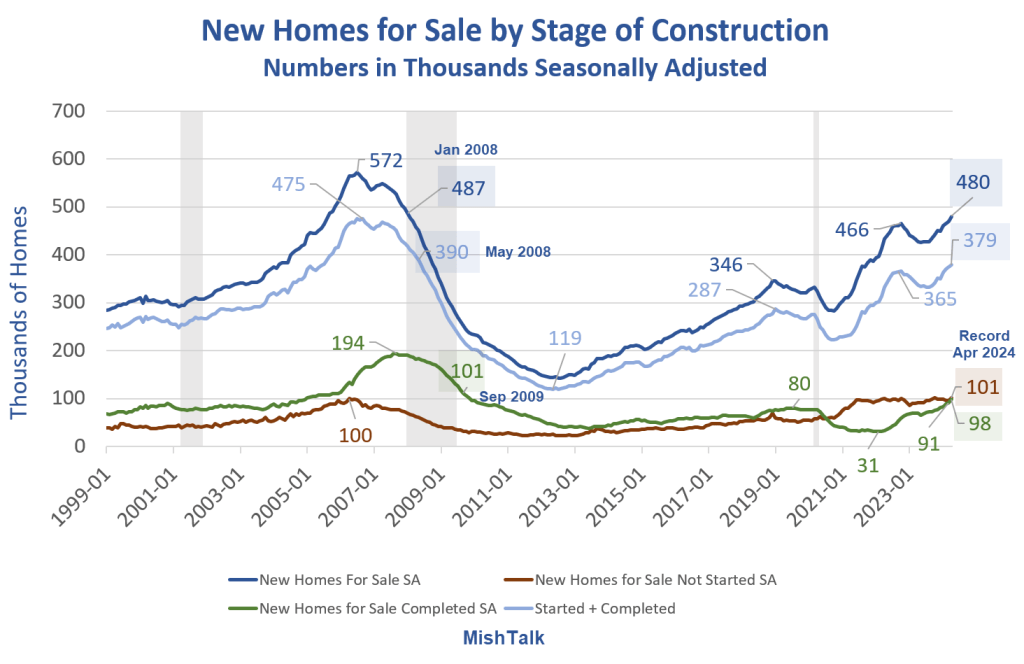

Speculative building, measured by started but unsold housing inventory, is at the highest level since May of 2008. To unload these units, builders will have to offer steep discounts.

Stage of Construction Details

- Homes for Sale: 480,000 the most since January of 2008

- Unsold Homes Started Plus Completed: 379,000 the most since May of 2008

- Unsold Completed Homes: 98,000 the most since September of 2009

- Unsold lots: 101,000 the most in history

Builder Optimism

Allegedly, there are 480,00 homes for sale but 101,000 of them have not been started. That is a land commitment only.

The builders are fully committed once they start building. That is a big speculative investment.

