Once again, rational people wonder what’s going on with the jobs report. The discrepancy between the trend in jobs and employment surges again.

In reaction to the allegedly hot jobs report, bond yields are down across the board as I type.

The 10-year and 5-year treasury yields are up 14 basis points as of 9:20 AM Eastern. Gold is down $49. But the stock markets are down only slightly.

Jobs vs Employment

From September 2020 through early 2022, nonfarm payroll job gains and full time employment changes tracked together.

Starting around March of 2022, a divergence between employment and jobs became very noticeable, and I have been discussing the divergence since then.

Payrolls vs Employment Gains Since May 2023

- Nonfarm Payrolls: 2,756,000

- Employment Level: +376,000

- Full-Time Employment: -1,163,000

In the last year, jobs are up 2.8 million while full-time employment is down 1.2 million.

Payrolls vs Employment Gains Since May 2022

- Nonfarm Payrolls: 6,615,000

- Employment Level: +2,769,000

- Full-Time Employment:+588,000

In the last two years, jobs are up by 6.6 million with full-time employment up 0.6 million, a discrepancy of only 6 million. The rise in total payrolls is about 3.8 million more than the rise in employment.

No amount of BLS smoothing can hide this, but hardly anyone discusses it.

Job Report Details

- Nonfarm Payroll: +272,000 to 158,543,000 – Establishment Survey

- Civilian Non-institutional Population: +182,000 to 268,248,000

- Civilian Labor Force: -250,000 to 167,732,000 – Household Survey

- Participation Rate: -0.1 to 62.5% – Household Survey

- Employment: -408,000 to 161,083,000 – Household Survey

- Unemployment: +157,000 to 6,649,000- Household Survey

- Baseline Unemployment Rate: +0.1 to 4.0% – Household Survey

- Not in Labor Force: +433,000 to 100,516 – Household Survey

- U-6 unemployment: +0.0 to 7.4% – Household Survey

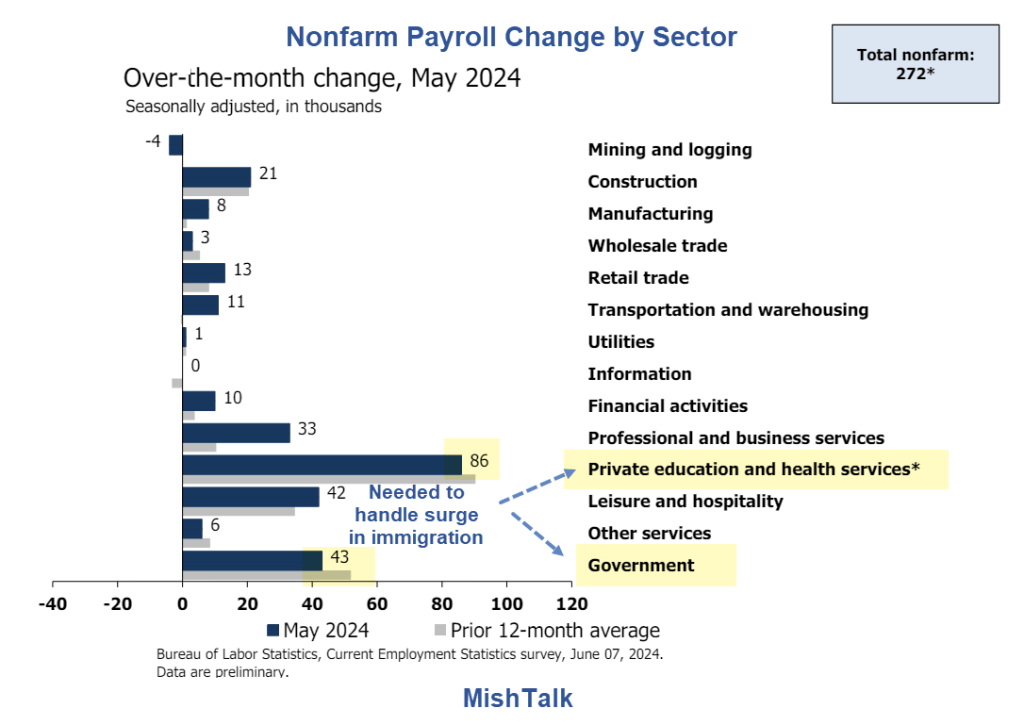

Nonfarm Payroll Change by Sector

Government and Health Services are related to the surge of illegal immigrants and the need to address them.

Social assistance jobs, a subcategory of private education and health services, rose by 12,000 in January; 24,000 in February; 9,000 in March; and 40,000 in April, and 15,000 in May.

Government jobs rose by 60,000 in January; 55,000 in February; 78,000 in March; 7,000 in April, and 43,000 in May.

Change in Nonfarm Payrolls January 2022 to February 2024

Monthly Revisions

- The change in total nonfarm payroll employment for March was revised down by 5,000, from +315,000 to +310,000.

- The change for April was revised down by 10,000, from +175,000 to +165,000.

