If consumers pay for tariffs, why have them, and why would countries retaliate?

Twitter Conundrum

- Jason Furman @JasonFurman: Puzzle for you: If foreign citizens effectively pay for U.S. tariffs then who will bear the incidence of the foreign tariffs that are levied in retaliation?

- John Carney @Carney: I’ve asked the opposite question of people who say that U.S. citizens pay for U.S. tariffs. Who bears the incidence of retaliatory tariffs? And if U.S. consumers are paying for our tariffs, why would there be retaliatory tariffs?

- John Carney: The related question I’ve asked frequently—and received no satisfactory answers—is why there would be retaliation at all? Why assume retaliation if you think tariffs are mostly a tax on domestic consumers?

Tariffs Are a Tax, But Who Pays?

Tariffs are a tax but who pays the tax? There are only two choices. Importers eat the cost or importers pass the cost on to consumers.

It’s not quite that simple because many forces work to mitigate tariffs. In isolation, Tariffs tend to strengthen the currency of the county that imposes them. And a strengthened dollar acts to mitigate some on the impact on consumers.

Simultaneously, a weakened yuan reduces some of the sting on exporters.

Also, importers seek new suppliers (say Vietnam or Mexico instead of China). The net economic impact on prices, imports, and revenues is not as big as one may initially think.

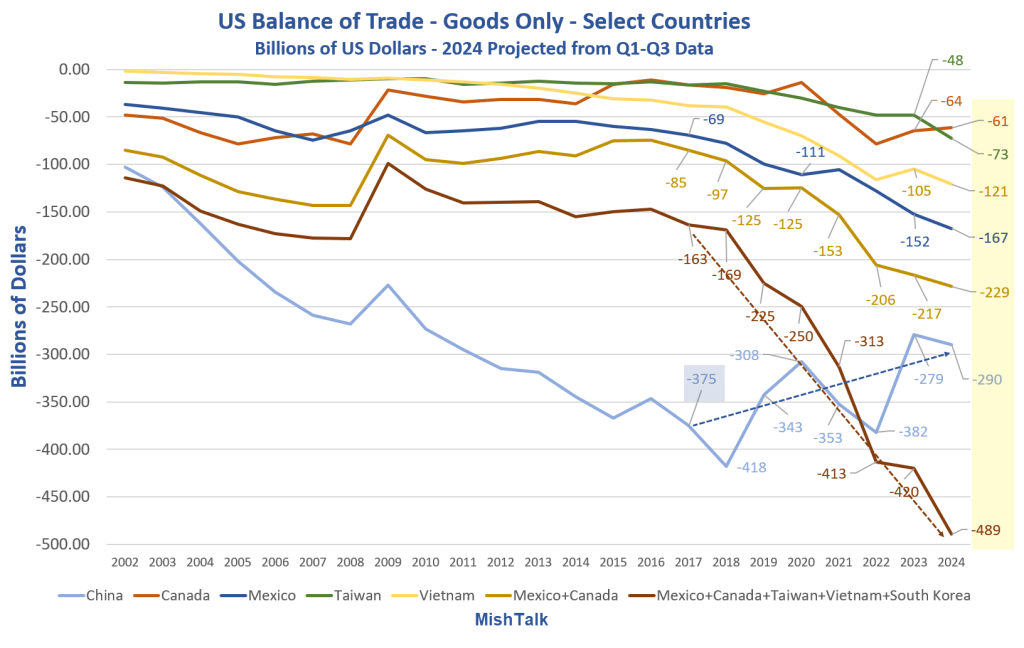

US Balance of Trade Select Countries Goods only 2024 Q4 Projection

Trump’s tariffs likely reduced the deficit with China at the expense of increasing the deficit elsewhere.

With the dollar strengthening vs most currencies, you have a lot of economic distortions with some industries getting hit harder than others.

In cases where there was a straight shift (say clothes from Vietnam instead of China), not much happened at all because tariffs were successfully avoided.

