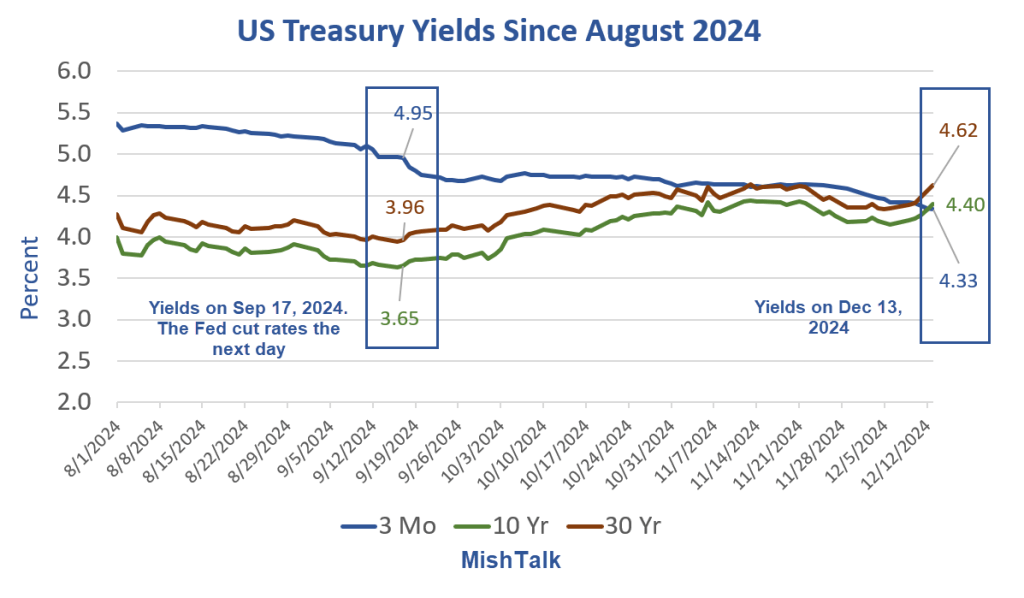

Long-term yields rise again as the market prices in more Fed interest rate cuts.

Yields through December 12 are end-of-day from the US Treasury. December 13 is a current real-time quote.

Today, the yield on the 10-year note is up 8 basis points (0.08 percentage points). The yield on the 30-year long bond is up 7 basis points, and the yield on the 3-month note is flat.

Change Since September 17, 2024

- 3-Month: -62 Basis Points

- 10-Year: +75 Basis Points

- 30-Year: +66 Basis Points

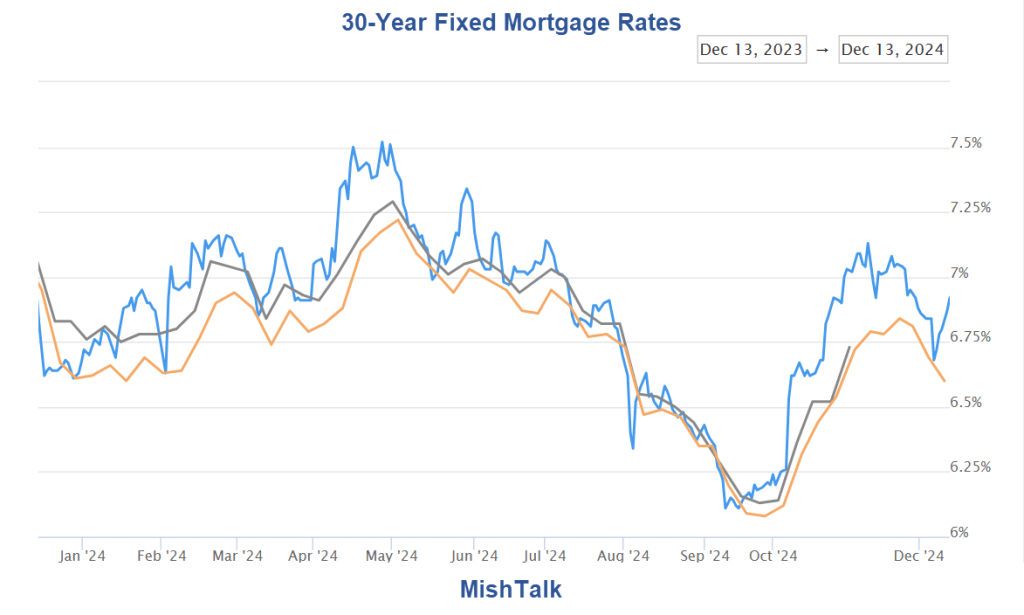

30-Year Fixed Mortgage Rates

Mortgage rates are roughly following 10-year treasury yields.

Those expecting mortgage yields to decline with Fed rate cuts were mistaken. I called this behavior in advance, as did some others who understand the implications.

Understanding Spreads

Spreads (differences between long- and short-dated Treasuries) increase in rate cutting cycles. This is a normal steepening impact.

Steepening can occur with yields on the long end either rising or falling. With rate cuts, yields on the short end always decline.

A bullish steepening means rates are the long end and short end of the curve both decline, but yields on the short end drop more.

In this case, we are seeing a bearish steepening. That means yields on the long end rise with yields on the short end falling.

Widening Spread

Everyone expected the spreads to widen. A minority of us expected the long end to get hammered (yields to rise) this early in the game.

The lead chart shows instantaneously.

What Does It Mean?

- Lack of faith in the Fed to contain inflation.

- Advance warning that Trump’s tariff threats will increase prices.

- Advance warning that Trump’s newfound love of unions will increase prices.

- Advance warning that Trump’s made in America policies will increase prices.

- Advance warning that the US deficit is out of control and Republicans won’t do a damn thing to fix it

If you vote for all of the above, then you agree with me.

Related Posts

On September 26, I commented Trump Claims Tariffs Will Reduce the Trade Deficit. Let’s Fact Check.

Trump proposes 60 percent tariffs on China. Would that reduce the trade deficit? Where? How?

October 1, 2024: Trump vs Frederic Bastiat: Who Is Right About Tariffs?

Previously, I discussed tariffs and the trade deficit. This post is about Trump’s proposal to use tariffs to fund projects.

November 22, 2024: Should Anyone Care Whether Underwear Is Produced in the US or China?

This ridiculous-looking question gets to the heart of tariff discussions.

December 4, 2024: The 2024 Destruction of Small Business Employment in Pictures

Small businesses with employees 1-49 are struggling in 2024. Large businesses are booming.

December 11, 2024: The CPI Rises 0.3 Percent in November, Rate Cut Odds Jump Anyway

Despite improvement in rent, the CPI rose another 0.3 percent in November. Here are the key numbers.

The Fed is out of its league here.

Importantly, the more Trump does what he says on Tariffs and mass deportations, and especially all of his tax cut proposals with no offsetting revenue, the worse inflation will get.

The bond market does not believe Republicans will cut the deficit or the Fed will handle things properly, and neither do I.

You are free to believe whatever you want.