Poof. Another Fed cut was priced out today in response to hot CPI data.

Word of the Day: Hot

Bond yields are up sharply and interest rate odds tumbled following a hot CPI report by the BLS today.

Rate Cut Odds

- Odds of a rate cut in June fell to 18.6 percent today from 57.4 percent yesterday. A week ago, rate cut odds were 62.3 percent.

- Looking ahead to December of 2024, another rate cut was priced out today. The weighted average expectation in December is now 4.93 percent up from 4.72 percent yesterday.

- A month ago, the weighted average expectation for December was 4.43 percent. That’s a difference of two full quarter-point cuts.

- We have gone from 6+ rate cuts projected in December of 2023 for December of 2024 to 1+ cuts now.

Bond Yields

- 30-Year: +0.084 to 4.583 Percent

- 10-Year: +0.143 to 4.506 Percent

- 2-year: +0.175 to 4.922 Percent

What Happened?

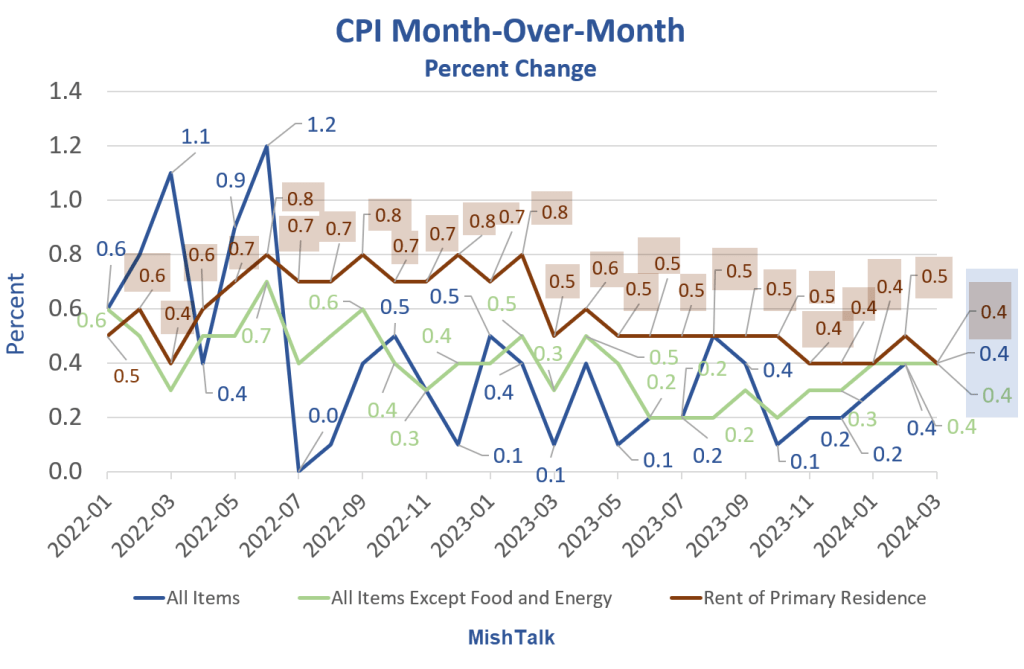

The CPI rose 0.4 percent in March. R

Rent is up another 0.4 percent in March with gasoline up 1.7 percent. Together, the pair was about half of the total rise.

Please note The CPI Rose Sharply in March Led by Shelter and Gasoline

Year-over-year the CPI rose by 3.5 percent.

Click on the above link for more details.

I warned about a steep increase in year-over-year inflation yesterday when I commented Expect Year-Over-Year Inflation to Increase

Last month, the reported year-over-year CPI increase was 3.2 percent.

Expect a year-over-year increase of 3.4 to 3.5 percent this month, but rent is a wild card.

Judging from the bond market and CME Fedwatch rate hike reactions, the hot CPI was not generally expected.