The answer to the first question is obvious. So let’s discuss what’s reasonable.

I created the lead chart from Budget of the U.S. Government Fiscal Year 2025 from the Office of Management and Budget.

Without giving any details, DOGE says it can cut $2 trillion in spending.

Assume Miracles

Team Doge wants to eliminate the Department of Education. Let’s assume that happens.

Heck, let’s temporarily assume DOGE is so successful that it cuts the entire $1.001 trillion of discretionary non-defense spending by eliminating 100% of every department, not just the Department of Education.

Wow. Well done DOGE!

But where does DOGE find another $1 trillion to achieve its goal of $2 trillion?

Defense Spending

Defense spending is $884 billion, and Trump wants to raise that.

Please note the Republican Platform says

Keeping the American People safe requires a strong America. The Republican Plan is to return Peace through Strength, rebuilding our Military and Alliances, countering China, defeating terrorism, building an Iron Dome Missile Defense Shield, promoting American Values, securing our Homeland and Borders, and reviving our Defense Industrial Base. We will build a Military bigger, better, and stronger than ever before.

We will invest in cutting-edge research and advanced technologies, including an Iron Dome Missile Defense Shield, support our Troops with higher pay, and get woke Leftwing Democrats fired as soon as possible.

How much would that cost? For now, let’s believe in more miracles.

Assume cost of of the iron dome and higher pay for troops is precisely $0.

Belief in Miracles

As long as we are believing in miracles, let’s believe DOGE cuts another $1 trillion from mandatory spending.

Wow. That’s another well done, DOGE!

TCJA and Other Promises

However, we do need to address Trump’s promises and priorities. His highest priority is renewing his 2017 Tax Cuts and Jobs Act (TCJA).

The Congressional Budget Office (CBO) projects that extending the TCJA would increase deficits by $4.6 trillion over 10 years, $0.6 trillion of which would result from additional interest payments.

That is roughly $460 billion per year.

Trump also proposes to reinstate State and Local Tax deductions. He needs to do that to buy vote from New York Democrats as an enticement for them to approve the renewal of the TCJA.

The Penn Wharton Budget Model estimates that to eliminate the SALT cap entirely beginning in 2025, would cost an additional $1,169 billion on top of the TCJA extension.

That is an extra $170 billion annually.

What about three other campaign promises including no tax on tips, no tax on overtime, and no tax on Social Security.

The Tax Foundation estimates No Tax on Social Security would cost $1.6 trillion over 10 years, an extra $160 billion annually.

The Tax Foundation estimates No Tax on Overtime would cost $680.4 billion over 10 years, $68 billion annually.

No Tax on Tips

The no tax on tips idea is interesting because bastions of alleged fiscal conservatives have latched onto the idea.

The Senate bill, introduced by Sen. Ted Cruz (R-TX) and titled the “No Tax on Tips Act,” would create a 100 percent above-the-line deduction for cash tip income, with cash in this context referring to payments in physical currency, debit or credit card payment, or checks. Non-cash tips (like a ticket, a coupon, or some other item of value) would presumably remain taxable. Additionally, both cash and non-cash tips would remain taxable under the payroll tax. Rep. Byron Donalds (R-FL) has introduced a companion bill in the House. However, a different House bill, introduced by Rep. Thomas Massie (R-KY) and Matt Gaetz (R-FL) and titled the “Tax-Free Tips Act of 2024,” would exempt tips from both income and payroll taxes.

The Committee for a Responsible Federal Budget estimates the cost of exempting tips from federal income tax would be $100 to $200 billion over a decade. If tips are also exempted from payroll taxes, the total could run to $250 billion.

That’s only $25 billion a year. But the results are hugely distortionary. The biggest beneficiaries would be those who work in casinos and high-end restaurants, not the short-order cooks and servers, and not the hotel maids who don’t report tips anyway.

The bill would also create huge fraud incentives to label some income as “voluntary tips”.

The idea is fiscally irresponsible, and it would create moral hazards while encouraging fraud. Nonetheless, alleged fiscal conservatives are for it.

Reflections on Discretionary Spending Cuts

The U.S. Immigration and Customs Enforcement (ICE) budget for fiscal year (FY) 2025 is $9.7 billion, the budget for Homeland Security is $64.8 billion, the budget for the FBI is $11.3 billion, the budget for the justice department is $37.8 billion and the budget for national intelligence is $73.4 billion.

Those items total $197 billion. Trump also wants more for the wall and mass deportations. Trump may need another 10,000 ICE agents even if his goal is a modest one to two million deportations.

Q: Wait a second Mish, didn’t you cut those expenses totally?

A: Yes. I cut 100% of discretionary spending.

But those are areas where Trump wants to increase discretionary spending.

Wonderland Thinking

“One can’t believe impossible things,” said Alice to the Red Queen.

“I daresay you haven’t had much practice,” said the Queen. “When I was younger, I always did it for half an hour a day. Why, sometimes I’ve believed as many as six impossible things before breakfast.”

Trump nominated Tulsi Gabbard for Director of National Intelligence. She would be gone too (or gone and not gone simultaneously in Wonderland thinking).

I eliminated the National Intelligence, the FBI, drug enforcement, NASA, justice department expenses, and agricultural department expenses.

Q:How realistic is that?

A: It’s not. Nor is it realistic to assume DOGE can come up with $1 trillion cuts to mandatory spending. But we need so come up with $2 trillion in savings, so I did. Voila! I’m a believer.

TCJA and Other Promises Annual Subtotals

- TCJA: $460 Billion

- SALT: $170 Billion

- No Tax on SS: $160 Billion

- No Tax on Overtime: $68 Billion

- No Tax on Tips: $25 billion

That’s $883 billion per year.

