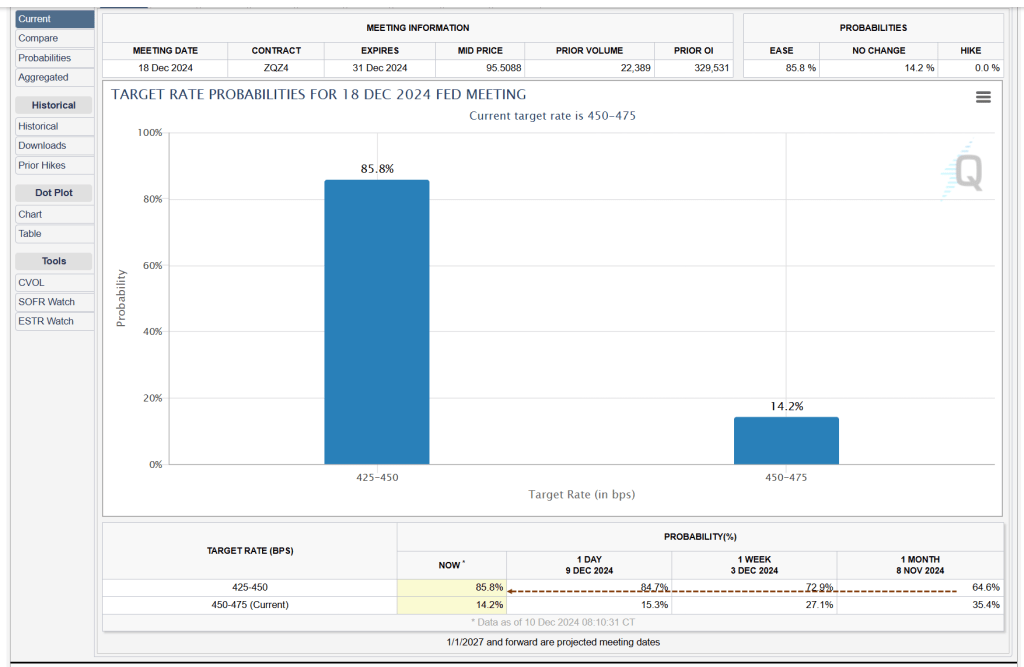

Rate cut odds have been rising despite relatively strong CPI data. The Fed meets December 18.

According to CME Fedwatch, there is an 85.8 percent chance of a quarter-point cut at the December 18 Fed meeting.

However, there does not seem to much of a reason to cut rates and even less of one if one believes CPI estimates.

Bloomberg Econoday CPI Consensus

The Bloomberg Econoday consensus CPI estimate is 0.3 percent month-over-month and 2.7 percent year-over-year, up from 2.6 percent.

I think there is a decent chance we do much better (lower) than 0.3 percent month-over-month, but that will largely depend on rent and Owners’ Equivalent Rent.

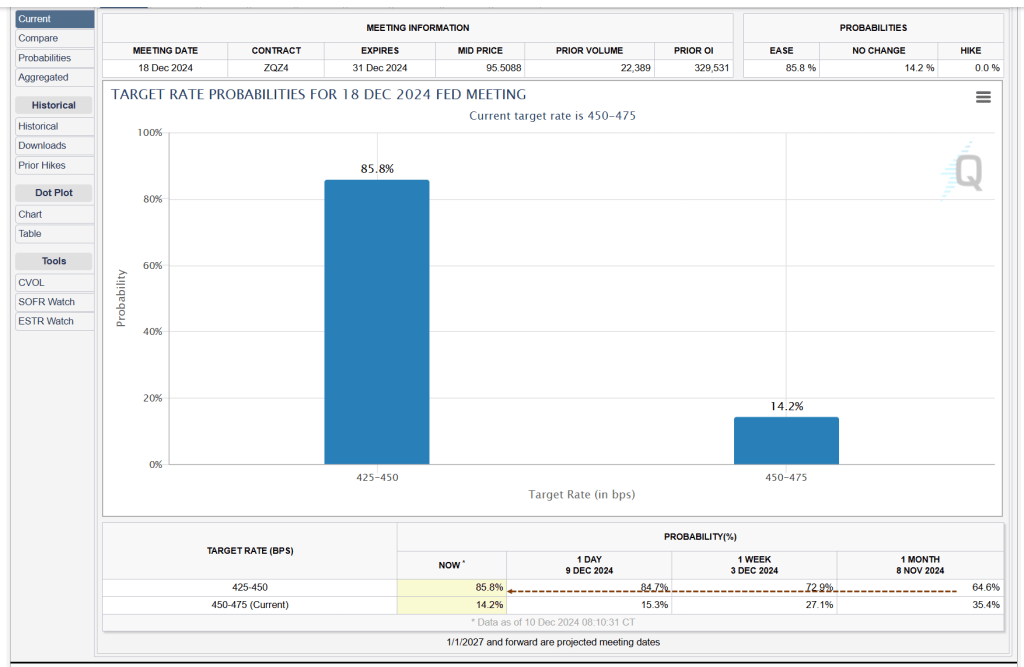

Target Rate Probabilities for March 2025

Are We No Longer Data Dependent?

Looking ahead to March, the market expects two more cuts in January and March.

Based on current inflation data, the Fed should not be cutting at all. But tomorrow is another day.

If the data does not warrant these cuts, but the Fed cuts anyway, expect yields on the long end to rise in revolt.