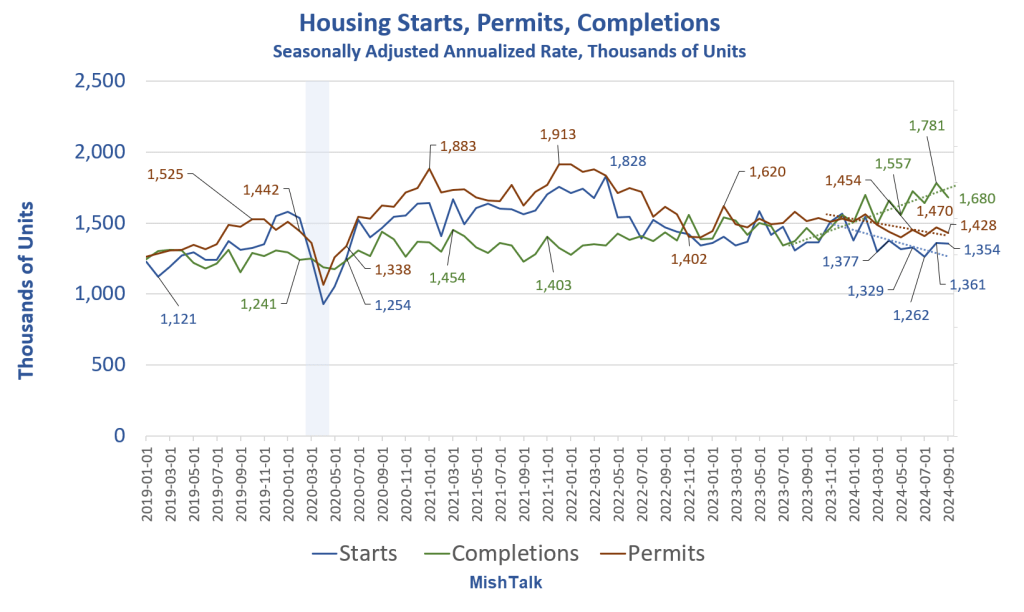

Housing continues to slowly weaken and completions surge relative to starts and permits.

Building Permits

- Privately-owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 1,428,000.

- This is 2.9 percent below the revised August rate of 1,470,000 and is 5.7 percent below the September 2023 rate of 1,515,000.

- Single-family authorizations in September were at a rate of 970,000; this is 0.3 percent above the revised August figure of 967,000. Authorizations of units in buildings with five units or more were at a rate of 398,000 in September.

Housing Starts

- Privately-owned housing starts in September were at a seasonally adjusted annual rate of 1,354,000.

- This is 0.5 percent (±13.0 percent) below the revised August estimate of 1,361,000 and is 0.7 percent (±16.1 percent) below the September 2023 rate of 1,363,000.

- Single-family housing starts in September were at a rate of 1,027,000; this is 2.7 percent (±13.4 percent) above the revised August figure of 1,000,000. The September rate for units in buildings with five units or more was 317,000.

Housing Completions

- Privately-owned housing completions in September were at a seasonally adjusted annual rate of 1,680,000.

- This is 5.7 percent (±19.9 percent) below the revised August estimate of 1,781,000, but is 14.6 percent (±11.9 percent) above the September 2023 rate of 1,466,000.

- Single-family housing completions in September were at a rate of 1,000,000; this is 2.7 percent (±7.8 percent) below the revised August rate of 1,028,000. The September rate for units in buildings with five units or more was 671,000.

Details from the Census Bureau New Residential Construction report.

