Rent rose another 0.4 percent in April. Food and beverages were flat with food at home declining but food away from home rising.

Bloomberg Econoday economists were correct across the board on the April CPI report. As expected, the CPI rose 0.3 percent, 0.3 percent excluding food and energy, and 3.4 percent year-over-year.

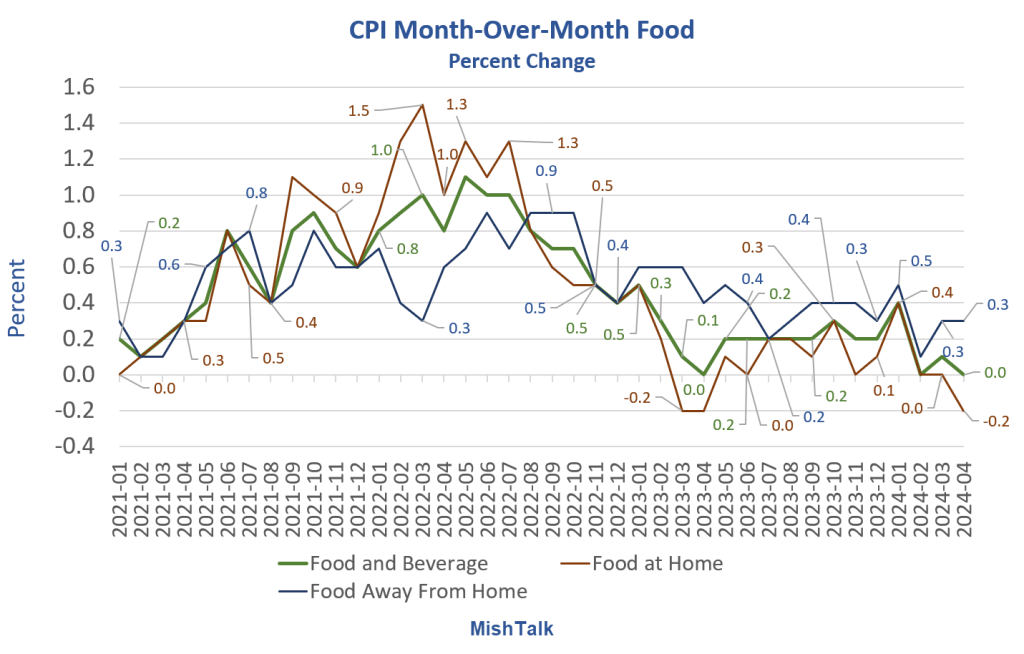

CPI Food

Food was the bright spot in April, provided you eat at home. Food at home declined 0.2 percent with food away from home rising 0.3 percent. Overall, food was unchanged.

CPI Month-Over-Month Medical Care

I added this series new this month. It is so amazingly volatile and unbelievably so. The year-over-year chart makes it easier to spot trends.

CPI Month-Over-Month Energy and Gasoline

Energy is another very volatile series. The last three months have not been good to consumers.

Month-Over-Month Synopsis

- CPI: +0.3 percent

- CPI excluding food and energy: +0.3 percent

- Rent: +0.4 percent

- Owners’ Equivalent Rent OER: +0.4 percent

- Food at Home: -0.2 percent

- Food Away From Home: +0.3 percent

- Medical Care Commodities: +0.4 percent

- Medical Care Services: +0.4 percent

- Energy: +1.1 percent

- Gasoline: +2.8 percent

Other than food at home, there is not that much to cheer about this month. Rent remains the killer.

Yet Another Groundhog Day for Rent

Rent of primary residence, the cost that best equates to the rent people pay, jumped another 0.4 percent in March. Rent of primary residence has gone up at least 0.4 percent for 32consecutive months!

The “rents are falling” (or soon will) projections have been based on the price of new leases and cherry picked markets. But existing leases, much more important, keep rising.

Only 8 to 9 percent of renters move each year. It’s been a huge mistake thinking new leases and finished construction would drive rent prices.

Most leases renew in May through August. I expect rent to moderate soon.

Also see Quotes of the Day on Rent Inflation By the Fed and Property Managers

CPI Year-Over-Year Percent Change

CPI Year-Over-Year Percent Change Food

CPI Year-Over-Year Percent Change Medical Care

CPI Year-Over-Year Details

- The CPI is up 3.4 percent from a year ago. That’s negative progress compared to the 3.0 percent registered in June of 2023, 10 months ago.

- Rent of primary residence and shelter are up 5.5 percent from a year ago.

- Food and beverage is up 2.2 percent from a year ago and perhaps as good as it gets.

- CPI excluding food an energy, a measure the Fed closely follows is up 3.6 percent from a year ago. That’s 1.6 percentage points higher than the Fed’s 2.0 percent target.

- Energy is up 2.6 percent from a year ago. Gasoline is up 1.2 percent from a year ago. Electricity is up 5.1 percent. Natural gas is down 1.9 percent,

Medical care services is on an ominous trend. This is especially important because the Fed’s preferred measure of inflation is the Personal Consumption Expenditures (PCE) price index, not the CPI. PCE overweighs medical care relative to the CPI which overweighs rent.

Final Thoughts

Other than food, there’s not all that much to cheer about.

That will change if and when rent abates which I do expect in one of the next two CPI reports.

Key Question

But after the inevitable high fives of inflation victory cheers, we must look further ahead. Here’s the key question: Is the decline in the rate of inflation permanent or trsnsitory?

Put me in the camp that says the inflation rise was real, and the decline will be transitory. There are inflationary and deflationary forces, but the scales are not even.

Biden’s energy policy is inflationary; student loan cancellations are inflationary; the push for union wages are inflationary; the inflation reduction act is inflationary; tariffs (both Trump and Biden are guilty) are inflationary; deficit spending is inflationary.

Producer Price Inflation Has Bottomed and Is Now Heading Back Up

Yesterday, I noted Producer Price Inflation Has Bottomed and Is Now Heading Back Up

Producer prices were a bit higher than expected today but negative revisions take that away. Importantly, prices appear to have bottomed.

Joe Biden vs Joe Biden on Tariffs, a Green Trade War Is Underway

Joe Biden’s changing story of tariffs would be funny if it was not so damaging. The president announced huge new tariffs today.

The Above Tweet was from June 11, 2019.

Yesterday, president Biden blasted China with huge new tariffs. For discussion, please see Joe Biden vs Joe Biden on Tariffs, a Green Trade War Is Underway

Also see Biden Wants EVs so Badly That He Will Quadruple Tariffs on Them

Astute readers will immediately notice the title of this post makes no sense. It’s not supposed to. But it is exactly what President Biden is doing.

A big green trade war has started. The result will be higher prices for cars, solar panels, even lumber, and housing.

It Trump was clueless, what does that make Biden who took Trump’s policies and escalated them?

My base case is a huge, damaging trade war no matter who wins the election in November. I have been talking about this for months. Mainstream media is finally starting to pick up on the idea.