Would you believe believe year-over year inflation is barely over two percent? That’s the Truflation claim as of April 17, 2024.

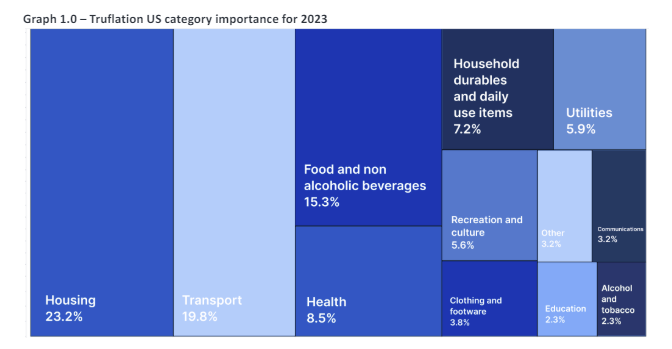

The above chart is courtesy of the Truflation Dashboard. Here’s the Truflation Methodology.

Truflation provides a set of independent inflation indexes drawing on as many as 30+ data sources and 13+ million prices of goods and services at a country level. These indexes are released daily, making them one of the world’s most up-to-date and comprehensive inflation measures.

OK, but what are the weights and how good are the sources.

Truflation Weights

Truflation weights housing at 23.2 percent.

BLS Weights

The above chart is as of March 2024. There’s no need to break it down further because I want to focus on housing.

The BLS has housing at 36.18 percent. The Truflation weight is 23.2 percent. Truflation’s rate is more than a bit questionable.

Half of American Renters Pay More Than 30% of Income On Housing

PBS reports Half of American Renters Pay More Than 30% of Income On Housing

Rental prices are unaffordable for a record number of Americans, with half of all renters paying more than 30 percent of their income on rent and utilities. That’s according to a new report from Harvard’s Joint Center for Housing Studies that examined 2022 census data.

Read that carefully. That 30 percent figure is from 2022. The average was 25 percent. Rent calculators use 30 percent as an average. I suspect it is now well above 30 percent, but let’s use 30 percent.

As of the third quarter of 2023, the Census Department had the Homeownership Rate at 65.7 percent. That means 34.3 percent of people rent.

The weight for people who rent should be .343 * .30 = 0.1029. Thus, the overall weight for renters should be something like 10.29 percent.

Truflation vs BLS

The above graph from the Truflation March 2023 report BLS Housing Data Discrepancies & Adjusting Our Model

The majority of categories in the BLS estimate were broadly consistent with our own price change predictions. The only outlier was the housing category, where estimates were wildly different from other reputable industry sources whose data we rely on.

The BLS has a particular way of calculating the costs of housing, or “shelter”, which is different from other sources. Firstly, it considers rent and housing costs to be one and the same. In other words, it assumes that homeowners will be paying an equivalent amount in mortgage as renters would pay for the same property, adjusted for size and location. The only difference is that for homeowners, this figure strips out utilities. The utility costs of rental properties are also included if they are part of the rent paid by the tenant. This is known as the Owner’s Equivalent Rent (OER).

With this method, the BLS intends to measure the cost of the consumption value of a home, rather than the changes in value of a house or the actual monthly mortgage repayments. This method has obvious flaws, since there are likely to be a significant number of homeowners who have paid off a portion of their mortgages. For these individuals, the costs would be lower than for property renters.

Meanwhile, when it comes to tenant rent, the BLS includes any government subsidies paid to the landlord in the total cost of the rent, which is also likely to skew the data to the upside. The BLS does take some measures to keep its sample representative, however. It adjusts for the quality of the properties it observes based on age, neighborhood improvements and physical renovations to the home, and it replaces one-sixth of the sample each year.

Truflation does not count rent subsidies. If the cost of rent goes up 10% but the government pays all of that, Truflation says there was no price increase.

Logically, that is ridiculous.

Second and more important, Truflation looks at mortgage rates. Those are relatively constant so Truflation essentially wipes out mortgages expect for new home buyers.

Heaven forbid Truflation look at things from the point of view of a renter looking to buy a home facing 7.5 percent mortgage rates on top of housing prices that have doubled since 2020.

The BLS makes the same mistake on grounds that a home is a capital expense not a consumer expense. This has gotten the Fed in numerous messes including the one right now where nearly everyone with a mortgage is trapped in their home unwilling if not unable to move.

Inflation goes well beyond consumer prices and neither the Fed, nor the BLS, nor Truflation has figured this out.

Third, the Truflation housing inputs are suspect.

