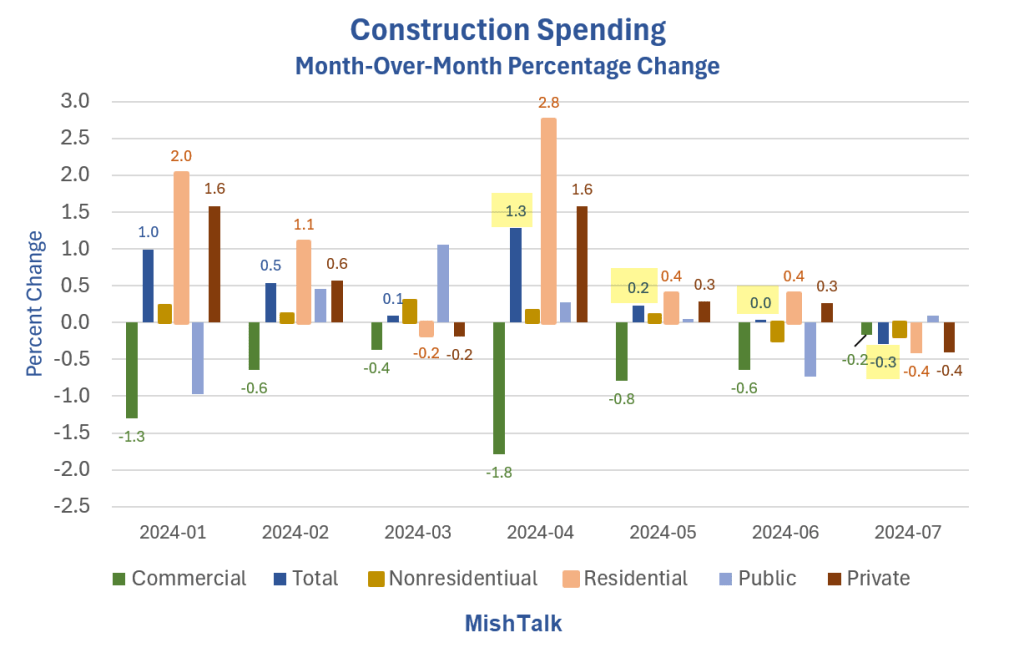

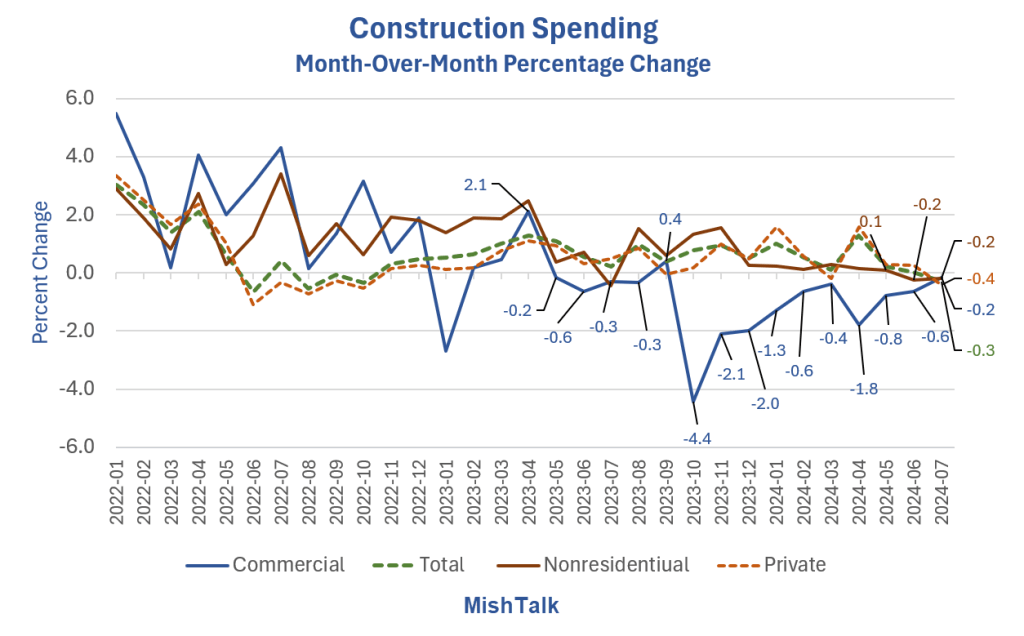

Commercial real estate spending is down for the 10th consecutive month. Most other sectors joined the slump in July.

