- Nonfarm Payrolls: 2,756,000

- Employment Level: +376,000

- Full-Time Employment: -1,163,000

In the last year, jobs are up 2.8 million while full-time employment is down 1.2 million

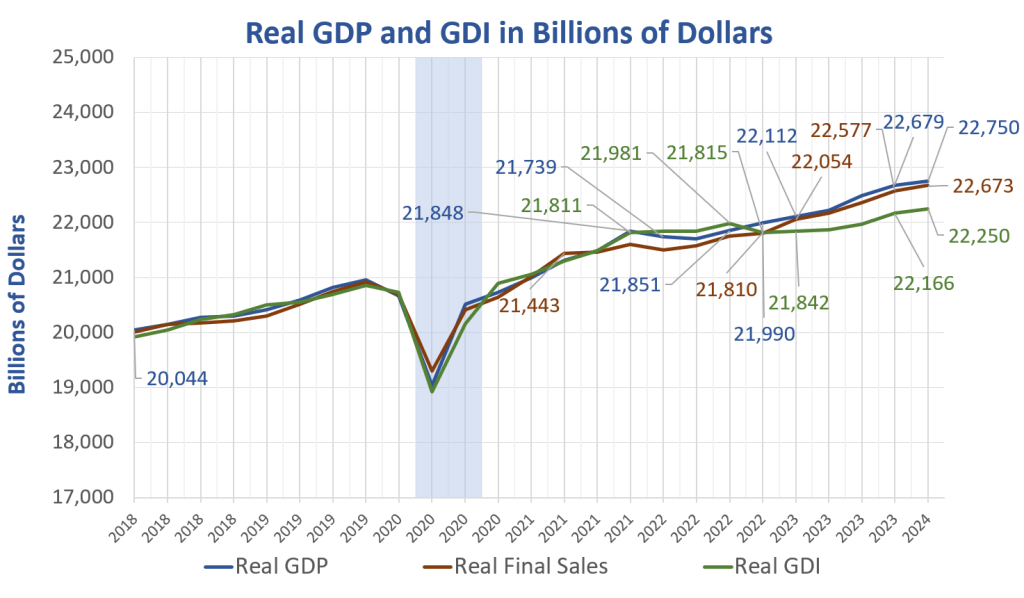

Similarly, there is a huge discrepancy between Gross Domestic Product (GDP) vs Gross Domestic Income (GDI)

Real GDP vs Real GDI

GDP and GDI are two measures of the same thing. Income received should match product produced.

However, income is historically low vs GDP

For discussion of the GDP-GDI discrepancy, please see More Soft Economic Data, Q1 GDP Revised Lower, Q4 GDI Significantly Lower

GDI lends credence to the idea that the household survey (employment) is correct, not the CES establishment survey (nonfarm payrolls) with its assumed birth-death adjustments.

I repeat my unpopular opinion: A Second-Quarter Recession This Year Looks Increasingly Likely

The Fed seems confident about the short term. I suggest they should be as confident about 2024 as they are about 2025, and that translates to no confidence at all.