Lawrence Yun is singing an optimistic tune on interest rates but cites the election as a factor.

The National Association or Realtors (NAR) reports Existing-Home Sales Slide 1.0% in September

Five Key Highlights

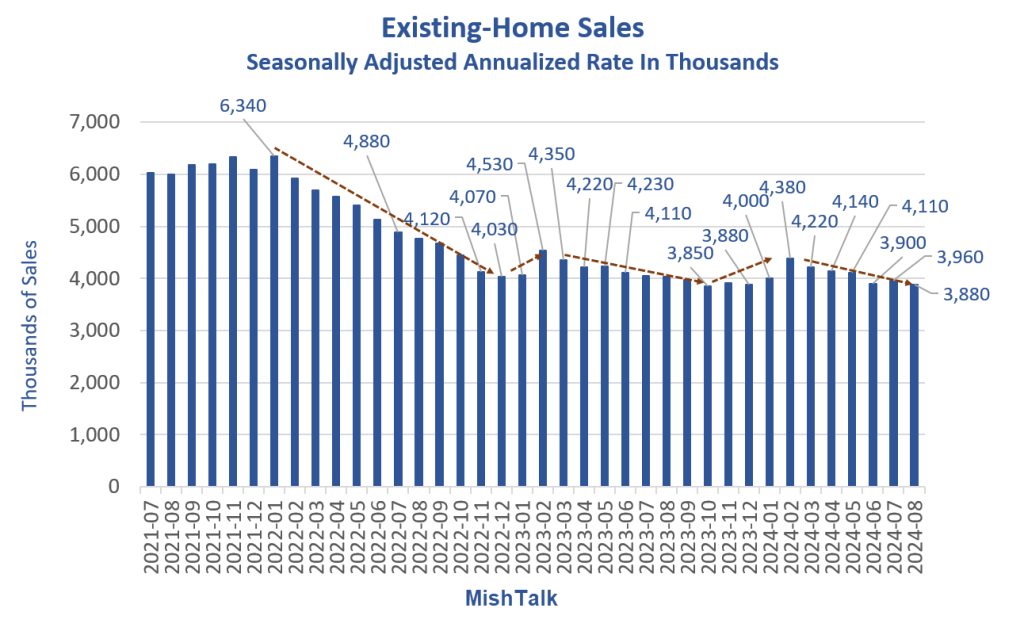

- Existing-home sales descended 1.0% in September to a seasonally adjusted annual rate of 3.84 million. Sales dipped 3.5% from one year ago.

- The median existing-home sales price climbed 3.0% from September 2023 to $404,500, the 15th consecutive month of year-over-year price increases. All four U.S. regions registered price increases.

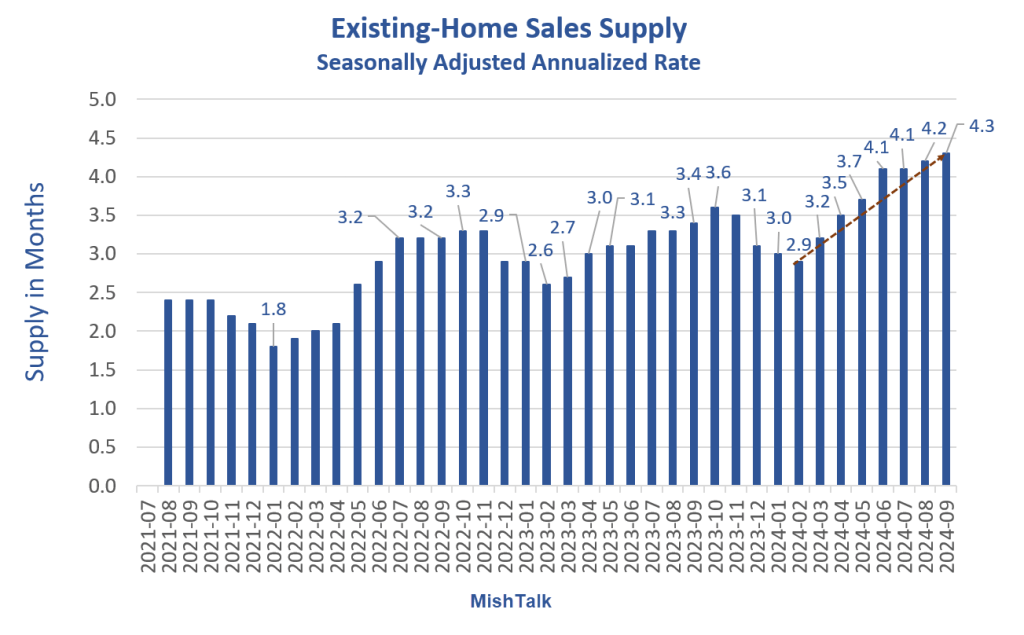

- Total housing inventory registered at the end of September was 1.39 million units, up 1.5% from August and 23.0% from one year ago (1.13 million). Unsold inventory sits at a 4.3-month supply at the current sales pace, up from 4.2 months in August and 3.4 months in September 2023.

