Housing starts jumped in December, nearly all of that was multi-family. Permits for future building were down.

Building Permits

- Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 1,483,000.

- This is 0.7 percent below the revised November rate of 1,493,000 and is 3.1 percent below the December 2023 rate of 1,530,000.

- Single-family authorizations in December were at a rate of 992,000; this is 1.6 percent above the revised November figure of 976,000. Authorizations of units in buildings with five units or more were at a rate of 437,000 in December.

- An estimated 1,471,200 housing units were authorized by building permits in 2024. This is 2.6 percent below the 2023 figure of 1,511,100.

Housing Starts

- Privately-owned housing starts in December were at a seasonally adjusted annual rate of 1,499,000.

- This is 15.8 percent (±14.4 percent) above the revised November estimate of 1,294,000, but is 4.4 percent (±11.3 percent) below the December 2023 rate of 1,568,000.

- Single-family housing starts in December were at a rate of 1,050,000; this is 3.3 percent (±10.9 percent) above the revised November figure of 1,016,000. The December rate for units in buildings with five units or more was 418,000.

- An estimated 1,364,100 housing units were started in 2024. This is 3.9 percent (±2.6 percent) below the 2023 figure of 1,420,000.

Housing Completions

- Privately-owned housing completions in December were at a seasonally adjusted annual rate of 1,544,000.

- This is 4.8 percent (±13.7 percent) below the revised November estimate of 1,621,000 and is 0.8 percent (±13.0 percent) below the December 2023 rate of 1,557,000.

- Single-family housing completions in December were at a rate of 948,000; this is 7.4 percent (±11.8 percent) below the revised November rate of 1,024,000. The December rate for units in buildings with five units or more was 570,000.

- An estimated 1,627,900 housing units were completed in 2024. This is 12.4 percent (±3.5 percent) above the 2023 figure of 1,448,800.

Details from the Census Bureau New Residential Construction report.

Confidence Level

The level of confidence in these numbers is not high.

To emphasize, starts rose 15.8 percent ±14.4 percent, and single-family starts rose 3.3 percent ±10.9 percent.

Negative revisions may be coming.

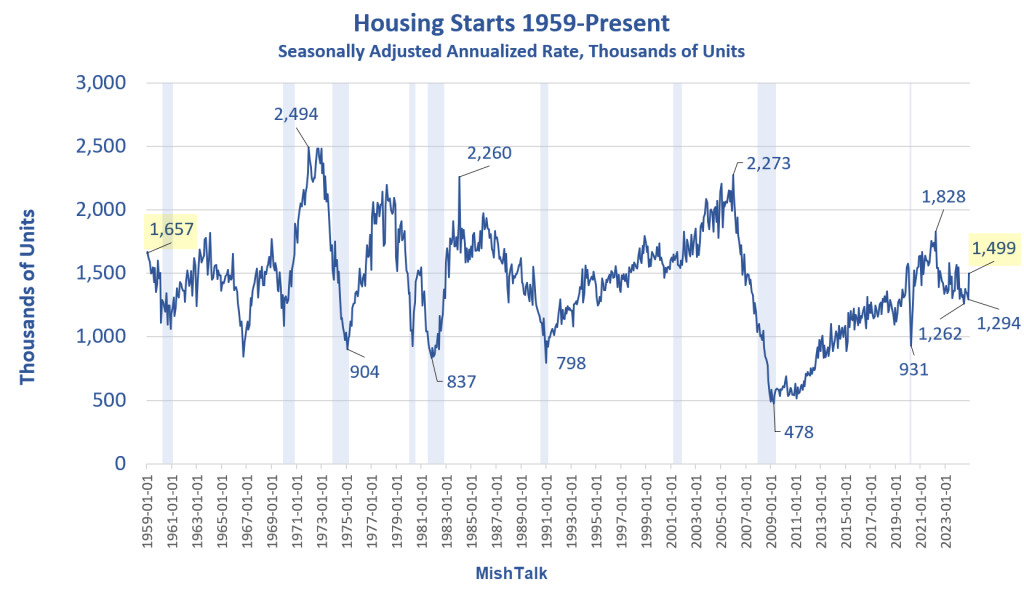

Housing Starts 1959-Present

Housing is very cyclical, but not in any predictable pattern.

The Great Recession is an exception. Then, it was very clear that housing would crash.

Housing Starts Single Family vs Multi-Family

Despite the December surge, the long-term patterns have not changed.

Single-family starts have generally been around 1 million since May of 2023.

The high in this period was 1.126 million in November of 2023. The low in this period was 861,000 in July of 2024. The average in this time frame is 1.007 million.

Decline Since March 2022 Peak

- Total starts fell from 1,828 to 1,499. That’s a decline of 18.0 percent.

- Single-family fell from 1,201 to 1,050. That’s a decline of 12.7 percent.

- Multi-family fell from 627 to 449. That’s a decline of 28.4 percent.

If we are not building enough multi-family units, in the right places, good luck with bringing down the cost of rent.

December sports a welcome jump in multi-family.

Recent Economic Posts

January 16, 2025: Another Strong Retail Sales Report Is a Mirage of Inflation

January 15, 2025: Strong Upward Pressure on the Cost of Food, What’s in Your Basket?

January 15, 2025: CPI Jumps 0.4 Percent in December, Markets Giddy Anyway