As housing affordability continues to worsen, homebuyers are looking to riskier mortgage products to improve their chances of buying.

Aashrith and his wife Daru, who did not want to use their real names for privacy reasons, secured a ‘deposit boost loan’ to increase their borrowing power and buy their dream home.

The loan enables buyers to purchase a home with a deposit as low as 2.2 per cent without paying lenders mortgage insurance.

While Aashrith says the interest on the loan was “pretty high”, they would not have been able to afford their property without it.

“[It allows you] to get into the market and get that opportunity (to buy property you wouldn’t normally be able to afford), which is fantastic.”

Most experts agree that the long-term solution to worsening housing affordability is to increase the supply of properties, but it could take years for buyers to benefit from the federal government’s , which aims to build 1.2 million new homes over the next five years.

In the meantime, desperate buyers are looking for ways to increase their borrowing capacity through riskier mortgages in the hopes of getting into the market.

Changing access to mortgages can quickly impact house prices

The Australia Institute senior economist Matt Grudnoff points out that the last time house prices dropped in Australia was five years ago, after the banking regulator, the Australian Prudential Regulation Authority (APRA), cracked down on lending to investors.

This included limiting growth in investor lending to 10 per cent annually from December 2014 and restricting interest-only loans to 30 per cent of new lending from April 2017.

The crackdown prompted an increase in the interest charged on investor loans and saw house prices fall 4.3 per cent between June 2017 and June 2019. This was one of the weakest two-year periods for house price growth in more than 30 years.

