Q: How’s that? A: Very poorly.

They’re stealing our jobs, not. The loss of employment is due to automation, the same as with manufacturing in general.

The Truth About Steel Tariffs

Trump’s first term steel tariffs hurt consumers and manufacturers. But Trump is doubling down despite objections from the UAW.

Please consider the Wall Street Journal report The Truth About Trump’s Steel Tariffs

President Trump gave the economy another jolt of uncertainty on Monday when he signed executive orders imposing 25% tariffs on all steel and aluminum imports. His advisers say these tariffs are economically “strategic” rather than a bargaining chip for some other goal. Is the strategy to harm U.S. manufacturers and workers?

That’s what his first-term tariffs did, and it’s worth revisiting the damage of that blunder as he threatens to repeat it. In March 2018, Mr. Trump announced 25% tariffs on steel and 10% on aluminum under the pretext of protecting national security. Then, as now, most U.S. metal imports came from allies including Canada, Mexico, Europe, South Korea and Japan.

Mr. Trump said tariffs were needed to boost domestic steel and aluminum production. But U.S. production was already increasing amid a surge in capital investment unleashed by his deregulation and 2017 tax reform. U.S. steel capacity utilization climbed to 78.5% in March 2018 from 72.4% in December 2016.

The real goal of U.S. steel and aluminum companies that wanted the tariffs was to boost their bottom lines. Raising prices on foreign imports allowed them to charge more. The price was paid by U.S. secondary metal producers and downstream manufacturers.

Consider Mid-Continent Steel and Wire, which produced roughly half of the nails made in the U.S. After the steel tariffs took effect, its sales plunged by more than half, causing it to lay off 80 workers. Another 120 quit because they worried its Missouri factory might close. After this damage, the Commerce Department granted the company a tariff exemption.

Auto makers were another casualty. Ford Motor said tariffs subtracted $750 million from its bottom line in 2018, which reduced profit-sharing bonuses for each of its workers by $750. GM said the tariffs dented its profits by some $1 billion, equal to the pay of more than 10,000 employees.

The tariffs also made U.S. manufacturers less globally competitive and prompted retaliation that hurt American businesses. Canada imposed tariffs on $12.8 billion in U.S. products, including 25% on steel and 10% on aluminum. Harley-Davidson shifted some production to Thailand to avoid Europe’s retaliatory tariffs on U.S. motorbikes.

Retaliation caused Mr. Trump to exempt Canada and Mexico as part of the renegotiated Nafta deal. His Administration also struck deals with some countries that exempted a certain amount of their steel and aluminum exports.

Even so, the tariffs created uncertainty for U.S. manufacturers and boomeranged on steel and aluminum companies. Employment in durable goods manufacturing began to decline in early 2019, which reduced demand for steel and aluminum. Employment in fabricated metals manufacturing that used steel and aluminum plunged and is still some 35,000 lower than when the tariffs took effect.

This is political rent-seeking at its most brazen, and it benefits the few at the expense of the many. None of this matters to Mr. Trump, whose dogmatic views on tariffs can’t be turned by evidence. But we thought our readers would like to know the rest of the story.

The Rest of the Story

I already knew the rest of the story.

Steel tariffs were a disaster and we are headed for a repeat performance.

I have written a about steel a dozen times. Here are some of them.

March 18, 2018: Pandora’s Box: Another Look at Steel Tariffs

Trump’s “national security” angle is an obvious lie. Most US steel imports come from allies, including Canada. Most aluminum imports come from Canada.

Not only do the steel tariffs harm US manufacturers that consume steel, they also open the door to other countries imposing tariffs on the US in the name of “national security”.

