The Markets are pleased with a CPI report that isn’t that great. Here are the details.

The BLS reports the CPI Rose 0.4 Percent in December.

The Econoday Consensus was 0.3 percent so the headline number was worse than expected.

However, excluding food and energy, the CPI was up 0.2 percent, 0.1 percentage point better than expected. Shelter was up 0.3 percent, not a great number for those seeking rent relief.

Nonetheless, the bond market and stock markets are happy for now although I fail to see how anything fundamental has changed.

CPI Month-Over-Month Details

- The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent on a seasonally adjusted basis.

- The index for shelter rose 0.3 percent. Rent of primary residence rose 0.3 percent and owners’ equivalent rent was up 0.3 percent.

- The food at home index increased 0.3 percent and the food away from home index rose 0.3 percent over the month.

- The index for all items less food and energy rose 0.2 percent.

- The energy index rose 2.6 percent accounting for over forty percent of the monthly all items increase.

- Medical care commodities were flat at 0.0 percent and medical care services rose 0.2 percent.

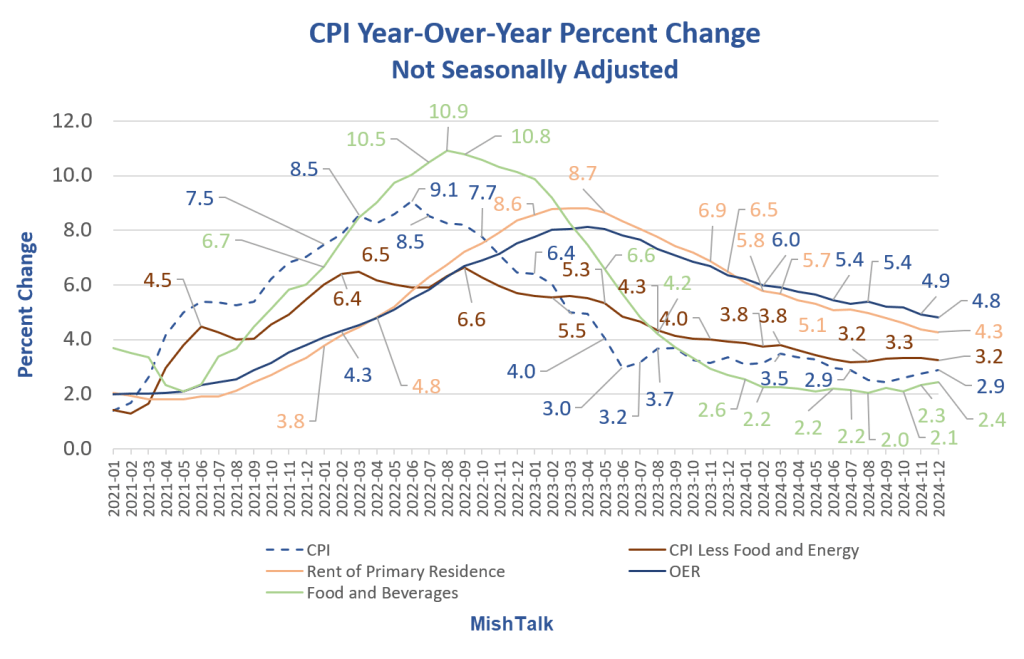

CPI Year-Over-Year Percent Change

Year-Over-Year Details

- CPI: 2.9 percent. That only 0.1 percentage point better than June of 2023.

- CPI Excluding Food and Energy: 3.2 percent

- Rent: 4.3 percent

- Shelter: 4.6 percent

- Food and Beverages: 2.4 percent

- Medical Care Services: 3.4 Percent

That’s roughly how the average economist views things. The next chart is how the average person views things.

CPI Index Levels

Starting September of 2021, inflation took off.

Percent Change Since September 2021

- CPI: 6.4 Percent

- Food and Beverage: 6.4 Percent

- All Items Excluding Food and Beverage: 8.1 percent

- Rent of Primary Residence: +13.5 percent

Rent is the largest expense item for anyone who does rent.

Final Thoughts

The best aspect of the report was medical care because that has a strong influence on the PCE price index, the favorite inflation measure of the Fed. Otherwise, this was not a particularly good report.

Nonetheless, the yield on the 10-year note dropped 12 basis points (0.12 percentage points) to 4.66 percent. And the yield on the 30-year long bond dropped 11 basis points to 4.88 percent. But mortgage rates were unchanged at 7.25 percent on a 30-year fixed rate mortgage.

I saw the reaction of the stock and bond markets before I saw the report. My initial thought was shelter had a big improvement. Wrong, it didn’t. And in general, the Fed will be struggling with inflation until shelter improves.

Let’s see how long this rally in stocks and bond lasts. For now, today smacks of technical action or short-covering.

Related Posts

January 14, 2025: A Mostly Good PPI Report With Easy Year-Over-Year Comparisons Coming UP

The Producer Price Index (PPI) for services was unchanged in December but the price of goods jumped 0.6 percent.

Final demand services is about 67 percent of the index. This is why services at 0.0 percent and goods at 0.6 percent resulted in a change of 0.2 percent.

January 12, 2025: Trump’s New Tariff Advisor and Advice for Advisors

Just as Trump wants, his new Tariff advisor call for 20 percent tariffs.

January 8, 2025: Bonds Hammered: Is it Fed Policy, Trump Policy, or Both?

Since the Fed’s first rate cut on September 17, yields on the long end have soared. So have mortgage rates.

The bond market is back to were it was when I wrote that post.

Bonds had been hammered so bad that any bit of good news could cause the reaction we saw today.

But Trump wants to add additional items to the TCJA renewal and expand military spending too.

Looking ahead, deficits are poised to soar under Trump.