- First-time buyers were responsible for 26% of sales in September – matching the all-time low from August 2024 and November 2021.

- All-cash sales accounted for 30% of transactions in September, up from 26% in August and 29% in September 2023.

Cheery Spin from Lawrence Yun, NAR Chief Economist

“Home sales have been essentially stuck at around a four-million-unit pace for the past 12 months, but factors usually associated with higher home sales are developing,” said NAR Chief Economist Lawrence Yun. “There are more inventory choices for consumers, lower mortgage rates than a year ago and continued job additions to the economy. Perhaps, some consumers are hesitating about moving forward with a major expenditure like purchasing a home before the upcoming election.”

“More inventory is certainly good news for home buyers as it gives consumers more properties to view before making a decision,” Yun said.

“Moderating home price increases are welcome news for home buyers,” Yun added. “With wage growth now outpacing home price appreciation, housing affordability will improve.”

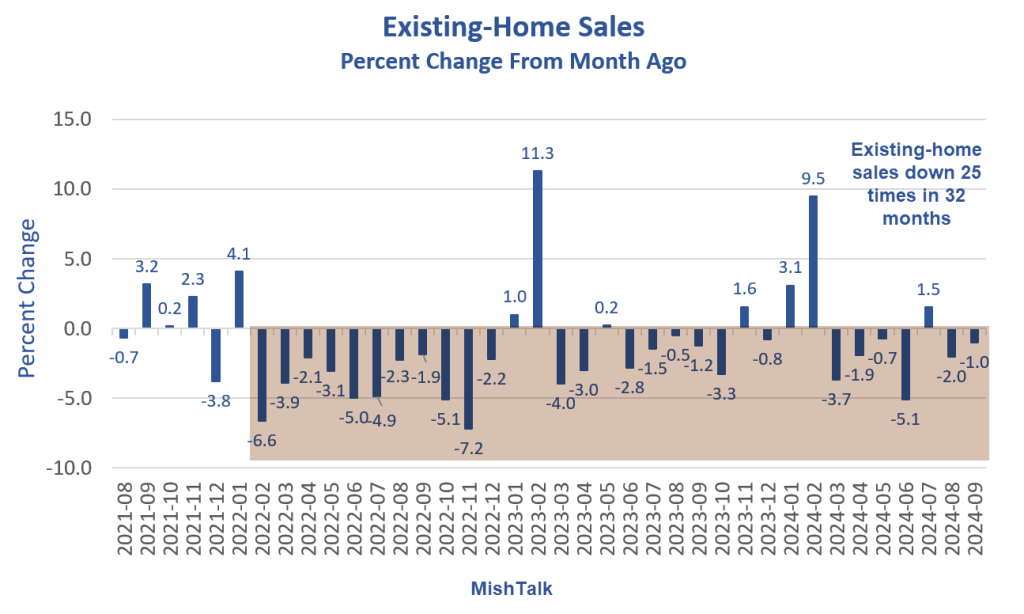

Existing-Home Sales Percent Change from Month Ago

Existing-Home Sales Supply

The supply of homes is the highest in over four years.

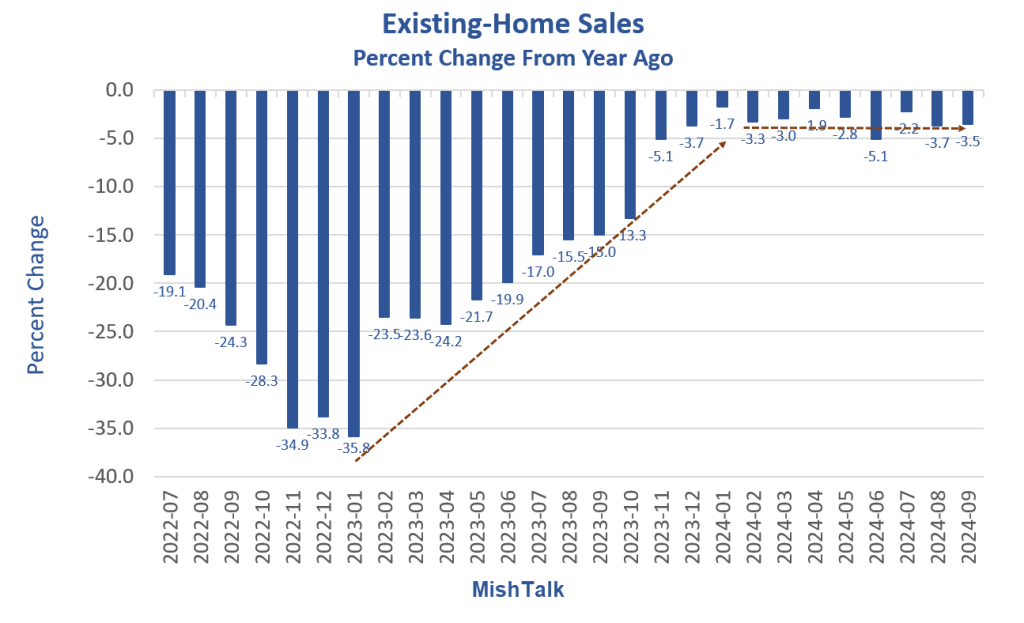

Existing-Home Sales Percent Change from Year Ago

Sales were falling so fast that year-over-year numbers were increasingly easy to beat. But things reversed lower after getting to -1.7 percent year-over-year.