Truflation uses Zillow, Trulio, Redfin, Apartment List and CoreLogic. It claims “Our methodology for calculating rental price changes incorporates both new rental agreements and rental renewals, which provides us with a balanced view of price changes over time.”

But Zillow, Redfin, and Apartment List all have a huge flaw. They only capture new leases when only about 9 percent of the people move each year.

According to the U.S. Census Bureau, the mover rate remained at a historic low across the country. Data shows that in 2022 the mover rate was 8.7%.

For example, Truflation assigns a weight of 8.1 percent to rental. Only 9 percent of that 8.1 percent should go to Zillow, Redfin, Apartment list, and if I am correct Trulio. If Truflation is weighting all of it’s rental sources equally, that is a huge error.

Corelogic

Corelogic’s Single-Family Rent Index year-over-year was 3.4% in February.

That is much lower than the BLS measure of 5.7 percent but it is way higher than Truflation’s 2.37 percent. And please note that it shot up from 2.6 percent in January

Apartment List, OER, CPI Rent, Zori

Apartment List says year-year-over-year rent is -0.9 percent. Zillow says it is 3.7 percent.

Which is it?

Is averaging the right thing to do when Apartment List suffers from an additional problem that it does not use seasonal adjustments.

What About OER?

Truflation makes a big stink about OER. I side with this view.

I understand the claim against OER. No one really pays it. People pay mortgages. But the calculation attempts to measure inflation as if owners rented.

But ignoring OER creates another problem, and it’s a big one. The cost of housing is going up, people are trapped in their own homes, unable or unwilling to move because it is too costly to do so.

Debate Over Lags, OER, and Rent: Is More Inflation On the Way?

Case-Shiller home price index, CPI rent index, and the index of hourly earnings for production and nonsupervisory workers.

I discussed the above chart in my post Debate Over Lags, OER, and Rent: Is More Inflation On the Way?

Look at that graph of home prices.

Truflation sweeps that under the rug as does the Fed and economists in general.

Auto and Home, Insurance & Maintenance Costs Soaring

Insurance, repairs, and maintenance costs are up for both homes and autos. Some homeowners are skipping home insurance. What’s going on and who is to blame?

On April 19, I commented Auto and Home, Insurance & Maintenance Costs Soaring and People Are Angry

Those who live in flood zones, hurricane zones, or fire zones have seen their rates rise 50-100 percent or more. A quote from $3,200 to $31,000 is shocking.

Ask anyone in a hurricane zone, anyone in school, and anyone who buys their own health insurance what their inflation rate is.

The BLS averages all of this. Economists wonder why so many people are angry.

The Fed (economists in general) view home prices as a capital expense, not a consumer expense. Thus home prices are not in the CPI nor in the PCE (Personal Consumption Expenditures) measure of inflation. The latter is the Fed’s preferred measure.

This is a serious ongoing economic mistake by the Fed. The Greenspan Fed and the Bernanke Fed both ignored home prices. Asset bubbles brewed, culminating in the Great Recession.

Powell made the same mistake. However, because there were no liar loans this time, the result is people are trapped in their homes unwilling to trade a 3.0 percent mortgage for a 7.0 percent mortgage.

Truflation makes the same mistake and compounds them by lowering its weights of rent and OER.

The Fed’s Big Problem, There Are Two Economies But Only One Interest Rate

I described the Fed’s role on February 20 in The Fed’s Big Problem, There Are Two Economies But Only One Interest Rate

And as a direct result of soaring home prices, insurance and maintenance costs had to rise. The only surprise is the lag in which that happened.

Some of the lag is due to regulators prohibiting insurers to raise prices.

Who Fits the Truflation Model?

If you are a renter, someone looking to buy a home, someone who pays their own health insurance, or someone with escalating college expenses, you probably think Truflation is nuts.

If you own your own house, are on Medicare, and are not in a flood, hurricane, or fire zone, congratulations, you fit the Truflation model. I am actually in the group of lucky ones (although I would prefer to be 40 again).

A Better Measure of Inflation?

Truflation wants to be a better measure of inflation. It isn’t. In attempting to fix some issues, it introduced others.

And it ignores the big elephant by insisting rising home prices have no part of inflation.

The 34 percent of the nation who rents would laugh at Truflation percentage weight of rent at 8.1 percent with a strangely calculated OER at 13.8 percent.

And so do I even though I personally fit their model. I do not believe I am the average person, nor do I believe that averaging wildly differing measure makes much sense in the first place.

We don’t need a better CPI, we need something that will take into consideration the issues I brought up starting with the huge mistake of ignoring housing bubbles as if they are not part of the inflation problem.