China produces nearly 80% more than the next nine biggest steel producers, which are, in order, India, Japan, the US, Russia, South Korea, Turkey, Germany, Brazil and Iran.

Here’s an interesting article on steel on the South China Morning Post via Michael Pettis on Twitter.

Six Key Steel Points

- China’s steel industry has become a stand-in for the overall economy, with growing supply facing declining domestic demand. According to the World Steel Association, China produces roughly 55% of all the steel produced in the world.

- It produces nearly 80% more than the next nine biggest producers, which are, in order, India, Japan, the US, Russia, South Korea, Turkey, Germany, Brazil and Iran.

- The article quotes the VP of the China Iron and Steel Association saying: “The biggest problem now is how to achieve a dynamic balance between supply and demand.”

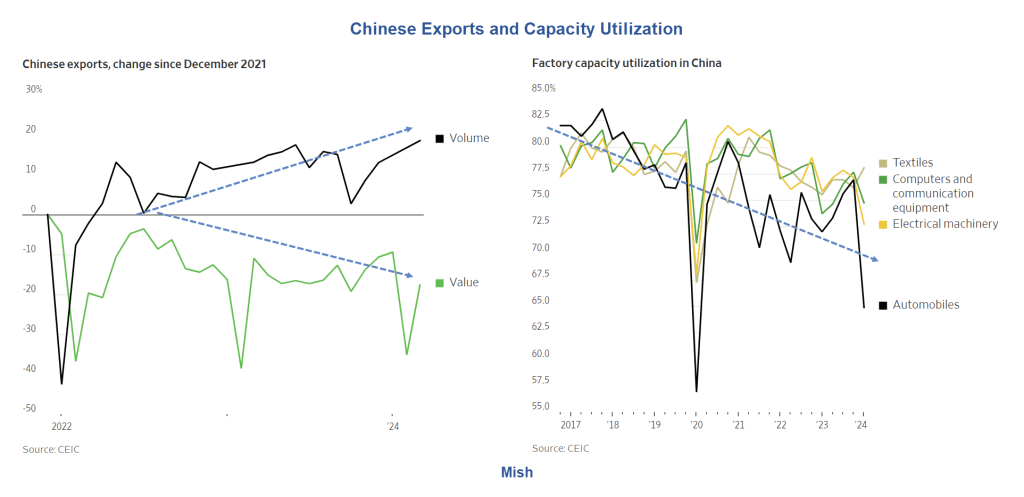

This will require some combination of a decline in production, which is bad for growth and unemployment in China, and an expansion in exports, which won’t be easy for other steel producers and exporters. - So far exports have taken up much of the slack. The article notes an Oxford Economics report which measures China’s combined export volumes of iron and steel to be 80 per cent above pre-pandemic levels.

- Fitch says that China’s steel exports climbed by 36.2% in 2023, to 90.26 million metric tonnes, and by 30.7% in the first quarter of 2024, to 25.8 million metric tonnes. This accounted for only 5% of China’s total output, suggesting it could grow a lot more.

- I suspect many steel producers will respond by protecting their steel industries, but this will be tougher for major steel exporters. After China, the largest steel exporters are Japan, South Korea, German, Turkey, Russia, Italy, Belgium, India and Brazil.

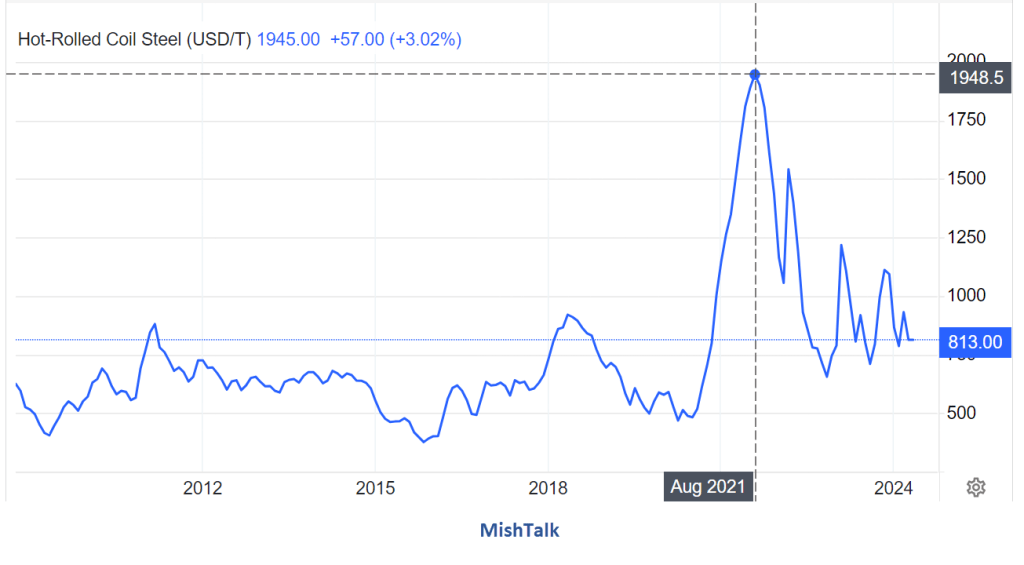

Despite the crash in the price of steel from $1945 to $813, the price is still much higher than the 2008-2019 average of about $500.

Manufacturers, especially auto and machinery, would welcome a further drop in the price of steel.

So would the construction industry.

And so would consumers who buy anything made out of steel.