From a year ago sales are down 3.5 percent. Sales are down 39 percent from the January 2022 high.

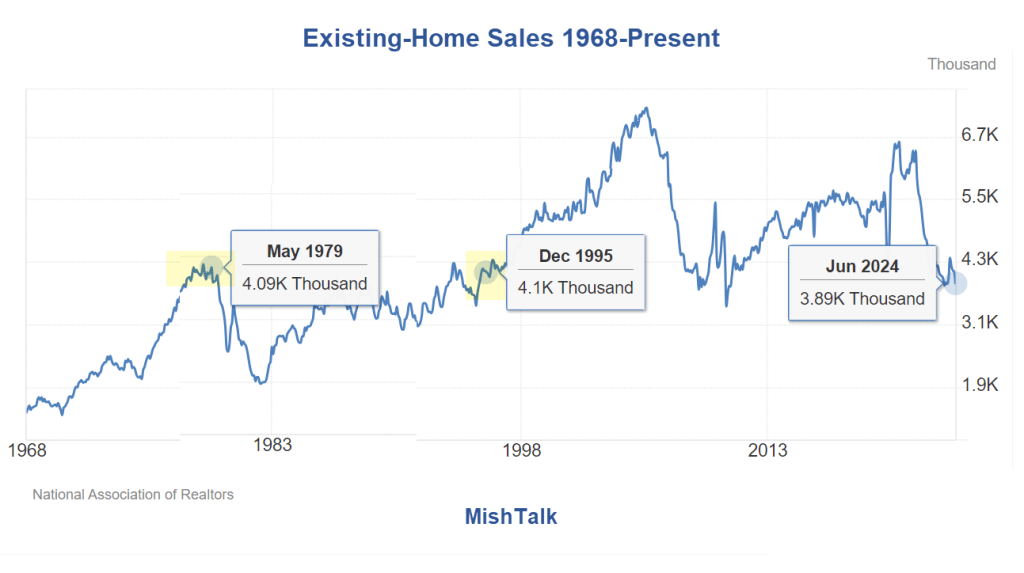

Existing-Home Sales 1968-Present

I repeated last months chart. The September 2024 sales are 3.84 million seasonally adjusted annualized.

Existing-home sales are below the level of December 1995 and also May 1979.

Adjusted for population, these are abysmal numbers.

Reflections on Yun’s Cheerleading

Inventory is up six times in the last seven months, with the other flat.

If it was a matter of inventory, home sales would be increasing.

Yun mentioned mortgage rates are down from a year ago. He blames sales on the election. What a hoot.

He also failed to note that mortgage rates are up again today to 6.92 percent according to Mortgage News Daily.

That’s up from 6.11 percent on September 11.

Mortgage rates dropped below 7 percent on July 10. It did not do a damn thing for existing-home sales. And now rates are nearly back to 7 percent and Yun is telling us falling mortgage rates will help sales.

That’s another Yun hoot and he’s provided many over the years.

Meanwhile, first-time buyers were responsible for 26 percent of sales in September, tying the record low.

Living Paycheck to Paycheck

Yesterday, I noted 20 Percent of Households Making Over $150,000 Live Paycheck to Paycheck

And if you factor in discretionary spending, over 40 percent live PTP.

The hidden cost of homeownership is one of the reasons.

New Record Highs on Home Prices

On September 28, I commented Yet Another Record High for Case-Shiller Home Prices

I have been talking about housing since the start of this blog in March of 2003. The Fed keeps making the same mistake over and over.

Fed Hubris

Flashback March 4, 2021: Fed Hubris: Housing Prices Show the Fed is Making the Same Inflation Mistake

Prior to 2000, home prices, Owners’ Equivalent Rent (OER), and the Case Shiller national home price index all moved in sync.

This is important because home prices directly used to be in the CPI. Now they aren’t. Only rent is. Yet, OER is the single largest CPI component with a hefty weight of 24.05% of the entire index.

The BLS explains this away by calling homes a capital expense not a consumer expense.

However, that explanation ignores easily observed and measurable inflation. And it’s inflation, not alleged consumer inflation, that is important.

A $150,000 House in 1988 Now Costs $707,500 Thank You Fed

Using Case-Shiller data of repeat sales, on August 10, 2024, I noted A $150,000 House in 1988 Now Costs $707,500 Thank You Fed

End the Fed

End the Fed was idea was a discussion focus on this blog and the Mises Institute in a series of recent posts.

Please see Fed “Playing With Fire” Take Two, Who Starts the Business Cycle? for a discussion of ideas and alternatives on ending or reigning in the Fed.

Hello Mr. Yun

Hello Mr. Yun, homes are not affordable and your cheerleading won’t make it so.