Consumers are concerned over inflation. Recession should be the bigger fear.

Pessimism Returns

The Conference Board reports US Consumer Confidence Dropped Sharply in February

The Conference Board Consumer Confidence Index® declined by 7.0 points in February to 98.3 (1985=100). The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—fell 3.4 points to 136.5. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions— dropped 9.3 points to 72.9. For the first time since June 2024, the Expectations Index was below the threshold of 80 that usually signals a recession ahead. The cutoff date for preliminary results was February 19, 2025.

“In February, consumer confidence registered the largest monthly decline since August 2021,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board. “This is the third consecutive month on month decline, bringing the Index to the bottom of the range that has prevailed since 2022. Of the five components of the Index, only consumers’ assessment of present business conditions improved, albeit slightly. Views of current labor market conditions weakened. Consumers became pessimistic about future business conditions and less optimistic about future income. Pessimism about future employment prospects worsened and reached a ten-month high.”

February’s fall in confidence was shared across all age groups but was deepest for consumers between 35 and 55 years old. The decline was also broad-based among income groups, with the only exceptions among households earning less than $15,000 a year and between $100,000–125,000.

Guichard added: “Average 12-month inflation expectations surged from 5.2% to 6% in February. This increase likely reflected a mix of factors, including sticky inflation but also the recent jump in prices of key household staples like eggs and the expected impact of tariffs. References to inflation and prices in general continue to rank high in write-in responses, but the focus shifted towards other topics. There was a sharp increase in the mentions of trade and tariffs, back to a level unseen since 2019. Most notably, comments on the current Administration and its policies dominated the responses.”

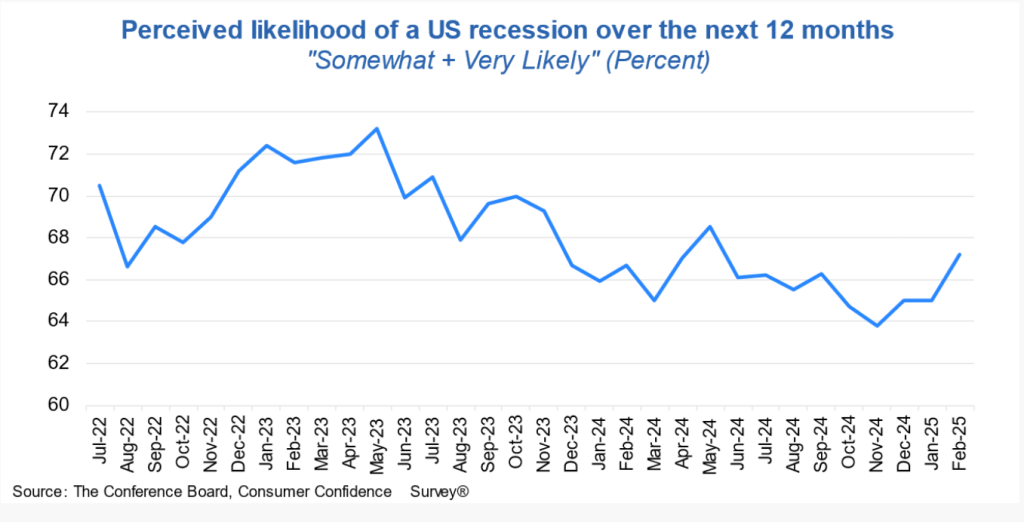

Consumers’ views of their Family’s Current and Future Financial Situation were less positive, retreating from the series highs reached in January. The proportion of consumers anticipating a recession over the next 12 months increased to a nine-month high. (These measures are not included in calculating the Consumer Confidence Index®.) Consumers’ bullishness about the stock market also retreated: only 46.8% of consumers expected stock prices to increase over the year ahead—the smallest share since April 2024, and down from 54.2% in January. By contrast, 32.8% expected stock prices to decline, up from 24.8% in January. More than half (51.7%) of consumers expected higher interest rates over the next 12 months. The share of consumers expecting lower interest rates dropped further to 24.0% from 27.1% last month.

Expectations Six Months Hence

Consumers’ outlook for business conditions turned negative in February.

