Trump backed down from Canada and Mexico Tariffs. I suspect not this time. But China retaliated, so what now?

The Wall Street Journal reports China Retaliates After Trump’s Tariffs Go Into Effect

China hit back against new U.S. tariffs with a series of moves including levies on certain American goods, an antitrust probe into Google and restrictions on Chinese exports of key minerals.

Just as new U.S. tariffs of 10% on China went into effect at 12:01 a.m. ET on Tuesday, Beijing announced its decision to retaliate. Its levies will go into effect on Feb. 10. The move came hours after the Trump administration struck deals to delay imposing new tariffs on Mexico and Canada.

President Trump said Monday that the 10% tariffs on China were just “an opening salvo.”

“If we can’t make a deal with China, then the tariffs would be very, very substantial,” Trump added.

China’s early response to new tariffs from the U.S. is “a more symbolic move for now,” Louise Loo, China lead economist at Oxford Economics, said in a report.

Very, Very Substantial?

Trump said the same thing about Canada and Mexico only to fold in one day.

So let’s see.

China holds one key card that Trump will have to deal with if he pushes China too hard. And here it is.

China Restricts Exports of Critical Minerals in Retaliatory Move

Please note China Restricts Exports of Critical Minerals in Retaliatory Move

In a separate move on Tuesday, China’s Commerce Ministry said that it would tighten control of exports of tungsten, tellurium, bismuth, molybdenum and indium products.

The controls didn’t single out exports to any particular country. The metals, though not household names, feature in a number of high-end industries that are increasingly the focus of competition between the U.S. and China. Molybdenum, for instance, is used to make steel stronger and less likely to rust, while tellurium is used in solar panels.

What’s different this time is China did not signal out just the US. China restricted access to certain minerals and technology twice last year, but on the US only.

The US avoided problems by buying rare earth minerals from allies. If China blocks minerals totally, there will be no minerals to get.

China’s Puts Export Curbs on Minerals US Needs for Weapons and Technology

On November 21, I commented China’s Puts Export Curbs on Minerals US Needs for Weapons and Technology

In a warning shot to the Trump administration, China tightens export controls on some dual-use minerals.

China Halts Rare Exports Used by US Technology Companies and the Military

On December 3, I noted China Halts Rare Exports Used by US Technology Companies and the Military

This is China’s advance salvo at Trump tariffs. It comes one day after the Biden administration expanded curbs on the sale of advanced American technology to China.

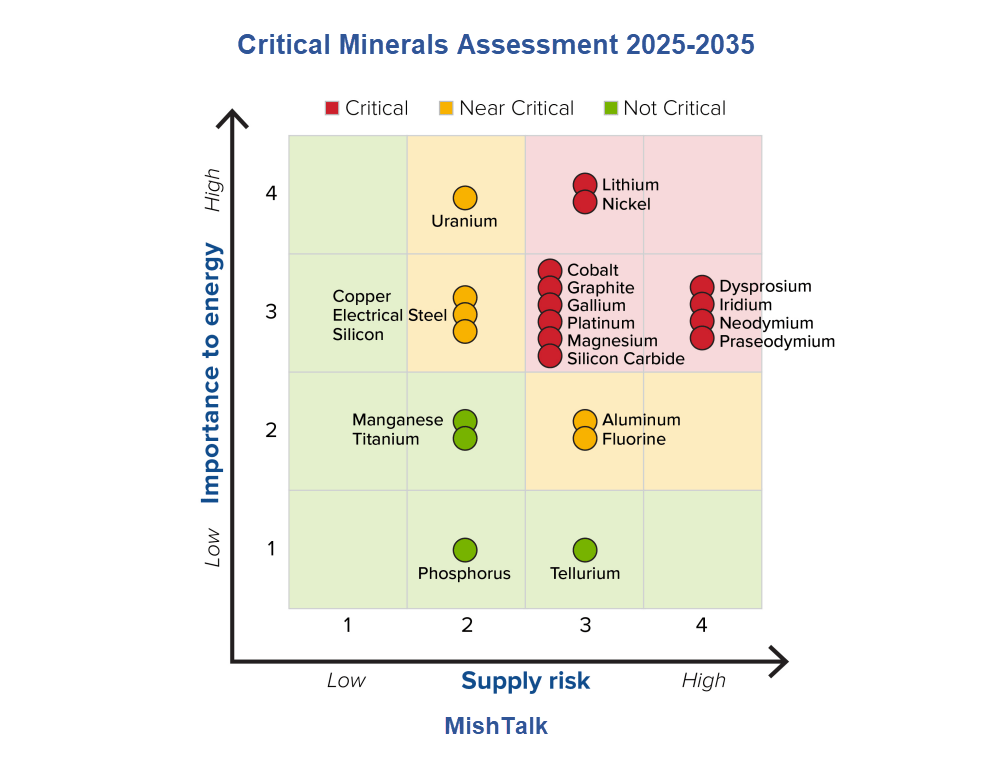

Also consider a Critical Materials Risk Assessment by the US Department of Energy

According to the analysis, there are six critical materials in the short term, which include cobalt, dysprosium, gallium, natural graphite, iridium, and neodymium. The uses for these critical materials are spread across rare earth magnets, batteries, LEDs, and hydrogen electrolyzers.

There are nine near-critical materials, which include electrical steel, fluorine, lithium, magnesium, nickel, platinum, praseodymium, silicon carbide (SiC), and uranium.

Finally, there are seven noncritical materials including aluminum, copper, manganese, phosphorous, silicon, tellurium, and titanium.

There are 12 critical, six near-critical, and four noncritical materials in the medium term.

The US Department of Energy has placed some of the rare earth minerals we need for weapons systems, windmills, batteries, and aircraft on a critical materials list.

Nothing stops China from a complete shutdown of all rare earth elements, and China controls about 80 percent of global supply.

The US out to have a strategic minerals reserve and ability to refine metals here. But we have neither.

This could get interesting if Trump follows through with his threat: “If we can’t make a deal with China, then the tariffs would be very, very substantial.”

Related Post

WSJ “Trump Blinks on North American Tariffs” Agree or Disagree?