US Steel Importers Lose

After President Trump’s steel tariffs took effect on June 1, 2018, Mid Continent Steel & Wire reports they lost close to 200 employees while losing more than 70 percent of its sales.

Mid-Continent is the US largest producer of nails. It nearly went under until Trump granted the company a tariff exemption.

Tariffs on products (e.g. steel) are not as easy to avoid as tariffs on countries.

Who Are the Beneficiaries of Export Subsidies?

China is subsidizing exports. The Chinese exporters gain. China made many billionaires in the process.

Who are the Chinese exporters? Typically it is State Owned enterprises (SOEs) and the politically connected.

The US consumer is the beneficiary and the loser is the Chinese consumer. In effect, Chinese consumers subsidize US consumers.

Why Retaliate If US Consumers Gain?

The beneficiaries of tariffs are politically connected US unions at the expense of everyone else.

A steel example shows the complexity of winners and losers.

Industry Winners and Losers on Steel Tariffs

In the US, auto manufacturers, nail manufacturers, and specialty product manufacturers all take a hit on steel tariffs, and they are all against steel tariffs.

But the auto manufacturers do welcome tariffs on cars and trucks.

In contrast to steel where the automakers welcome cheaper steel, both the auto workers and the steel workers support tariffs on cars.

In general, US consumers are losers on tariffs, and Chinese consumers are the losers on export subsidies.

Enter Politics

Both Trump and Biden claim foreigners are stealing our jobs. The unions make the same claim. It makes for great campaign rhetoric.

It’s easy to rally political support for tariffs because consumers believe the lies they are told by unions and politicians pandering to unions.

Conundrum Solved

No one speaks for the little guy anywhere. So it is the little guy who pays the price for export subsidies and tariffs.

To solve the conundrum, all you needed to do was figure out who the winners and losers are on each side of the trade.

The overall impact due to these economic frictions and attempts to avoid them is a net loss despite the fact that there are some individual winners and losers. No one wins trade wars.

Realistically, the only case where tariffs and subsidies make any sense is in cases of genuine national security risks.

The chip sector and AI are possible examples. In contrast, cars and clothes are not security threats.

The best thing that Biden did was woo Taiwan Semiconductor to the US to build plants in Arizona. A China takeover of Taiwan is a genuine national security threat.

If China wants to subsidize US underwear, the correct response is to welcome it. To view things differently is the same as proposing a tax on the sun for free light at the expense of candlemakers.

Trump Claims Tariffs Will Make U.S. Steel Great Again

Yesterday, I commented Trump Claims Tariffs Will Make U.S. Steel Great Again, He’s Very Wrong

As U.S. Steel and Nippon sue the Biden administration, Trump weighs in on the deal.

Since there are vastly more users of steel than there are producers of steel, tariffs on steel are very poor policy.

There is plenty of steel from friendly nations and besides, Nippon wants to expand in the US. We should welcome the deal, but don’t because of politics.

US auto manufacturers, consumers, and specialty manufacturers will all take a hit. Not only will prices rise, the net impact will be an overall loss of jobs.

Standards of living rise when goods become more affordable. There is no benefit to inflation.

Political and Economic Irony

Trump vows to take actions that not only act to strengthen the US dollar but also increase costs.

The US is already the highest cost steel producer in the world. Opposition to the Nippon deal will increase costs. Union pandering in general increases costs.

It’s hard to increase exports when you are the highest cost producer with a strong currency on top of it.

And tariffs will provoke retaliations for political reasons even if the correct economic response is to do nothing.

I discussed this on November 23 in Trump’s Conflicting Economic Agenda and Goals Are Impossible

Trump promises to increase exports, increase tariffs, reduce the trade deficit, reduce the fiscal deficit, reduce inflation, reduce taxes, and increase growth.

Believe what you want, but Trump’s proposed policies won’t come close.

And Revenue?

Finally consider How Much Revenue Can Trump Realistically Bring in From Tariffs?

There are many moving parts to this question including Congress, retaliations, and economic impacts above and beyond tariff collection. I sort through them all.

Please check it out.