China keeps returning to a well that has run dry, using exports as a means for growth. China is about to hit a brick wall, with global consequences.

For decades, China had two ways to hit its GDP targets, a property bubble and exports.

But the property bubble has permanently collapsed as have the State Owned Enterprises SOEs that fueled the bubbles.

China desperately needs measures to support consumption, instead it goes back to the wll one more time with exports. It’s a move that cannot work.

Chinese Exports and Capacity Utilization

WSJ writer Nathaniel Taplin says China’s Overcapacity Is Already Backfiring

China’s first-quarter growth beat most estimates, rising 5.3% on the year—thanks mostly to strong industrial output and exports. But the economic data released Tuesday also showed that excess capacity is very real, and could be damaging to China itself.

In other words, firms’ pricing power both at home and abroad is weakening and margin pressure is probably mounting: The March industrial financial data, which will be released later this month, will be worth watching.

So will private investment in manufacturing. If external demand, in value terms, doesn’t find a stronger footing soon and China’s domestic economy remains weak, then eventually such investment will need to slow. Otherwise the government, or state-owned banks, will have to start absorbing the cost of too many loans to industry more directly, as they already have with real estate and infrastructure.

Particularly interesting is the breakdown of that capacity utilization data itself. Falling run rates were especially obvious in Beijing’s favorite sectors like automobiles and electrical equipment—the so-called “new productive forces,” including electric vehicles, chips and solar panels, which policymakers have highlighted in recent speeches and have been stalking Western politicians’ nightmares. Automobile manufacturing utilization rates fell below 65% in the first quarter: well below their previous low (excluding the first quarter of 2020) of 69.1% in mid-2016.

What About Tariffs?

I agree with Taplin, but he failed to mention a key reason China will fail.

Trump has pledged to raise tariffs on China by a whopping 60 percent and the rest of the world by 10 percent.

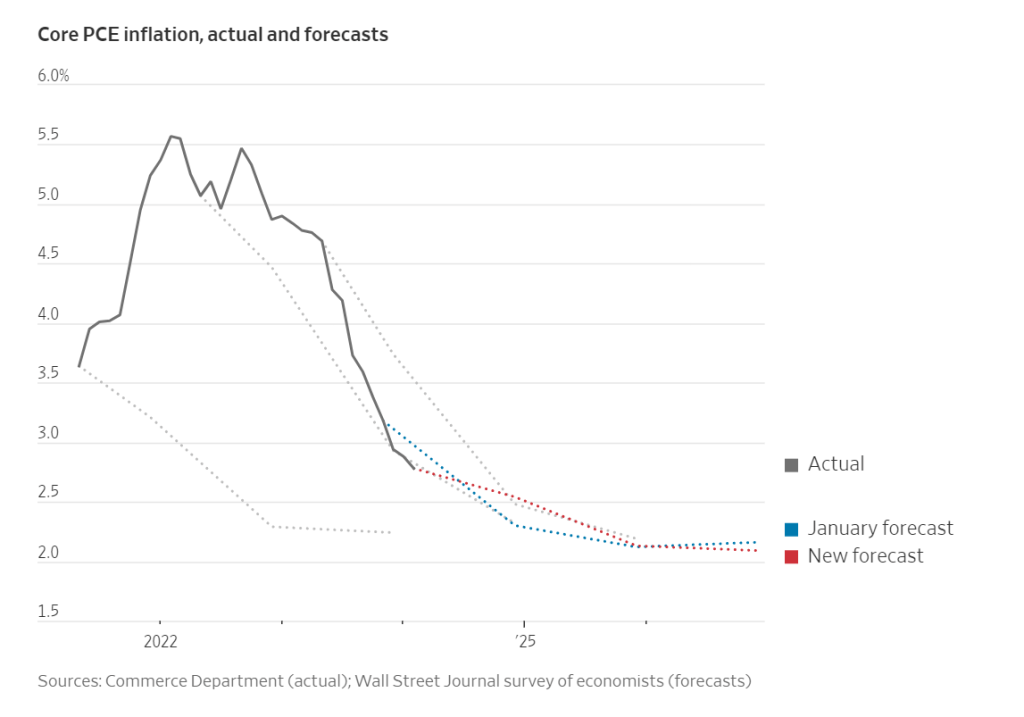

According to Bloomberg Insight (paywalled) Trump’s 60% Tariffs May Push Powell’s PCE to 3.7%. That could pressure the Fed to choose between raising interest rates to curb inflation or cutting them to bolster economic growth.

Biden is hugely protectionist as well and will not allow Chinese autos into the country.

And this week Biden Called for Steep Hike to Tariff on Chinese Steel

The president wants to increase a key tariff rate on Chinese steel and aluminum products to 25% from 7.5%

Biden won’t say it but like Trump, he does not want imports from China. Both want to make the US a near-island, and Biden with union labor and free child care.

What is China going to do with all that EV and steel manufacturing capacity if the US won’t take Chinese cars or allow China to build its cars here?

Fighting China on Green Tech

Politico asks Does the EU Have What it Takes to Fight China on Green Tech?

The EU is getting increasingly trigger happy as it launches probe after probe into whether China is unfairly supporting its exporters and, in so doing, potentially killing off competitors based in the bloc’s single market — in sectors ranging from electric vehicles to wind turbines.

The EU is making increasing use of its newest competition bazooka, the Foreign Subsidies Regulation (FSR). It also has anti-subsidy and anti-dumping weapons in its trade armory.

This year, we have already seen the first three investigations under the FSR: One into a Bulgarian rail contract; a second into a Romanian solar farm; and a third, broader investigation into wind turbine operations in Spain, Greece, France, Romania and Bulgaria from this week.

In the Bulgarian case, the Chinese bidder withdrew from the competition after the Berlaymont went public. While that removes the threat of unfair competition, it also means that the regulation has yet to be put to the test.

The Commission can also investigate dumping, which is the practice of exporting products more cheaply than they would cost in your own market — often even below the cost of production — just to grab market share. The EU starts anti-dumping cases on a regular basis.

China has found sophisticated workarounds, for instance by investing in steel production in countries like Indonesia. The Commission, in an innovation, targeted that maneuver with an anti-subsidy investigation — which held up in court.

A Major Trade War Looms

No one wins these trade wars, and this one is likely to have major international repercussions.

China is hell bent on growing via exports while the rest of the world is hell bent on stopping that. Via announced policy US trade policy will stop Chinese imports and the EU is fast heading in that direction.

Tariffs are inflationary and excess capacity is deflationary.

Thus, the trade war will be very deflationary in China, but stagflationary in the US and EU.

China will try to get around the tariffs by exporting cars or assembling the parts in Mexico. But Trump and Biden will both attempt to stop that, dragging Mexico into the trade war.

I think this rates to be near the top of macroeconomic events in 2025. It is not on most people’s radar. And it will be a huge issue no matter who wins the presidential election in November.

Economic Predictions

The Wall Street Journal asked 69 economists what they thought about the economy. Let’s check out the results.

How Inflation Predictions Work

Economists want the Fed to get inflation under control, so that is what they predict.

The Fed operates exactly the same way, perpetually predicting what they want. Hubris applies.

For more discussion and 9 additional charts, please see Hoot of the Day: Economists Believe Biden Would Be Better for the Economy

US Treasury Issuance

Let’s investigate US treasury debt issuance by month and year.

The US is not in recession yet, but spending is soaring.

For details please see How Much Treasury Issuance Does the US Add Every Month to Finance Debt?

So, what happens if a major trade war plunges the US (global economy) in recession?

Heaven help us if my trade analysis is in the ballpark.