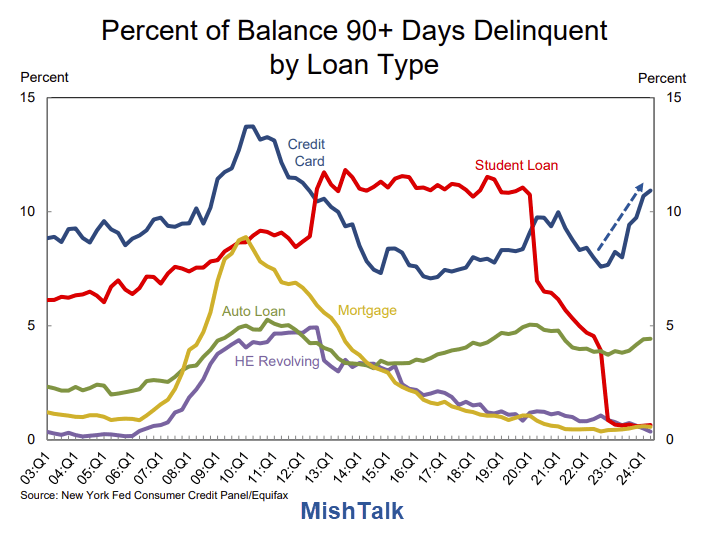

Over ten percent of credit card outstanding debt is over 90 days delinquent. Banks will be curtailing credit.

This a second look at some interesting charts from the New York Fed Quarterly Report on Household Debt and Credit.

Over 10 Percent of Credit Card Debt is Seriously Delinquent

Serious Delinquency for Auto Loans by Age

Serious Delinquency for Credit Cards by Age

Lenders Took More Risk

The Consumer Financial Protection Bureau (CFPB) reports Credit Card Delinquencies are Higher than in 2019 Because Lenders Took on More Risk.

After falling during the pandemic, the share of consumers with a delinquent credit card has increased rapidly since 2021 and is now higher than in 2019. While consumers with delinquencies clearly show signs of struggling, news reports have taken the rising delinquency rate as a sign that financial distress is becoming more widespread, suggesting underlying weakness in the U.S. economy. We show that rather than being a sign of broader distress, this increase in delinquencies is explained by a substantial increase in the riskiness of recently issued credit cards.

Delinquencies have been concentrated among credit cards originated in the last few years and we show these credits cards were much riskier than in previous years. Two factors explain this extra risk: First, lending standards loosened a bit in 2021 and 2022 judging by a decline in credit scores at origination. At the same time, pandemic aid and forced savings pushed average credit scores up sharply. Effectively, by not tightening significantly, lenders were originating cards much further down the risk spectrum. We show this shifting risk composition explains why delinquencies are higher than in 2019.

Overall delinquencies increased rapidly over the last few years because the credit cards originated in 2021, 2022, and 2023 have gone delinquent much more rapidly than credit cards originated in other years. About 8 percent of credit cards originated in 2016 became delinquent about four years after origination. Meanwhile, the 2021 vintage reached an 8 percent delinquency rate just after 2 years while the 2022 vintage reached 8 percent after less than two years and 2023 has followed 2022 closely so far. (The 2020 vintage is in between the pre-pandemic and post-pandemic vintages reaching 8 percent delinquency after 3 years.) At the same time, credit cards originated in earlier years have not seen a similar increase in delinquencies in recent years.

Cards Originated in 2021 Through 2023 Were Riskier than Before

Figure 3 [Above Image] shows the credit score of new credit cards originated each month and the average credit score of all consumers on the left axis. During the Great Recession, lending standards tightened sharply, so that consumers with a new credit card had average scores above 720, even while the average credit score among all consumers was around 690. As a result, the average credit score rank for consumers with a new credit card was above 55 percent from 2008 to 2014, as shown on Figure 3’s right axis. A consumer’s credit score rank is what percentage of all consumers with a score have a score lower than that consumer.

Credit stress is rising just as layoffs are increasing and it’s getting much harder to find a job if you lose one.

That newer issued credit is failing faster again suggests it is renters and generation Z that is most impacted.

But it’s not just Millennials and Zoomers. Delinquencies are rising in all age groups, just more steeply in age groups 39 and younger.

Recession Debate

On August 9, I discussed why things are worse than they look.

If you missed it, please see Recession Debate: Citing the Sahm Rule, WSJ’s Greg Ip Says No Recession

Recessions frequently start with positive job growth and positive industrial production.

And jobs are highly likely to be seriously overstated. My calculations of pending negative revisions is similar to that of Bloomberg’s chief economist.

For discussion, please see Expect the BLS to Revise Job Growth Down by 730,000 in 2023, More This Year

If you think jobs are strong, you are very mistaken.