New HUD energy rules will raise the cost of home construction by imposing stricter building codes. Payback time is 90 years.

Homes To Become Even More Unaffordable

The Wall Street Journal comments on Biden’s New Plan for Unaffordable Housing.

The Department of Housing and Urban Development is mandating costly new energy standards for new homes insured by the Federal Housing Administration (FHA), which will become de facto nationwide building codes.

HUD last Thursday announced that it will require new homes financed or insured by its subsidy programs to follow the 2021 International Energy Conservation Code standard.

Many governments have declined to adopt the 2021 standards because of their higher costs. The National Association of Home Builders says the energy rules can add as much as $31,000 to the price of a new home. It can take up to 90 years for a buyer to realize a payback on the higher up-front costs through lower energy bills.

Not to worry, HUD says taxpayers will help cover the cost. It “is anticipated that many builders will take advantage” of numerous tax incentives in the Inflation Reduction Act “as well as rebates that will become available in 2025 or earlier for electric heat pumps and other building electrification measures,” the rule says.

These incentives include a $5,000 per unit tax credit for “zero energy” multifamily construction that meets prevailing-wage requirements that also raise building costs. HUD adds that builders may also “take advantage of certain EPA Greenhouse Gas Reduction Fund programs, especially the Solar for All initiative” and an investment tax credit that can offset 50% of a solar project’s cost.

Even with the subsidies, HUD estimates the price of a new home will go up by $7,229.

You get a $5,000 credit but only if the builder pays union wages for everything. How much will that cost?

My general rule of thumb is to take government estimates and triple them. That’s for short projects like building a home. But 10x would not be surprising. And this is with subsidies.

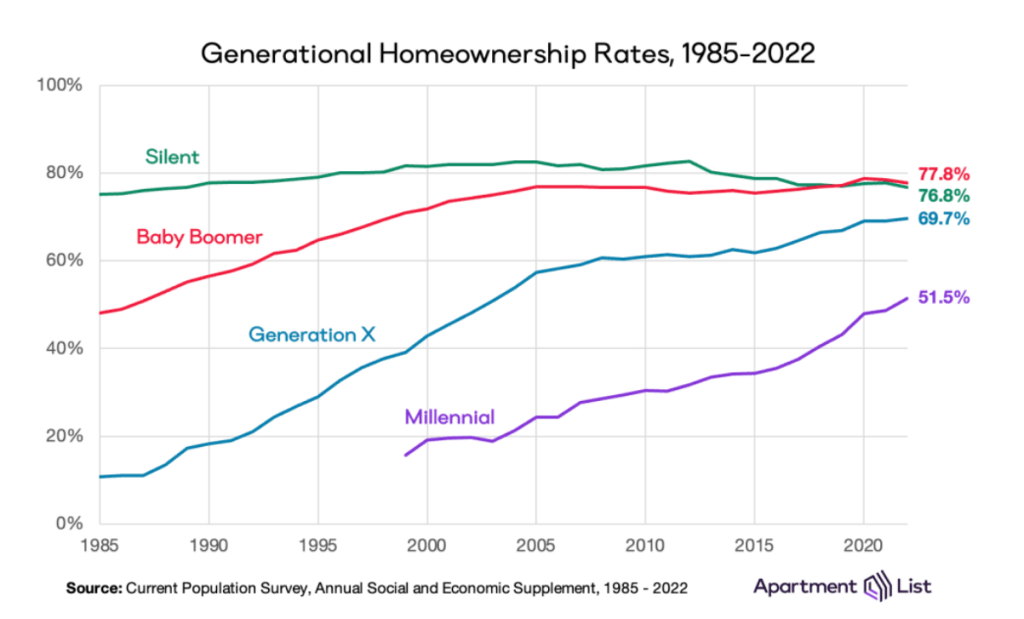

Generational Homeownership Rates

Who Are the Renters?

The answer is younger voters and blacks.

Generation Z homeownership is dramatically lower than the home ownership rate of millennials.

And according to the National Association of Realtors, the homeownership rate among Black Americans is 44 percent whereas for White Americans it’s 72.7 percent.

That’s the largest Black-White homeownership rate gap in a decade.

Home Prices Hit New Record High

The latest Case-Shiller housing data shows home prices hit a new record high. Adding insults and costs, the 30-year mortgage rate ended last week at 7.50 percent

Youth Poll

On April 20, I commented People Who Rent Will Decide the 2024 Presidential Election

Q: What is it that young voters really have on their minds?

A: Rent

Many with rent as their top concern will switch to Trump. They are fed up with rising inflation. Rent is up at least 0.4 percent per month for 30 months.

Young voters propelled Biden over the top in 2020. Things look very different today. Many voters who do not like either Trump or Biden will sit this election out.