- 20.2% of consumers expected business conditions to improve, down from 20.8% in January.

- 26.7% expected business conditions to worsen, up from 19.6%.

Consumers’ pessimism about the labor market outlook worsened.

- 18.4% of consumers expected more jobs to be available, down from 19.1% in January.

- 25.9% anticipated fewer jobs, up from 21.0% in January.

Consumers were less optimistic about their income prospects in February.

- 18.2% of consumers expected their incomes to increase, a slight uptick from 18.1% in January.

- But 13.7% expected their incomes to decrease, up from 12.3%.

Recession Outlook

Biggest Monthly Decline Since August 2021

CNN Reports Consumer Confidence Registers Biggest Monthly Decline since August 2021 as Inflation Fears Take Hold

Economic jitters are showing up across various sentiment surveys as the Trump administration aims to reconfigure America’s trade relationship with the world and inflation shows signs of getting stuck.

The latest evidence comes from The Conference Board’s Consumer Confidence Index for February, released Tuesday morning. The index fell to 98.3, falling for the third-straight month and marking the largest monthly decline since August 2021, as expectations for inflation in the year ahead climbed. That coincides with the trends reflected in the University of Michigan’s consumer survey for February.

Homebuilders are also growing worried, according to the National Association of Home Builders; even US small businesses, which remain somewhat optimistic about deregulation and tax cuts, are in doubt about the economy’s future. The National Federation of Independent Business’ Uncertainty Index rose in January to its third-highest reading on record.

America’s souring economic mood, driven by worries over President Donald Trump’s aggressive approach to tariffs, is a stunning reversal from the (brief) burst of optimism after President Donald Trump’s election in November.

Stephanie Guichard, senior economist, global indicators, at The Conference Board, said in a release that “consumers became pessimistic about future business conditions and less optimistic about future income.”

If Trump’s policies cause inflation to pick up, “it could be appropriate to ignore or look through an increase in the price level if the impact on inflation is expected to be brief and limited,” St. Louis Fed President Alberto Musalem said at a recent event in New York. “However, a different monetary policy response could be appropriate if higher inflation is sustained, or long-term inflation expectations rise.”

“I would be especially concerned by evidence suggesting (inflation expectations) are becoming unanchored,” Musalem said.

Sentiment surveys don’t necessarily predict future spending behavior.

But today’s economic landscape is rife with uncertainty, which may be affecting people’s spending plans, according to a new Wells Fargo survey released Tuesday. About three-quarters of 3,657 adults and 203 teens surveyed across the country said they plan to reduce their spending, citing uncertainty in the economy.

“Consumer behaviors are shifting,” said Michael Liersch, head of advice and planning at Wells Fargo, in a release. “The value of the dollar and what it is providing may not be as predictable anymore, which seems to be more pronounced for younger Americans.”

The survey showed that 82% of Gen Z adults and 79% of Millennials plan to pare back their spending in the coming months. Eating out or food delivery gave respondents the most sticker shock, according to the survey, followed by a tank of gas and prices for concerts or sporting events.

Much Lighter Confidence Than Expected

CNBC reports Consumer Confidence Comes in Lighter than Expected in Latest Sign of Slowing Economy.

Consumers grew more pessimistic about the economic outlook in February as worries brewed about a slowing economy and rising inflation, the Conference Board reported Tuesday.

The board’s Consumer Confidence Index slipped to 98.3 for the month, down nearly 7% and below the Dow Jones forecast for 102.3. This was the lowest reading since June 2024 and the largest monthly drop since August 2021.

“Views of current labor market conditions weakened. Consumers became pessimistic about future business conditions and less optimistic about future income,” said Stephanie Guichard, the board’s senior economist for global indicators. “Pessimism about future employment prospects worsened and reached a ten-month high.”

Though most economic indicators reflect continued growth, the Conference Board gauge matches other recent surveys showing waning confidence. Last week, the University of Michigan reported a larger-than-expected monthly decrease of nearly 10% in February while the five-year inflation outlook among respondents hit its highest level since 1995.

Inflation Expectations Nonsense

Components of the CPI

Inflation may rise or fall, but expectations will not have anything to do with it.