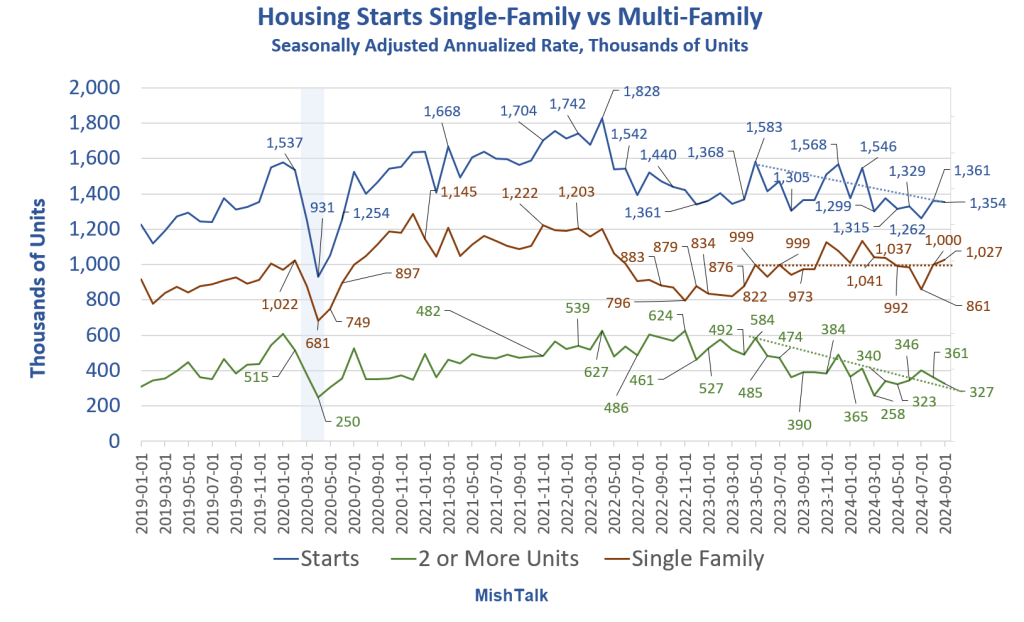

Housing Starts Single Family vs Multi-Family

The trend on starts is negative led by multi-family.

Since May 2023, single-family starts have been steady on average, but in a very choppy fashion. The average over this period has been 1,006. Vs May 2023, single-family starts are up 2.8 percent.

Total starts dropped from 1,583 to 1,354. That’s a decline of 14.5 percent.

Multi-family starts from 584 to 327. That’s a plunge of 44.0 percent. Wow.

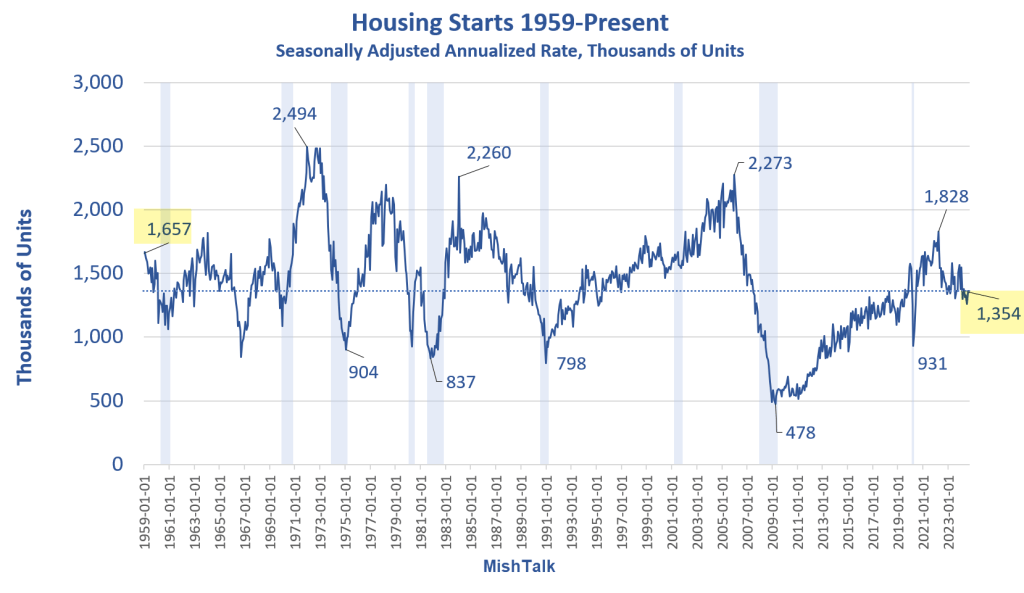

Housing Starts 1959-Present

To put the housing report numbers into proper perspective, starts are 18.3 percent below January of 1959.

Recent Economic Reports

Addendum

A reader asked about population-based comparisons. I replied …

Existing home sales are a much better model compared to prior years than housing starts and new home sales.

Housing starts are population based but one also has to factor in teardowns, a surge in immigration, the birth rate, and the rate of change in prime homeownership age say (25-40 or 28-48) or whatever.

I do not know how to adjust for all of those things. But a surge in immigration of 15 million in the past x years does require a lot of shelter.

That shelter has to come from somewhere. Is apartment construction enough? The data in this report does not imply anyone buying a home. At least multi-family doesn’t.

If we have not added enough apartments to accommodate immigration, teardowns, etc., my expectation of falling rents will be wrong or won’t last for long.