Ford (F) reports a huge loss on every EV. Sales are down 20 percent holding the losses to $1.3 billion.

My tongue in cheek “good news” comment aside, Ford Just Reported a Massive Loss on Every Electric Vehicle it Sold.

Ford’s electric vehicle unit reported that losses soared in the first quarter to $1.3 billion, or $132,000 for each of the 10,000 vehicles it sold in the first three months of the year, helping to drag down earnings for the company overall.

Ford, like most automakers, has announced plans to shift from traditional gas-powered vehicles to EVs in coming years. But it is the only traditional automaker to break out results of its retail EV sales. And the results it reported Wednesday show another sign of the profit pressures on the EV business at Ford and other automakers.

The EV unit, which Ford calls Model e, sold 10,000 vehicles in the quarter, down 20% from the number it sold a year earlier. And its revenue plunged 84% to about $100 million, which Ford attributed mostly to price cuts for EVs across the industry. That resulted in the $1.3 billion loss before interest and taxes (EBIT), and the massive per-vehicle loss in the Model e unit.

The losses go far beyond the cost of building and selling those 10,000 cars, according to Ford. Instead the losses include hundreds of millions being spent on research and development of the next generation of EVs for Ford. Those investments are years away from paying off. And that means this is not the end of the losses in the unit – Ford said it expects Model e will have EBIT losses of $5 billion for the full year.

Ford rival General Motors reported earlier this week that it remains on track to have its North American EV business turn profitable in the second half of this year, while Stellantis, which makes cars and trucks in North America under the Jeep, Ram, Dodge and Chrysler brands, said its European EV business was already profitable last year.

On Tuesday Tesla, the world’s largest EV maker, reported that its adjusted earnings plunged 48% in the first quarter as revenue fell 9%, after it reported the first year-over-year drop in sales since the pandemic.

These losses are despite huge tax incentives and subsidies. GM is on track for profits counting on subsidies.

Ford is more dependent on truck buyers than GM, and truck buyers have shown little interest in electric trucks.

G.M. Reports Big Jump in Profit on Gasoline Car Sales

The New York Times reports G.M. Reports Big Jump in Profit on Gasoline Car Sales

General Motors on Tuesday reported a big jump in profits for the first three months of the year, based on the strength of its gasoline vehicle business, and raised its outlook for the rest of the year.

“We’re maximizing the strength of our ICE business. We’re growing our E.V. business and improving profitability,” G.M.’s chief financial officer, Paul Jacobson, said in a conference call with reporters, using the shorthand for internal combustion engine.

G.M. made all of its profit in North America and lost money in the rest of the world, including a $106 million loss in China; a year earlier, the company reported an $83 million profit in that country.

This year, the company plans to add several new electric vehicles that use the new Ultium batteries. They include a GMC Sierra pickup truck that is supposed to have maximum range of 440 miles and a Chevrolet Equinox sport utility vehicle that G.M. said would have a starting price of $34,995 and a range of up to 319 miles.

The irony on that title is stunning. Let’s see if starting prices at $35,000 entice buyers and if GM can make a profit on them.

I sense a bit of overoptimism.

Tesla’s Deliveries Drop for First Time Since 2020

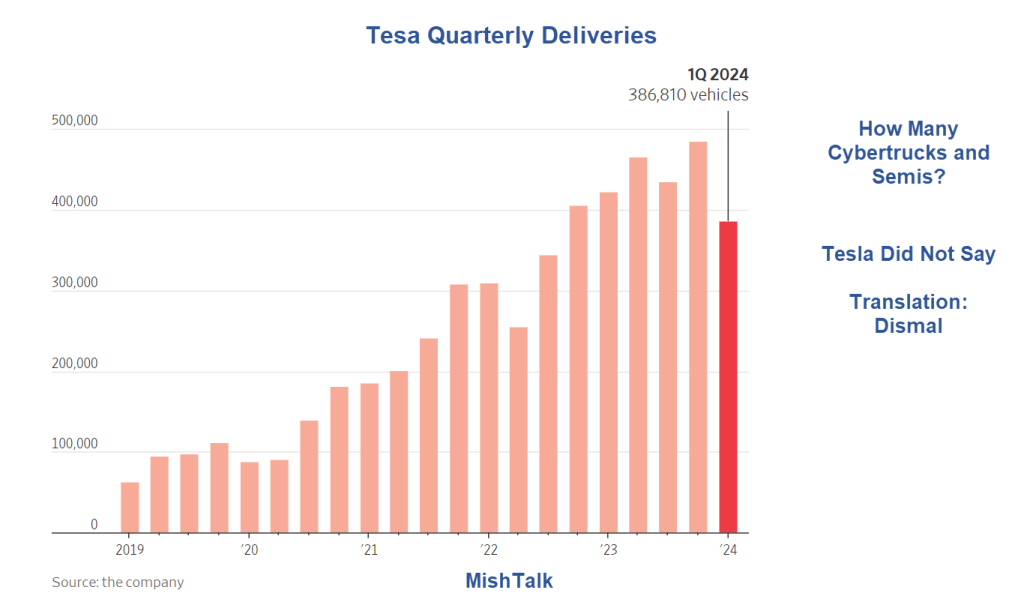

Tesla’s (TSLA) quarterly deliveries in the first quarter of 2024, are down 8.5% from a year earlier. It’s the first quarterly decline since 2020.

Tesla blames production setbacks for the Decline in Quarterly Deliveries, but falling demand is the bigger issue.

On April 2, I commented Tesla’s Deliveries Drop for First Time Since 2020, It’s Demand Not Supply

Elon Musk Fires 10 Percent of Tesla Workforce

On April 15, I noted Elon Musk Fires 10 Percent of Tesla Workforce, Prepares for “Next Phase of Growth”

In preparation for more growth, Musk issues a memo announcing an workforce cut of 10 percent and two top Tesla (TSLA) executives resign.

One does not prepare for growth by firing staff, pausing construction of the giga semi factory, and repeating the same hollow lies every year since 2016.

Tesla Rebounds On Musk Promises With No Details, It Won’t Stick

For a Tesla roundup, please see Tesla Rebounds On Musk Promises With No Details, It Won’t Stick