The monthly Construction Spending report shows a downturn in most construction categories.

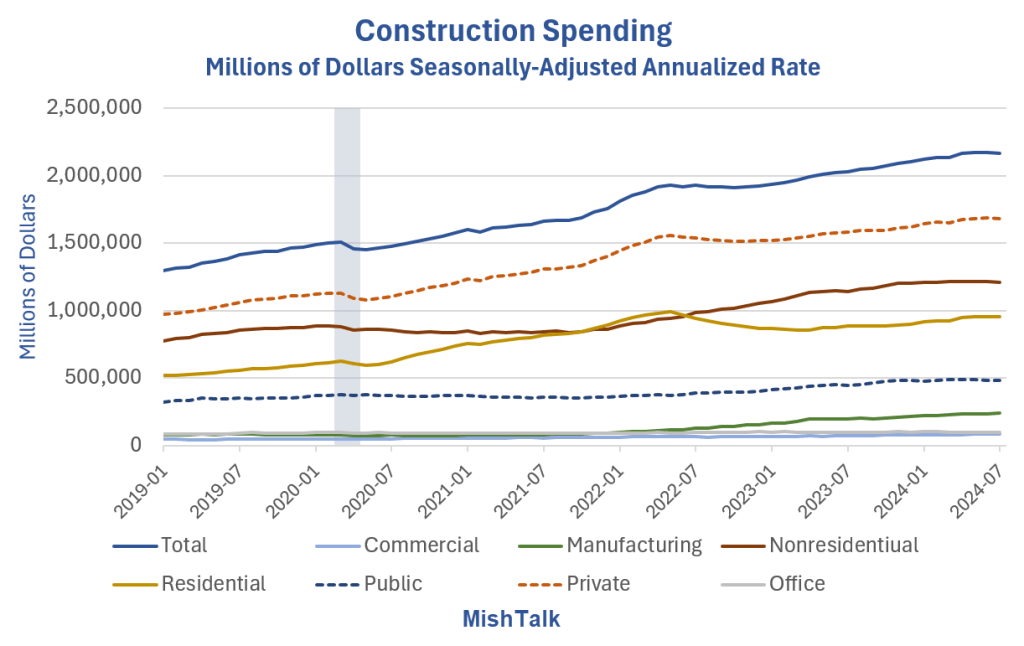

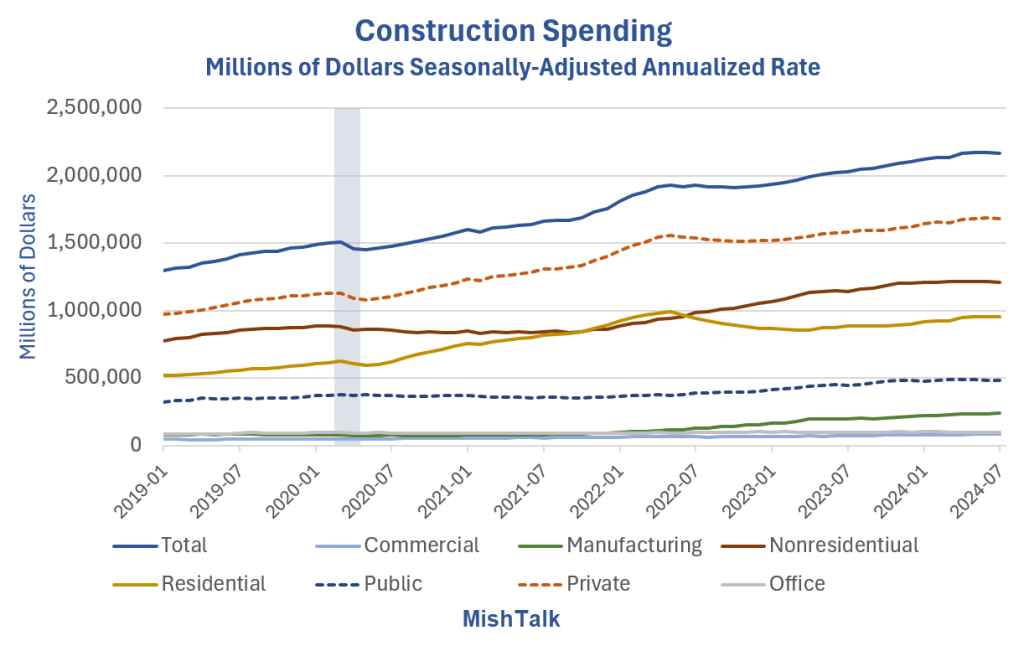

Total Construction Construction: Total spending during July 2024 was estimated at a seasonally adjusted annual rate of $2,162.7 billion, 0.3 percent (±1.0 percent) below the revised June estimate of $2,169.0 billion.

Private Construction Spending: Private construction was at a seasonally adjusted annual rate of $1,678.7 billion, 0.4 percent (±0.7 percent) below the revised June estimate of $1,685.5 billion.

Residential Construction: Residential construction was at a seasonally adjusted annual rate of $941.6 billion in July, 0.4 percent (±1.3 percent) below the revised June estimate of $945.3 billion.

Nonresidential Construction: Nonresidential construction was at a seasonally adjusted annual rate of $737.2 billion in July, 0.4 percent (±0.7 percent) below the revised June estimate of $740.2 billion.

Public Construction In July: The estimated seasonally adjusted annual rate of public construction spending was $484.0 billion, 0.1 percent (±1.8 percent) above the revised June estimate of $483.5 billion.

Construction Spending Millions of Dollars

Every key component of construction has peaked and is rolling over except for manufacturing.

The latter is due to misguided attempts by the auto industry to roll out EVs and more importantly free money from the Biden administration for autos, chip manufacturing, solar manufacturing, etc.

Spotlight Commercial

Commercial construction spending is down 10 consecutive months and 14 out of the last 15.

Commercial Construction Categories

The Census Department has a nice breakdown of Construction Spending Categories.

In general, commercial Includes buildings and structures used by the retail, wholesale and selected service industries.

Offices are part of nonresidential construction as is commercial. But offices are not part of commercial.

Here’s a spotlight on commercial construction.