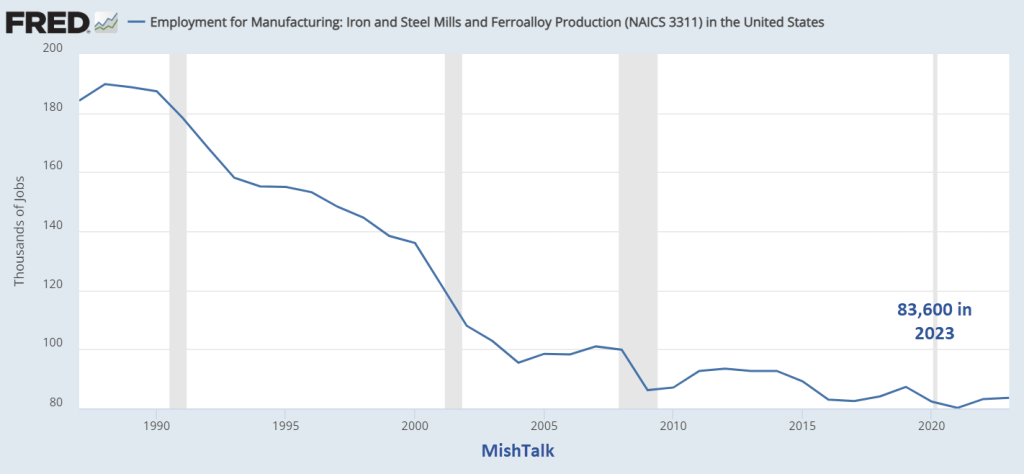

Iron and Steel Mills Employment

For comparison purposes the UAW has more than 391,000 as of February 24, 2022.

Top Steel Users

The Top User of Steel is construction, not automotive.

- 1) Construction

Out of all of the industries that consume steel, the construction industry reigns supreme. In fact, according to the Organization for Co-Operation and Development, the construction industry accounts for approximately 50 percent of the world’s total steel consumption. This comes as no surprise seeing as steel is used to construct the majority of buildings and other infrastructures. - Wondering just how much steel the construction industry consumes? think somewhere along the lines of 7.5 billion U.S. dollars worth of steel each year. On a country-by-country basis, the United States is the largest consumer (no surprise there) and China comes in at a close second.

- 2) Besides construction, the automobile industry consumes more steel than any other industry. This isn’t surprising as iron and steel make up nearly 70 percent of an automobile’s weight. When it comes to the makeup of automobiles, vehicle manufacturing uses various steel products, but surface treated steel sheets are the type most utilized. Surface treated steel typically includes hot dipped galvanized, electro galvanized as well as galvannealed steel sheets.

- 3) The machinery industry is the third most steel-consuming industry in the world. The machinery industry manufactures industrial equipment and components made by cutting and welding steel plates. Specialty steels, along with steel sheets, pipes and bars are also frequently used. The machinery industry is responsible for the means of production for agriculture, mining, public utility, and more, so they rely heavily on the steel industry.

Is China Dumping Steel?

Let’s define dumping as exporting steel at a cost lower than the cost to produce it.

I would prefer to have a definitive answer with percentages, but let’s assume China is dumping steel.

Who are the Beneficiaries of Dumping?

- The entire construction industry, especially home builders and road construction.

- The US auto industry and machinery producers.

- Ultimately, US consumers win. Everything made with steel costs less to produce and those costs are inevitably passed on to consumers.

Who Are the Losers?

- 83,600 US Steel Workers

- Chinese consumers

Ultimately, Chinese consumers pay a price by subsidizing US consumers who benefit.

Neither President Biden nor Trump understands the above simple truth.

Both would rather have 86,300 happy steel workers at the cost of price increases across the board than happy consumers across the board.

So expect a massive increase in tariffs no matter who wins the election.

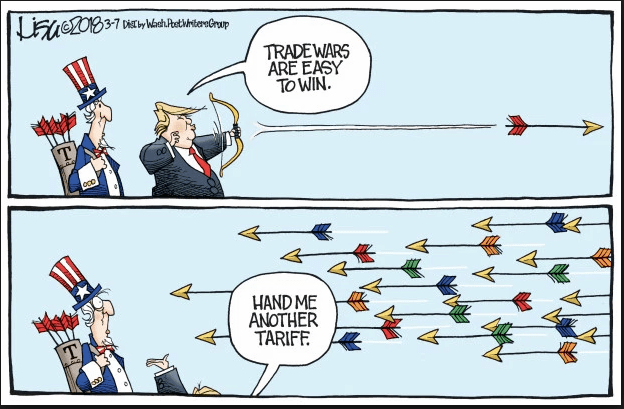

Trump Tweets “Trade Wars are Good and Easy to Win”

Flashback March 2, 2018 Trump Tweets “Trade Wars are Good and Easy to Win”

Can someone please explain what Trump “won”.

A Big Deflationary Push From China But Will Biden or Trump Allow That?

On April 22, I cautioned A Big Deflationary Push From China But Will Biden or Trump Allow That?

China keeps returning to a well that has run dry, using exports as a means for growth. China is about to hit a brick wall, with global consequences.

The Only Way to Win

Everyone thinks they can win a trade war. The only way to win is not play the game.

Neither China, nor the US, nor Germany or Japan has figured this out. And everyone wants to be a big exporter. It’s mathematically impossible.

My #1 issue looking ahead to 2025 is a global trade war with serious repercussions.

Meanwhile, please note Biden’s New Carbon Capture Mandates Will Cause Blackouts, Increases Prices

If there is a brief respite of serious disinflation, it will be transitory.