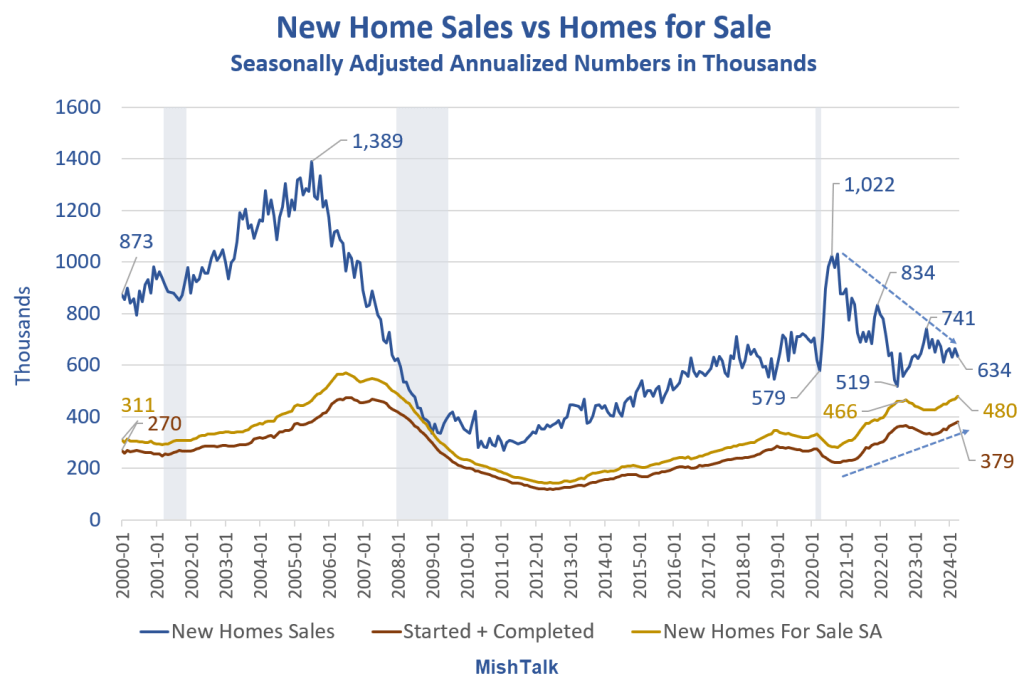

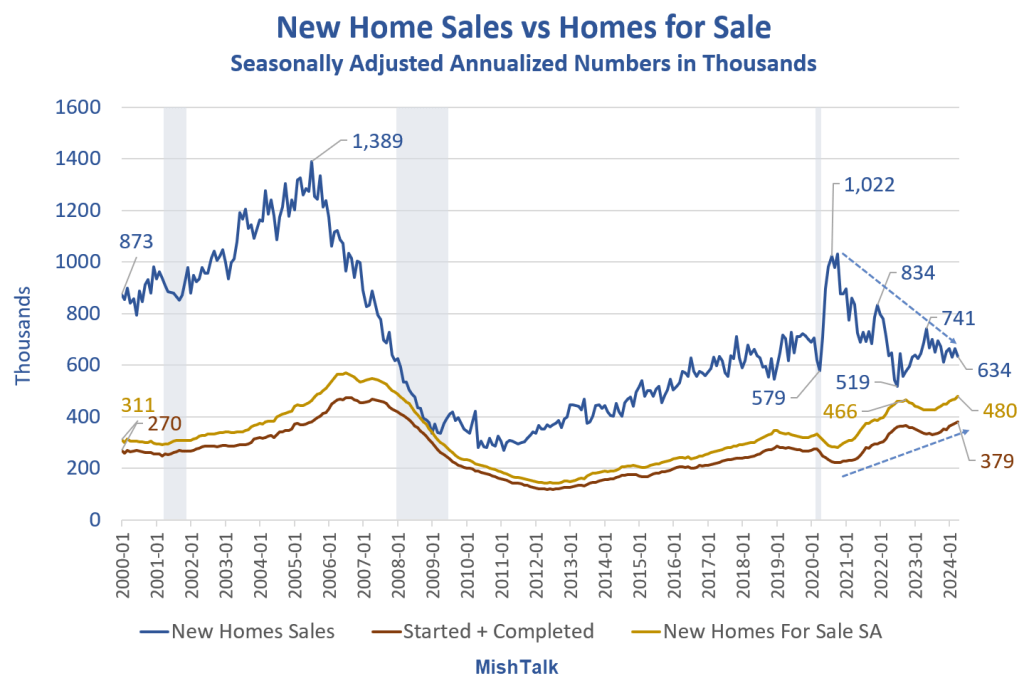

New Home Sales vs Homes for Sale

Sales vs for Sale Key Points

- New home sales are sinking fast.

- Builder commitments as measured by started plus completed is rising fast.

- Unsold land is at a record high, but it’s unsold starts and completions that will pressure builders the most.

