A deeper dive into personal income and outlays for March shows significant signs of consumer stress to maintain standards of living.

This is a follow-up with a couple new charts to my post on Friday, Personal Spending Jumps More than Income in March

Income Minus Spending Chart Notes

- Real means after inflation. DPI means disposable Personal Income after taxes.

- Only twice in the last 10 months has growth in real income been greater than growth in real spending.

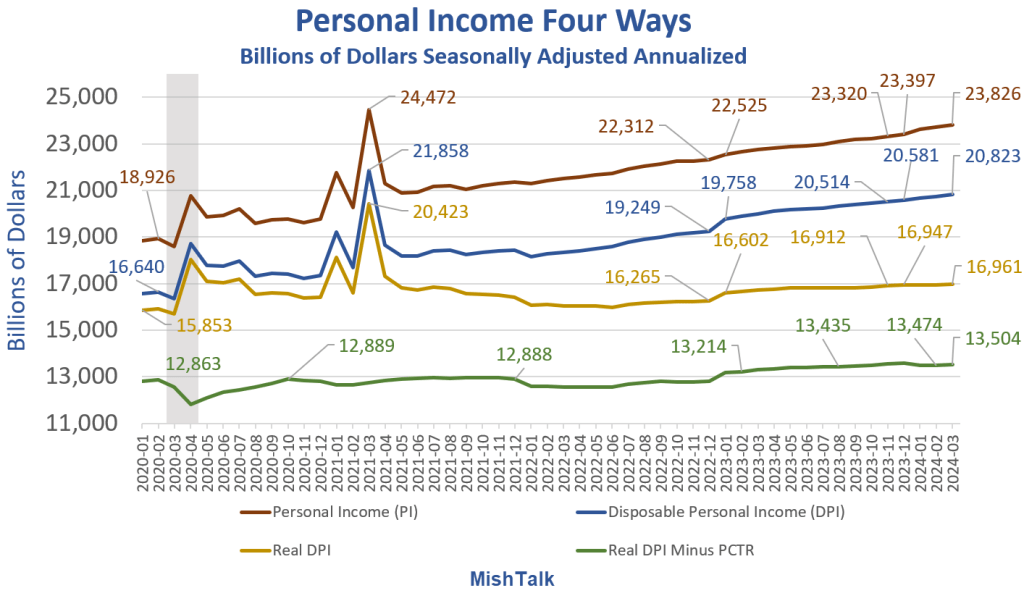

Personal Income Four Ways

Understanding Personal Income

- The difference between PI (red) and DPI (blue) is taxes, just over 3 trillion dollars annually.

- The difference between DPI (blue) and Real DPI (yellow) is inflation.

- The difference between Real DPI (yellow) and Real DPI Minus PCTR (green) is Personal Current Transfer Receipts

PCTR are government benefits that include Medicare, Medicaid, food stamps, Social Security, and disability payments.

Personal Income and Real Hourly Wages

Percentage Increases in Income and Hourly Earnings

- DPI is up 25.2 percent since pre-pandemic

- Real DPI is up 6.6 percent since pre-pandemic

- Real Average Hourly Earnings are up 0.9 percent since pre-pandemic

Income includes wages and salaries, Social Security and other government benefits, dividends, and interest.

Who’s Doing Well and Who Isn’t?

Those dependent on wages and salaries alone have not fared well since the pandemic. That also includes many on government benefits.

The asset holders (those with interest income, rental income, dividend income etc., are doing much better.

On average, things look at least OK, if not good.

But for millions of people struggling with food and rent on real hourly earnings that have gone nowhere in four years, the economy does not look OK.

The CPI Rose Sharply in March Led by Shelter and Gasoline

The CPI rose 0.4 percent in March. Rent was up another 0.4 percent with gasoline up 1.7 percent. Together, the pair was about half of the total rise.

Rent of primary residence, the cost that best equates to the rent people pay, jumped another 0.4 percent in March. Rent of primary residence has gone up at least 0.4 percent for 31 consecutive months!

The “rents are falling” (or soon will) projections have been based on the price of new leases and cherry picked markets. But existing leases, much more important, keep rising.

Only 8 to 9 percent of renters move each year. It’s been a huge mistake thinking new leases and finished construction would drive rent prices.

For discussion, please see The CPI Rose Sharply in March Led by Shelter and Gasoline

If you own your home and refinanced near or below 3.0 percent, congratulations. If you are among the 36 percent who rent, you are probably not happy.

This is why I suggest People Who Rent Will Decide the 2024 Presidential Election