The Manufacturing ISM was above contraction in February, but barely. Not to worry, I hear things are going according to plan.

Please consider the February 2025 Manufacturing ISM® Report On Business® .

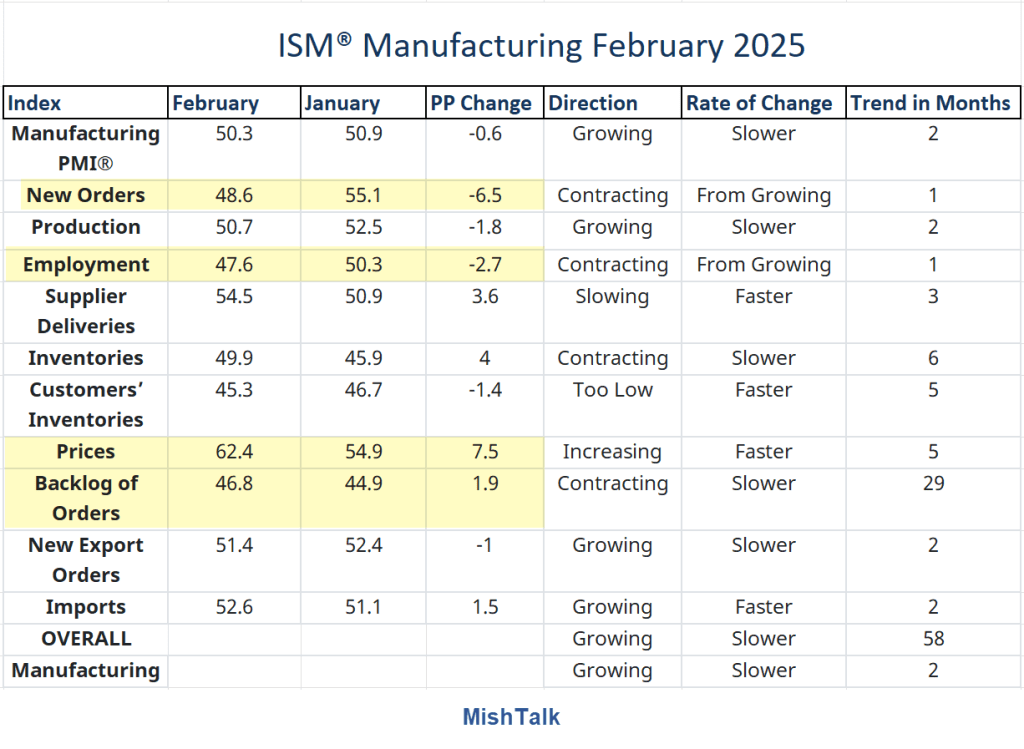

Economic activity in the manufacturing sector expanded for the second month in a row in February after 26 consecutive months of contraction, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The Manufacturing PMI® registered 50.3 percent in February, 0.6 percentage point lower compared to the 50.9 percent recorded in January. The overall economy continued in expansion for the 58th month after one month of contraction in April 2020,” says Fiore.

“Demand eased, production stabilized, and destaffing continued as panelists’ companies experience the first operational shock of the new administration’s tariff policy. Prices growth accelerated due to tariffs, causing new order placement backlogs, supplier delivery stoppages and manufacturing inventory impacts. Although tariffs do not go into force until mid-March, spot commodity prices have already risen about 20 percent.”

Respondent Comments

- “The tariff environment regarding products from Mexico and Canada has created uncertainty and volatility among our customers and increased our exposure to retaliatory measures from these countries.” [Chemical Products]

- “Customers are pausing on new orders as a result of uncertainty regarding tariffs. There is no clear direction from the administration on how they will be implemented, so it’s harder to project how they will affect business.” [Transportation Equipment]

- “Tariff impact has been minimal to overall manufacturing and raw material supply. Limits on U.S. government spending in key organizations like the Food and Drug Administration, Environmental Protection Agency and National Institutes of Health are delaying some orders.” [Computer & Electronic Products]

- “Inflation and pricing pressure continue to drive uncertainty in our 2025 outlook. We are seeing volume impacts due to pricing, with customers buying less and looking for substitution options.” [Food, Beverage & Tobacco Products]

- “The incoming tariffs are causing our products to increase in price. Sweeping price increases are incoming from suppliers. Most are noting increases in labor costs. Vendors are indicating open capacity. Inflationary pressures are a concern. Our company is working diligently to see how the new tariffs will affect our business.” [Machinery]

- “Business is still slow, but some indications of improved demand are six to nine months out. Steel and scrap costs are increasing, and it’s too early to tell how high they will go.” [Fabricated Metal Products]

- “New orders continue to be strong after picking up in December. The uncertainty about tariffs keeps us cautious on spending, despite the strong sales right now.” [Electrical Equipment, Appliances & Components]

- “Management now has us running scenarios to project tariff impacts to our business. They want numbers in 24 hours on variables that equate to a wild guess. Interesting times we live in.” [Nonmetallic Mineral Products]

- “Internal analysis ongoing about impact of tariffs, but nothing concrete yet. General business conditions remain tepid; outlook on the durables side growing more pessimistic with growing domestic inventories of automobiles.” [Plastics & Rubber Products]

- “Customer volumes seem to be better than 2024. However, customers are still very hesitant to commit to long-term volumes due to the market uncertainty caused by proposed tariffs on steel/aluminum imports.” [Primary Metals]

Every comment mentioned tariffs, uncertainty, or price hikes related to Tariffs. Only one had the impact as minimal.

My favorite respondent comment regards nonmetallic minerals: They [management] want[s] numbers in 24 hours on variables that equate to a wild guess. Interesting times we live in.”

Commodities Up in Price, Down in Price, Short Supply

- Commodities Up in Price: Aluminum (15); Cocoa Beans; Copper; Electrical Components; Electronic Components; Labor — Temporary; Natural Gas (5); Plastic Resin; Polypropylene Resin; Solvents; Steel; Steel — Carbon; Steel — Hot Rolled; and Steel — Scrap (2).

- Commodities Down in Price: Ocean Freight.

- Commodities in Short Supply: Electrical Components (53).

The number of consecutive months the commodity is listed is indicated after each item.

Aluminum is up in price for 15 months and electrical components are short in supply for 53 months.

Things Are Going According to Plan

Q: What plan is that?

A: I am not privy to these discussions, but the logical conclusion is Trump wants a tariff-related recession to blame on Biden.

Q: What makes you think there is a plan?

A: Good point. Things are just going, there is no plan, just beliefs.

Q: What beliefs are those?

A: Trade wars are good and easy to win. We can use tariffs to balance the budget. We can use tariffs to bring manufacturing back to the US. We can use tariffs to lower inflation.

Q: Aren’t those somewhere between ridiculously contradictory and impossible?

A: Yes. But no one can admit that, silly. So we have to say that things are going to plan. This is 5D chess you know.

Related Posts

February 10, 2025: Trump to Impose 25 Percent Tariffs on Steel and Aluminum, Expect Higher Prices

All US consumers of steel and aluminum will pay higher prices, especially the automakers.

February 11, 2025: Trump’s Steel Tariffs Now Will Work as Good as the First Time

Q: How’s that? A: Very poorly.

February 17, 2025: Five Republican Senators Caution Trump about Pain from Tariffs

Senators warn Trump, but Trump won’t listen.

February 17, 2025: Trump’s Tariffs Will Increase the Cost of a Pickup Truck by $8,000.

Trump says it’s full speed ahead with tariffs. It will cost US jobs.