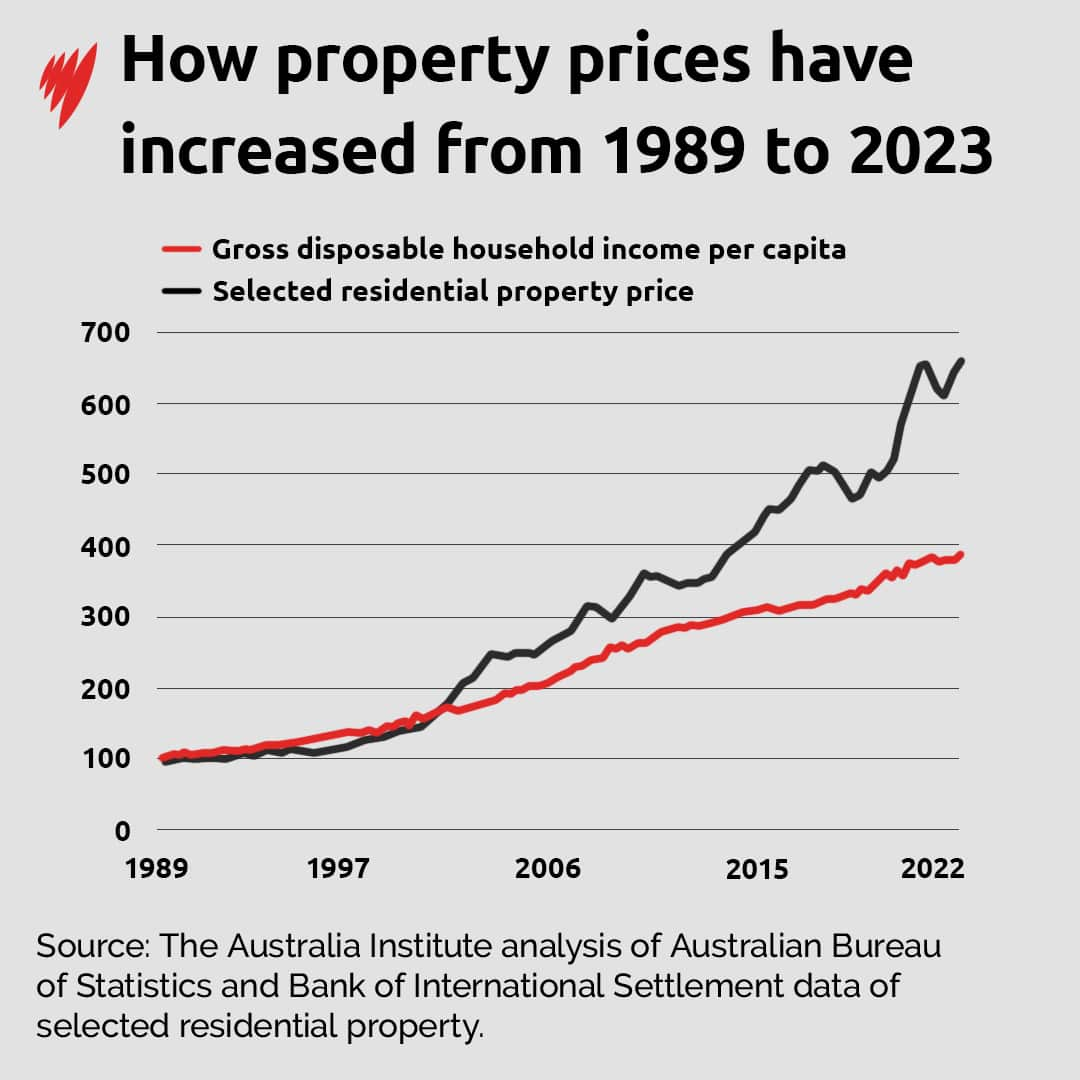

Property prices have risen almost continuously but dipped after 2017 once restrictions on investor lending were introduced. Source: SBS News

“These kinds of macro-prudential regulations — which is what APRA calls them — can actually slow the rate of investors rushing into the market and slow [the growth of] house prices,” Grudnoff says.

Investor loans only began increasing in 2021 after house prices again started rising and the APRA changes were phased out, starting in April 2018.

A Senate inquiry is looking into the impact of lending practices on housing affordability, with a report expected to be submitted by 5 December.

Grudnoff says changing lending practices would certainly be faster at improving housing affordability than increasing the supply of housing, which is a longer-term solution.

This is a way of impacting the market a lot more quickly — you’ll see results in months rather than years.

Matt Grudnoff, senior economist, The Australia Institute

Housing affordability not taken into account

Changes to lending practices can be complicated.

APRA does not have a mandate to make decisions that influence property prices, and its previous tightening of investor lending was to address concerns about the growth in higher-risk lending.

In its latest update in July, APRA said it had no plans to introduce lending limits. Its next update is due before the end of the year.

Grudnoff says the government should give APRA the power to take housing affordability into account when making its decisions.

The Australian Prudential Regulation Authority is responsible for ensuring the financial system remains stable and sets banking regulations under a mandate from the Commonwealth Government. Source: AAP / Mick Tsikas

Grudnoff says the government could also look at other ways to tighten investor lending, but this would not treat the root cause of the problem — which stems from incentives like the capital gains tax (CGT) discount and negative gearing.

“The best way [to cut back on investor lending] would be to scrap the CGT discount,” he says.

“That would make households investing in residential property less tax effective.”

But Peter Tulip, chief economist of the Centre for Independent Studies warns toughening lending restrictions for investors could hurt renters as it could also lower the number of investment properties available.

Relaxing lending rules could enable people to borrow more

Another option would be to broaden access to mortgages, with some experts suggesting that APRA rules could be relaxed to allow owner-occupiers to borrow more.

In assessing a potential customer, APRA currently requires banks to consider whether they could still make repayments if interest rates increased by 3 per cent.

Removing or lowering this rate means banks could potentially lend more money to borrowers.

Tulip points out one flaw of the 3 per cent mortgage serviceability buffer is that it also applies to fixed-rate mortgages.

“Even if you fix your interest rate for five years (your borrower still has to assess your ability to pay 3 per cent more in interest) which pretty much defeats the point of the fixed rate mortgage.”

He believes banks should be able to set their own responsible lending provisions rather than have them dictated by regulators.