Please consider How Do Inflation Expectations Impact Wages and Future Consumer Inflation?

By my calculation, at least 80 percent of the CPI is inelastic.

People will not double up on rent in advance if they think rent will go up. Similarly they will not double up on gasoline, medical operations, etc.

People can stock up on food, if they have a freezer, as I recommend. If so, they stock up on sales prices. People do not generally stock up at the highest prices expecting still higher prices. And where would they store it anyway? A freezer only holds so much.

Do people buy two cars if the price is going up? Take out extra prescriptions?

Among elastic items, do people take two vacations this year and none the next if the cost will be higher next year?

So, expectation proponents, please tell me what the hell people will stock up on at high prices simply because they expect higher prices next year. Then tell me what percent of the CPI that is.

Why Do We Think That Inflation Expectations Matter for Inflation? (And Should We?)

Please consider the Federal Reserve study Why Do We Think That Inflation Expectations Matter for Inflation? (And Should We?)

The direct evidence for an expected inflation channel was never very strong. Most empirical tests concerned themselves with the proposition that there was no permanent Phillips curve tradeoff, in the sense that the coefficients on lagged inflation in an inflation equation summed to one.

Finally, even if one is willing to entertain the idea that in some vague, mushy sense concern over costs and demand by individual firms facing fixed prices leads to a dependence of aggregate inflation on expected inflation, we are still left with the conclusion that short-run expectations should be the ones that are most important.

The Fed study was not only accurate, it was funny, replete with humorous quotes. Here are some of the quotes in the article.

Amusing Quotes

- I’m always a little dubious about an appeal to expectations as a causal factor; expectations are by definition a force that that you intuitively feel must be ever present and very important but which somehow you are never allowed to observe directly: R. M. Solow (1979)

- Pure economics has a remarkable way of pulling rabbits out of a hat—apparently a priori propositions which apparently refer to reality. It is fascinating to try to discover how the rabbits got in; for those of us who do not believe in magic must be convinced that they got in somehow: J. R. Hicks (1946)

- Don’t interfere with fairy tales if you want to live happily ever after: F. M. Fisher (1984)

- Few things are harder to put up with than the annoyance of a good example: Mark Twain, The Tragedy of Pudd’nhead Wilson (1894)

The good example is the CPI components. Shelter is about 35 percent of the CPI. You won’t wait for rent to fall or rent two homes based on expectation.

Nor will you stop eating, or driving, or have two medical operations.

It is irrelevant if consumers think prices will go up by 6 percent because they can’t do a damn thing about it.

Of the discretionary spending, consumers can cut back but they tend not to double up. That is what the Fed study shows.

Trump’s Policies

- Tariffs: Recessionary and Inflationary

- Deportations: Recessionary and disinflationary

- Border Shutdown: Recessionary and disinflationary

- Layoffs: Recessionary and disinflationary

- Student Loan Repayments: Recessionary and disinflationary

Related Posts

February 4, 2025: Job Openings Drop by 556,000 in December, Quits Show Job Finding Stress

Job openings have collapsed. And the number of quits confirms people are staying put.

February 5, 2025: ADP Payrolls Better than Expected But Two-Thirds of the Economy Has Stalled

ADP reported a better than expected 183,000 jobs in January, but small business trends are unsettling.

On February 14, I noted Retail Sales Crash – Did the Consumer Finally Throw in the Towel?

The Census Department shows huge across-the-board declines in multiple categories, down 0.9 percent overall.

February 19, 2025: Housing Starts Drop 9.8 Percent, Unable to Retain Any Traction

Housing starts have mostly been rangebound since late 2022 as high prices and high mortgage rates dampen demand.

February 20, 2025: How Will 77,000 DOGE Terminations Impact Unemployment and Jobs?

As of Feb. 13, 77,000 employees accepted the offer, according to White House press secretary Karoline Leavitt.

February 22, 2025: Trump Signs Order Cutting Off All Federal Benefits for Illegal Immigrants

Trump’s executive order is definitely legal. But what does it mean in practice?

The above related posts all have one thing in common: They are recessionary.