- Auto: includes auto dealerships, motorcycle dealerships, auto showrooms, and truck dealerships.

- Food: includes supermarkets, bakeries, dairies, markets, convenience stores, and delicatessens.

- Dining/drinking: includes liquor stores, bars, nightclubs, cafés, diners, restaurants, cafeterias, taverns, inns (eat & drink only), and bistros.

- Fast food: includes drive-in restaurants and fast food restaurants.

- Multi-retail: includes department stores and variety stores, shopping centers, shopping plazas, and town centers.

- Other commercial: includes drug stores and pharmacies, hardware stores and lumber yards, clothing stores, jewelry stores, salesrooms (non-auto), furniture stores, office supply stores, storerooms, and electronics stores.

Commercial Construction a Driver of Job Growth

Commercial construction is only $125.1 billion compared to $952.9 billion residential, $484.0 billion public, and $2.2 trillion total.

However, once houses and roads are built, there are no further directly related jobs. Once stores are built, there are many directly related jobs.

Commercial construction is a tiny component of construction spending but a mighty contributor to future jobs once completed.

ISM Index Little Slightly Better But New Orders and Production Contracting Faster

In the manufacturing sector ISM Index Little Slightly Better But New Orders and Production Contracting Faster

The Production Index continued in contraction territory in August, registering 44.8 percent, 1.1 percentage points lower than the July reading of 45.9 percent. Of the six largest manufacturing sectors, only Computer & Electronic Products reported increased production. The index is at its lowest level since May 2020, when it registered 34.2 percent.

With new orders, new export orders, and production worsening, employment is headed nowhere.

There is little to cheer about in any economic reports. And a big international trade war is on the horizon.

For discussion, please see Faced with Stagnant Domestic Growth China Starts a New Global Trade War