So, even if we assume DOGE can cut $500 billion from somewhere (that Congress approves), Trump would increase the deficit by $383 billion per year if his key proposals pass.

How Realistic is $500 Billion in DOGE Savings?

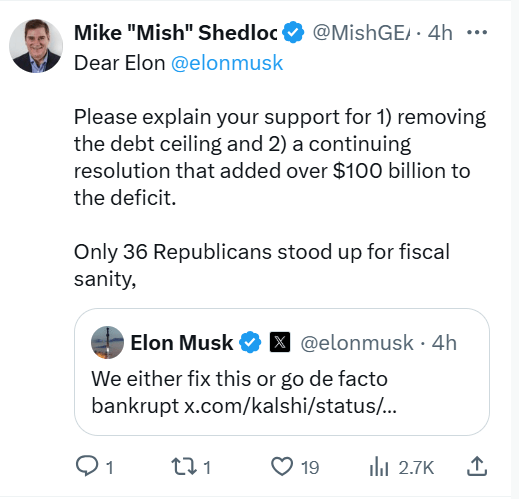

Yesterday, I asked Elon Musk a question.

The deal to avert the government shutdown added $110 billion in disaster and farm aid. I was OK with that as long as the deal cut $110 billion elsewhere, but that didn’t happen.

Although DOGE prevented a bigger disaster it also approved the above compromise. Thus DOGE officially starts fiscal year 2025 $110 billion in the hole.

Q: What do we call this?

A: Winning, obviously.

Fortunately, that’s only a one-time win (until it happens again) which is guaranteed to happen when Trump carries through with his threat of 200 Percent Tariffs on John Deere, driving up the cost of most farm equipment.

Also, please factor something in for the iron dome and whatever else Trump concocts for defense spending. That’s more winning.

Fiscal Year 2025 Revenue

Total revenue is $5.485 trillion. Total spending is $6,942 trillion. That would be an annual deficit of $1.457 trillion.

But revenue won’t be as stated because of TCJA and SALT. We already addressed those shortfalls to which Trump added $383 billion annually.

That would make the annual deficit $1.840 trillion. And this assumes the cost of the iron dome defense system is zero (or doesn’t pass).

Trump Proposes Eliminating Individual Income Taxes

In October, Trump Proposed Abolishing Individual Income Taxes.

“When we were a smart country, in the 1890s … this is when the country was relatively the richest it ever was. It had all tariffs. It didn’t have an income tax,” Trump said after a barber asked whether it would be possible to jettison the federal income tax. “Now we have income taxes, and we have people that are dying. They’re paying tax, and they don’t have the money to pay the tax.”

A few days later, podcaster Joe Rogan asked Trump whether he was serious about replacing federal income taxes with tariffs.

“Yeah, sure, why not?” Trump said during his interview Friday on “The Joe Rogan Experience.”

Eliminating income taxes would cost $2.679 trillion annually.

Outlays would remain the same as shown in the lead chart (plus another $383 billion net difference between DOGE gains and Trump proposals), but revenue would shrink to $2.806 trillion.

The new net would then be: $2.806 trillion in Other Revenue – ($6.942 trillion FY 2025 Total Outlays + 0.383 trillion in Net Additions) = -4.519 trillion per year.

To balance the budget with tariffs as Trump proposes, he would need to increase tariffs (a tax on consumers) by $4.519 trillion annually.

Impossible? Not if you are the Red Queen. And please note Trump promises to bring manufacturing back to the US.

This implies another miracle. So once again, I am a believer. We will simultaneously collect $4.519 trillion annually in tariffs and bring the jobs back home while increasing exports too. Wow!

Sobering Balance of Trade Math

Total US goods imports from the entire world in 2023 was $3.226 trillion.

So, even if we magically assume Trump can collect 100% tariffs on 100% of imports, Trump would still be $1.293 trillion short.

Returning from Wonderland with 60 percent tariffs on China, trade with China would stop completely. Trump would not collect a cent from China.

With more modest tariffs Trump might be able to collect $300 billion (from US Consumers) assuming no mass retaliation and no global economic meltdown.

That would mean annual deficits of $4.219 trillion ($42 trillion over 10 years not counting interest on the national debt).

My non-Wonderland conclusion is that eliminating income taxes is so ridiculous that it won’t be seriously discussed other than to explain the math to Trump who perhaps may not understand.

More Realistic But Still High Assumptions

Expecting $500 billion from DOGE cuts is on the high side, but let’s assume that happens anyway.

If we further assume that Trump’s plan to have no tax on tips, no tax on Social Security, and no tax on overtime all fail, the cost of the iron dome is zero, the border improvements cost nothing, ICE costs nothing, and Trump does not have to increase handouts for Democrat priorities to get TCJA across the finish line, then Trump’s proposals would only increase the deficit by $150 billion per year to $1.607 trillion.

Instead, if you further assume $650 billion in DOGE cuts (or other revenue increases), then annual deficit is unchanged at $1.457 trillion. Hooray?

Finally, the above examples assume no recession in the next 10 years (alternatively net revenue does not drop and deficit spending does not rise).

Hopefully, you are beginning to see why Trump demanded the debt ceiling be eliminated.

What Would You Do to Balance the Budget?

Unlike DOGE and Trump, I did balance the budget in my proposals.

For discussion, please see An Interactive Exercise: What Would You Do to Balance the Budget?

In my pro-growth proposal, I cut corporate taxes to zero on domestic income while keeping the tax at 15% elsewhere.

I also slashed income taxes for all but the very top-end.

To pay for the above, I let TCJA expire, eliminated all deductions, and decreased military spending.

I assumed $630 billion in DOGE cuts (or other revenue increases wherever DOGE failed).

I ended up with a surplus. Click on the link for more discussion and the economic gains of my proposals.

What can you come up with?