The regulator should butt out — they should let borrowers and lenders decide for themselves what terms make sense.

Peter Tulip, chief economist, Centre for Independent Studies

But Tulip acknowledges relaxing lending practices could increase the average amount people borrow, which may worsen affordability.

“The first solution needs to be increasing housing supply,” he says.

“Once you’ve got builders building, then you can increase home borrowing.”

Grudnoff agrees allowing people to borrow more would worsen affordability in the long run as it would increase demand. This includes ideas such as allowing people to take out 50-year loans.

“As weird as it sounds and as perverse as it sounds, helping by making it easier for some buyers or borrowers to be able to borrow, makes housing less affordable because it pushes up prices,” he says.

Buyers look to low-deposit loans for help

In a tight housing market, desperate buyers are looking for innovative mortgage products to help increase their borrowing power.

Aashrith and Daru moved to Australia from India in 2020, and despite having a combined income of $210,000, they were only able to borrow around $650,000 with a 5 per cent deposit.

This was not enough to buy what they wanted: A three-bedroom house close to Adelaide’s CBD.

Their fortunes changed when they took out an OwnHome deposit boost loan, which helped them increase their deposit to 20 per cent.

This allowed them to buy a $867,000 home in a location 10 minutes out of the city via public transport.

But it also led to them paying off two debts: Their 15-year loan to OwnHome for the boosted deposit was charged at 13 per cent interest, and they had a separate mortgage loan with another lender on a 6.5 per cent variable rate for the remainder of the purchase price.

This made repayments on their $867,000 three-bedroom house very high — around $6,300 a month.

Aashrith says with such a high repayment, their goal was to refinance as quickly as possible.

Aashrith and Daru could not afford their dream home in Adelaide until they found a low deposit loan. Source: AAP / Sam Mooy

Luckily for them, house prices kept rising and increased their equity in the home, which meant they were able to discharge the deposit boost loan after eight months when they refinanced through another provider.

This brought their monthly repayments down to $5,100, which was a “huge relief”.

“It worked out pretty well for us — all the stars aligned,” Aashrith says.

Unequal access to intergenerational wealth

OwnHome co-founder James Bowe says the deposit boost loan benefits the kinds of buyers who don’t have the “bank of mum and dad” to help them save for a deposit.

Data suggests that two-thirds of home buyers rely on their parents for direct financial support to bridge the deposit either as a gift or a loan.

OwnHome co-founder James Bowe

“But of course, we know that not everyone in Australia has access to that intergenerational wealth.”

Bowe says 52 per cent of their customers are first-generation migrants.

“They’ve got really strong financial discipline and really clear aspirations of home ownership, but often they’re starting from scratch in terms of savings,” he says.

“Maybe they’ve even sold a home overseas but it’s not even enough to cover stamp duty [in Australia].”

Soren Financial director Monsour Soltani says the deposit boost loan is not suitable for every buyer but believes it does provide a way for high-income earners who aren’t eligible for the — which helps people buy with a 5 per cent deposit — to access the market more quickly.

This could be important for those living in certain areas where prices are rising quickly, such as the eastern suburbs of Sydney.

Buyers in areas where prices are rising more slowly may be better off to keep saving, Soltani says.

“It’s really a case-by-case basis on whether this suits someone or not.”

Riskier mortgages raise economic concerns

Grudnoff says he understands why people are taking bigger risks to get into the housing market.

“[But] from an economy-wide perspective, it is concerning,” he says.

An increase in people taking on risk means that any financial crash will have a bigger impact on us.

Matt Grudnoff, senior economist, The Australia Institute

In order for housing affordability to improve, Grudnoff says incomes need to grow faster than house prices.

“You really need house prices to be flat for an extended period of time — like a decade — so that incomes continue to grow,” he says.

Grudnoff points out that it took 20 years for the housing market in Australia to be “stuffed up”, and it was not going to be fixed instantly.

“The problem is, year by year, things are actually getting worse, not better.”