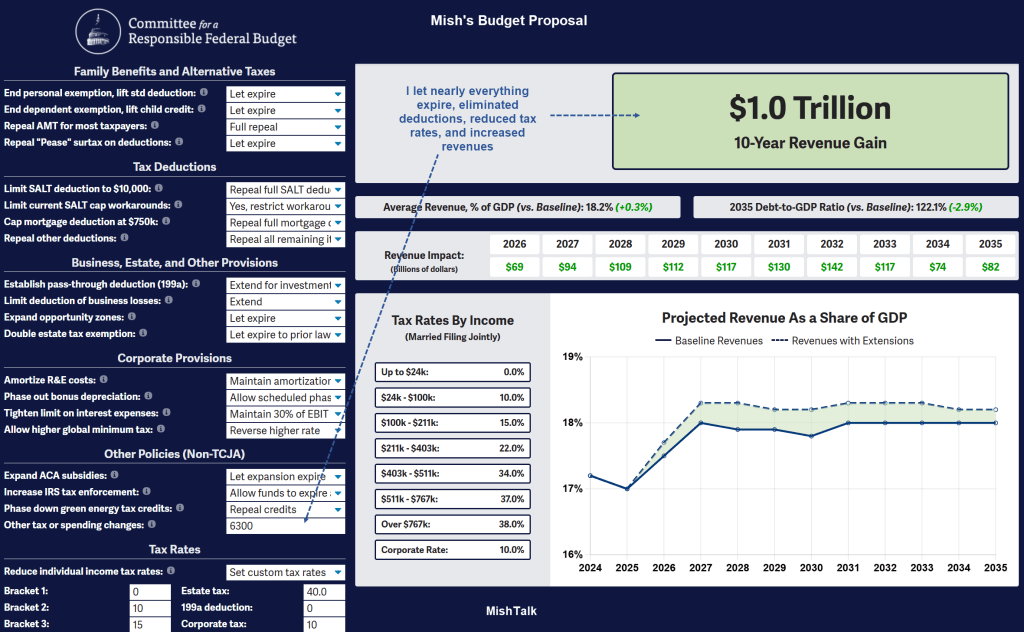

The Committee for a Responsible Federal Budget has a nice interactive site that lets you adjust exemptions and set tax rates. Have a go at it. Here’s mine.

Large parts of the 2017 Tax Cuts & Jobs Act (TCJA) are set to expire at the end of 2025. Design your own solution at Build Your Own Tax Extensions

To pay for those gigantic tax cuts and end up with a surplus, to stabilize the national debt, I had to reduce spending or increase revenues elsewhere. I did so by raising $6.3 trillion over 10 years, $630 billion per year.

My Email Proposal to the CRFB

Suggestions: I propose a zero percent corporate tax rate for profits on items and services produced in the US, and a 15 percent rate overseas. That was not an option.

I eliminated all standard and itemized deductions including SALT and mortgages, eliminated the AMT, and I propose corporate rates as noted above although my form says 10 percent.

I set the seven tax brackets to 0, 10, 15, 22, 34, 37, and 38. This dramatically reduces income tax for the bottom 4 brackets but eliminated all standard and itemized deductions. Those in the lower two brackets, and especially the lowest, don’t have deductions anyway.

I am striving for a genuine low-to-middle tax cut, while simplifying the tax code and spurring corporate investment in the US, not overseas.

In addition to being more than tax neutral, I want to reduce overall deficits. I added $6.3 trillion in other items ($630 billion a year) by attacking disability and Medicaid fraud, unleashing DOGE (e.g. eliminating the dep’t of education etc), and reducing military spending.

I would love to see how my proposals would impact GDP over time. Can you do this?

Thanks

OK, It’s your turn. Please don’t tell me tariffs is all we need.

I factored in nothing. But if you insist, properly label tariffs increases as a tax on consumers and count on retaliations with big negative repercussions.

“Make Tariff’s Great Again”

For discussion of Trump’s threat to Mexico and Canada, please see What Industries Will Suffer the Most Under Trump’s Plan to “Make Tariff’s Great Again”?

Trump is upping the rhetoric on Mexico, Canada, and China on top of previous tariff threats. Who will be hardest hit?

Regarding China ….

China Halts Rare Exports Used by US Technology Companies and the Military

For discussion of tariff repercussions, please see China Halts Rare Exports Used by US Technology Companies and the Military

Trump’s 50 percent tariff threats on China will do one of two things, perhaps both: Block all rare earth exports from China or start WWIII.

Good luck with that.

Oh, please recall: Trade wars are good and easy to win.

Addendum

75 percent of the budget is non-discretionary.

61 percent of the budget is mandatory. 13 percent on interest payments is mandatory as well. The US won’t default.

That leaves 26 percent discretionary spending and military spending is roughly half of of that.

My proposal goes after Medicaid fraud, especially disability fraud. I do not know how much that is. Medicare fraud is also hefty but again I have no numbers.

I am willing to defund the Department of Education and that is factored into my proposal to raise revenue/reduce costs of $6.3 trillion over 10 years. My $6.3 trillion also includes a stab at reducing fraud.

I am willing to cut defense spending by a quarter.

Those are all part of my $6.3 trillion revenue and cuts proposals. Any shortfalls in my proposal can come from a national sales tax or VAT.

We also need to attack the source of some costs. To do that we need to end collective bargaining of public unions, kill Davis-Bacon and prevailing wage laws, and kill the Jones Act.