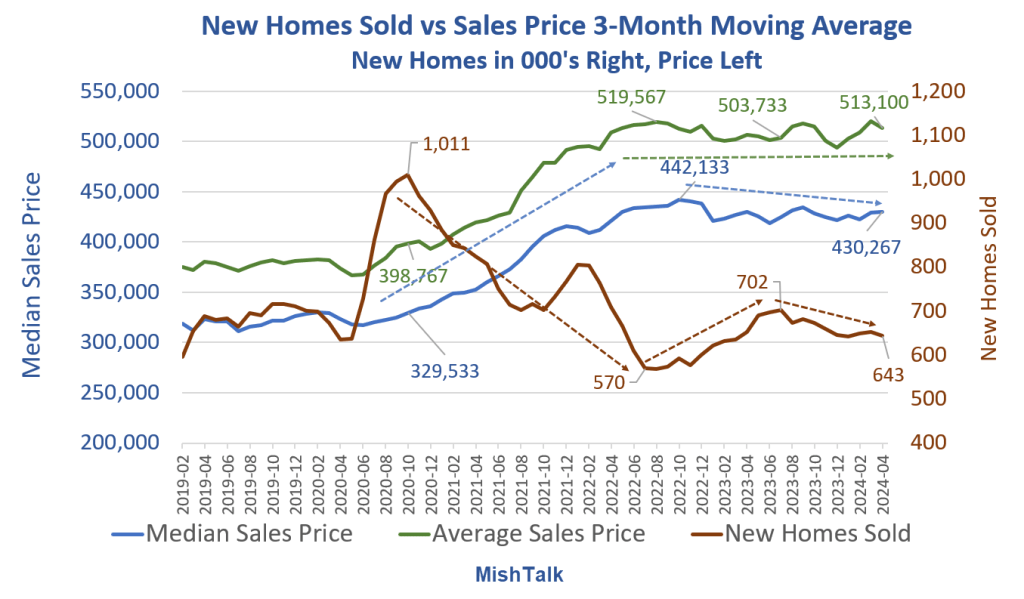

New Homes Sold vs Sales Price

Builders reacted to the huge slowdown (first red arrow down) by building smaller homes, on smaller lots, with fewer rooms, and fewer amenities, coupled with mortgage rate buydowns.

About a year ago, buyers balked while median prices fell and average prices went sideways.

The price insensitive buyers are still willing to pony up, for now, but what are builders going to do for an encore otherwise?

I dislike median and average price computations because they do not reflect what you get for your money. Is it granite or vinal? Three bedrooms or four? Etc.

I have no idea what those buyers are getting but I strongly suspect much less for the money than four years ago. Mortgage rate buydowns are not free. Getting far less for your money does not make a house affordable.

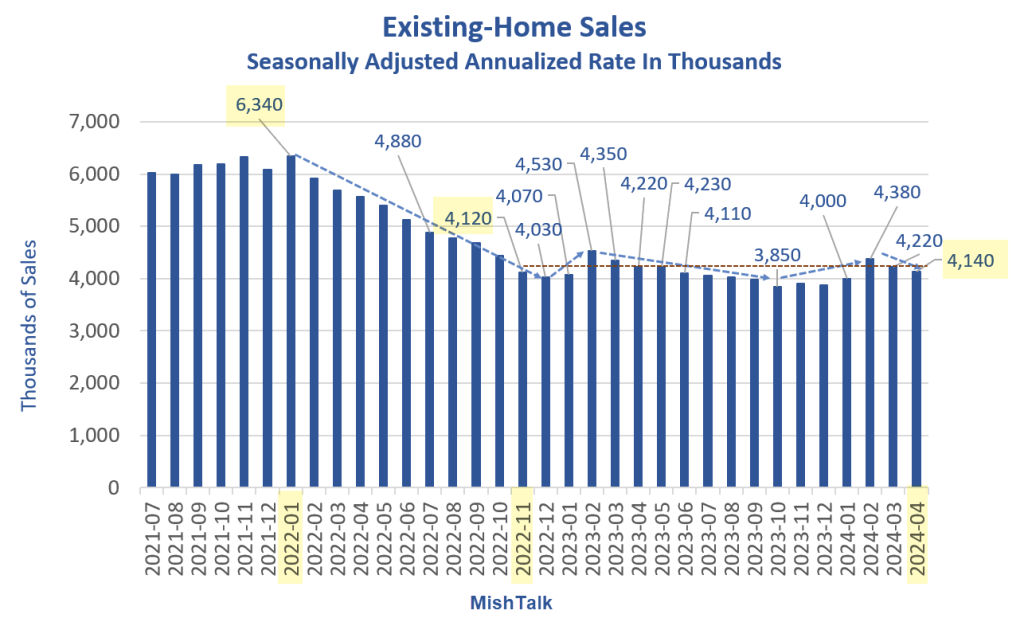

Existing-Home Sales Decline 1.9 Percent

Existing-home sales fell 1.9 percent in April and are also down 1.9 percent from a year ago. Sales have not gone anywhere for 17 months.

On May 27, I commented Existing-Home Sales Decline 1.9 Percent, Sales Mostly Stagnant for 17 Months

Key Highlights

- Existing-home sales faded 1.9% in April to a seasonally adjusted annual rate of 4.14 million. Sales also dipped 1.9% from one year ago.