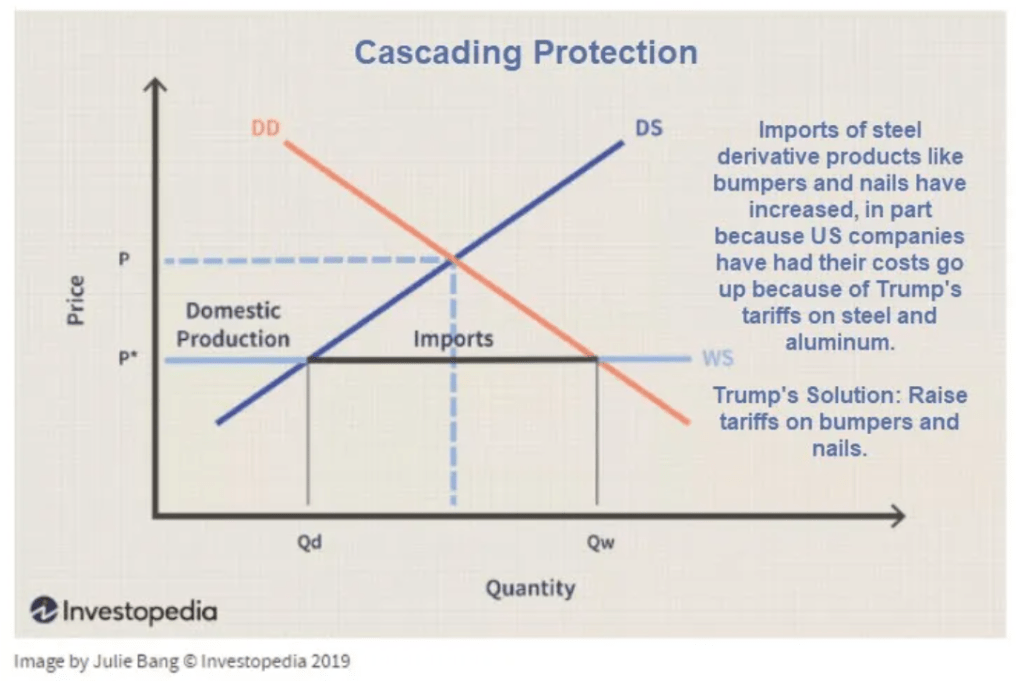

Cascading Pain

February 4, 2020: Trump’s Steel Tariffs Start Cascade of Downstream Pain

Tweet Thread by Chad P. Bown.

- On Friday night, Trump admitted that US companies whose costs he has raised – by imposing tariffs on the metals they need – are no longer competitive with foreign firms. Because of his policies, they too must now be shielded from trade…

- Trump announced he was expanding the product coverage of his national security tariffs on STEEL and ALUMINUM to include “derivative” goods that use steel and aluminum as an input – eg, steel nails or aluminum bumpers.

- Imports of those “derivative” products have increased, in part because US companies have had their COSTS go up because of Trump’s tariffs on steel and aluminum. In Econ 101 terms, the cost increase shifts the US supply curve (DS) to the LEFT. That makes imports INCREASE.

- Economists call this “cascading protection.” Trump’s tariffs on inputs lead to higher costs for US companies making the downstream products, and this results in a clamoring for ADDITIONAL trade protection for those products. This was all completely predictable.

Trump’s Steel Tariffs Failed Miserably, Biden Should Scrap Them

May 23, 2021: Trump’s Steel Tariffs Failed Miserably, Biden Should Scrap Them

Historic Shortages

Over 300 US manufacturers sent a Letter to Biden this month, protesting scarce metal materials and unsustainable prices.

Manufacturers in the United States currently face historic shortages of readily available and globally priced steel and aluminum products at a time when the country is relying on our sector to help drive the economy and overcome the unprecedented challenges caused by the COVID-19 pandemic.

The temporary increase of 4,800 steel industry jobs in the United States since 2018 recorded by the Bureau of Labor Statistics is not directly attributable to the Section 232 tariffs and is dwarfed by the 6.2 million American manufacturing jobs at risk in steel- and aluminum-using industries. On some products, American businesses pay 40 percent more for similar steel compared to their European counterparts — an unsustainable situation for any U.S. employer.

Mr. President, we support a strong and thriving steel and aluminum industry, but producers today simply cannot meet demand and the tariffs create a tax that only manufacturers in the U.S. must pay.

National Security Ruse

Trump labeled steel production a national security item. He said the same thing about Volkswagen car imports.

His National Security Tariff Ruse was so bad the Pentagon would not even go along.

In an undated memo released to the media, Defense Secretary Jim Mattis wrote that “imports of foreign steel and aluminum based on unfair trading practices impair the national security.” But he added that, “As noted in both Section 232 reports, however, the U.S. military requirements for steel and aluminum each only represent about three percent of U.S. production. Therefore, DoD does not believe that the findings in the reports impact the ability of DoD programs to acquire the steel or aluminum necessary to meet national defense requirements.”

Tariffs Kill High-Paying American Jobs

April 20, 2018: Fed Study: “Tariffs Kill High-Paying American Manufacturing Jobs and Businesses”

On occasion, Fed economists get things correct even if the voting members get things backward.

For example, New York Fed economists ask and answer the question: Will New Steel Tariffs Protect U.S. Jobs?

Firms that are dependent on steel and aluminum inputs—both importers and non-importers—will face higher prices. Downstream domestic producers will have to increase their prices or reduce markups, which makes them uncompetitive relative to competing imports. Similarly, U.S. exporters that need steel or steel-related inputs will face higher input costs and will have to either increase export prices or reduce their profit margins. These effects could lead to lower employment in these steel-intensive industries and possibly plant shut downs. Researchers estimate that the number of jobs in steel-intensive industries, which they define as industries with steel inputs of at least 5 percent of total, is around 2 million—for example, manufacturers of auto parts, motorcycles, and household appliances.

It is in steel-related industries where jobs are likely to be at risk. To get a sense of the magnitude of the employment effects, we can turn to a similar episode in 2002 when President Bush introduced steel tariffs of up to 30 percent, although under different legislation. Studies of these tariffs found evidence of higher steel prices and job losses of 200,000 across the United States. This number is higher than the total number of workers employed by U.S. steel producers (187,500) at the time.

My lead chart confirms the Fed analysis.

Trump to Impose 25 Percent Tariffs on Steel and Aluminum

On February 10, 2025 I commented Trump to Impose 25 Percent Tariffs on Steel and Aluminum, Expect Higher Prices

All US consumers of steel and aluminum will pay higher prices, especially the automakers.

The reinstitution of aluminum and steel tariffs across the board is in direct violation of Trump’s loudly bragged USMCA “Best Trade Deal in History”.

Trump has proven ability to repeatedly make the same mistakes, needlessly taunt allies, and violate his own treaties.

No good, and lots of bad will come from this, just as happened before.