- With these revisions, employment in March and April combined is 15,000 lower than previously reported.

Part-Time Jobs

- Involuntary Part-Time Work: -50,000 to 4,419,000

- Voluntary Part-Time Work: -+409,000 to 22,662,000

- Total Full-Time Work: -625,000 to 133,264,000

- Total Part-Time Work: +286,000 to 28,004,000

The above numbers never total correctly due to the way the BLS makes seasonal adjustments. I list them as reported.

Hours and Wages

This data is frequently revised.

- Average weekly hours of all private employees is flat at 34.3 hours.

- Average weekly hours of all private service-providing employees was flat at 33.2 hours.

- Average weekly hours of manufacturers was flat at 40.1 hours.

An overall decline or rise of a tenth of an hour does not sound line much, but with employment over 160 million, it’s more significant than it appears at first glance.

Hourly Earnings

This data is also frequently revised. Here are the numbers as reported this month.

Average Hourly Earnings of All Nonfarm Workers rose $0.14 to $34.91. A year ago the average wage was $33.54. That’s a gain of 4.1%.

Average hourly earnings of Production and Nonsupervisory Workers rose $0.14 to $29.99. A year ago the average wage was $28.79. That’s a gain of 4.2%.

Year-over-year wages are keeping up with year-over-year inflation after underperforming for many months.

Unemployment Rate

The unemployment rate hit a 50-year low in January and April of 2023 at 3.4 percent. It’s now 4.0 percent.

The unemployment rate has bottomed this cycle and will generally head higher.

Alternative Measures of Unemployment

Table A-15 is where one can find a better approximation of what the unemployment rate really is.

The official unemployment rate is 4.0%.

U-6 is much higher at 7.4%. Both numbers would be way higher still, were it not for millions dropping out of the labor force over the past few years.

Some of those dropping out of the labor force retired because they wanted to retire. Some dropped out over Covid fears and never returned. Still others took advantage of a strong stock market and retired early.

The rest is disability fraud, forced retirement (need for Social Security income), and discouraged workers.

Birth Death Model

Starting January 2014, I dropped the Birth/Death Model charts from this report.

The birth-death model pertains to the birth and death of corporations not individuals except by implication.

For those who follow the numbers, I retain this caution: Do not subtract the reported Birth-Death number from the reported headline number. That approach is statistically invalid.

The model is wrong at economic turning points and is also heavily revised and thus essentially useless.

Birth-Death Methodology Explained

Every month this subject comes up. I gave a detailed explanation of the model and why the hype is wrong in my December 8, 2023 post How Much Did the Huge 412,000 Birth-Death Adjustment Impact October’s Job Report?

The month does not matter. If you think the model has a big impact, please click on the above link for why it doesn’t.

Household Survey vs. Payroll Survey

- The payroll survey (sometimes called the establishment survey) is the headline jobs number. It is based on employer reporting.

- The household survey is a phone survey conducted by the BLS. It measures employment, unemployment and other factors.

If you work one hour, you are employed. If you don’t have a job and fail to look for one, you are not considered unemployed, rather, you drop out of the labor force.

Looking for job openings on Jooble or Monster or in the want ads does not count as “looking for a job”. You need an actual interview or send out a resume.

These distortions artificially lower the unemployment rate, artificially boost full-time employment, and artificially increase the payroll jobs report every month.

Can the Jobs and Employment Numbers Both Be Reasonably Correct?

The answer is yes (discounting measurement error) because they measure different things. A person working three part time jobs counts for three jobs but only a single person employed.

I have repeatedly asked ADP to account for duplicate social security numbers but they won’t. Amusingly, the BLS wants to, but the employees tell me they can’t because “they don’t have access to the data for security reasons.”

This is a simple sort-merge program but alas, we depend on a phone survey for employment numbers.

Notably, discrepancies like these don’t last for years unless there is some truth to the employment numbers because measurement errors are random. Also, the unemployment rate is based off the same set of numbers.

Closing Thoughts on the May Jobs Report

The discrepancy between jobs and employment is persistent and rising.

These monthly jobs reports (CES – Current Employment Statistics) are based on a 5.6 percent sample of the data. Job numbers based on the entire data (QCEW – Quarterly Census of Employment and Wages) lag by about 5 months.

The most recent QCEW data is from December of 2023.

2022 Q4-2023 Q4 CES vs QCEW

- CES: 155,211,000 to 158,269,000 (+3.06 million)

- QCEW: 152,525,000 to 154,848,000 (+2.32 million)

CES reports 32 percent more job gains in 2023 vs QCEW.

Nonfarm Payrolls NSA Minus QCEW

The BLS does not revise the previously reported numbers in its annual benchmark adjustments making the historical charts, including my lead chart, wrong. Jobs are overstated on all the charts.

For discussion of the difference between QCEW and the monthly jobs report please see How Much Does the BLS Overstate Monthly Jobs?

Finally, the rising trend in payrolls vs QCEW corresponds to the rising discrepancy between jobs and payrolls.

Expect more negative revisions to the monthly jobs reports.