- The median existing-home sales price rose 4.8% from March 2023 to $393,500 – the ninth consecutive month of year-over-year price gains and the highest price ever for the month of March.

“Home sales changed little overall, but the upper-end market is experiencing a sizable gain due to more supply coming onto the market,” said NAR Chief Economist Lawrence Yun.

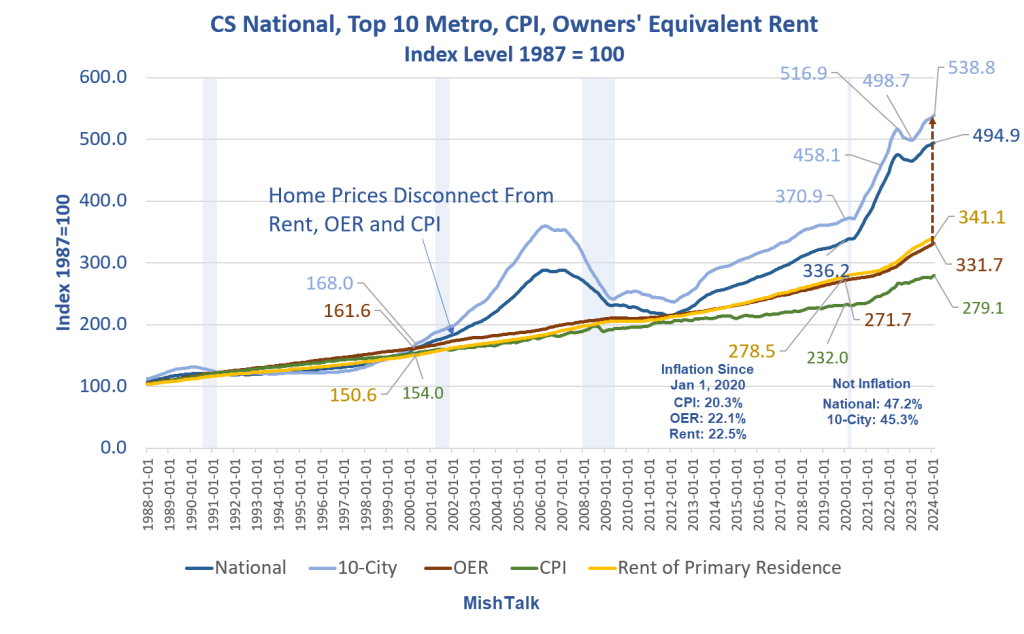

Case Shiller Home Price Index

The Case-Shiller national home price index hit a new high in February. That’s the latest data. Economists don’t count this as inflation.

Chart Notes

- National and 10-City Case-Shiller home prices hit new record highs in February

- OER, CPI, and Rent are indexes measured by the Bureau of Labor Statistics (BLS).

- OER stands for Owners’ Equivalent Rent. It’s the price one would pay to rent one’s own house unfurnished and without utilities.

Case-Shiller measures repeat sales of the same home over time and the indexes attempt to weed out major home improvements.

Case-Shiller is a far better measure of home prices than median or average prices which do not factor in the number of rooms, location, lot size, or amenities.

Home Prices Hit New Record High, Not Inflation

For discussion of the previous chart, please see Home Prices Hit New Record High, Don’t Worry, It’s Not Inflation

Not Inflation?!

Economists, including the Fed, consider homes a capital expense, not a consumer expense.

As a result, they all ignore economic bubbles and blatantly obvious inflation on grounds it’s not consumer inflation. This has gotten the Fed into trouble at least three times. The first was the dot-com bubble, then the Great Recession housing bubble and now.

It’s really pathetic when you make the same major mistake over and over and over. It’s a result of groupthink.

They all believe in the same silly models based on disproved theories including inflation expectations and the Phillips curve. You do not get in the good ole boys Fed club unless you think like a good ole boy.

The big problem with Case-Shiller is the huge lags. It’s nearly June and Case-Shiller is from February. And that reflects sales for 1-3 months prior.

Are Home Prices Still Rising?

I have very strong doubts. But those sitting on an existing home do not want to trade a 3.0 percent mortgage for a 7.0 or higher percent mortgage.

Would-be sellers hoping to move are trapped and waiting things out.

Homebuilders do not have the luxury of waiting things out. As unsold speculative inventory rises, the urge to reduce prices will be overwhelming.