Housing starts plunged in March, but for the past year, it’s really a tale of two markets, single-family vs multi-family.

Housing starts fell 14.7 percent in March from February as noted by the Census Department New Residential Construction report.

But weakness since the beginning of 2023 has predominately been in multi-family construction.

Single-Family vs Multi-Family Since 2023

- Total Starts: -1.4%. 1,340 to 1,321

- Single-Family: +24.2%, 823 to 1,022

- Multi-Family: -42.2%, 517 to 299

Construction Report Details

Building Permits: Privately‐owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 1,458,000. This is 4.3 percent below the revised February rate of 1,523,000, but is 1.5 percent above the March 2023 rate of 1,437,000. Single‐family authorizations in March were at a rate of 973,000; this is 5.7 percent below the revised February figure of 1,032,000. Authorizations of units in buildings with five units or more were at a rate of 433,000 in March.

Housing Starts: Privately‐owned housing starts in March were at a seasonally adjusted annual rate of 1,321,000. This is 14.7 percent (±9.9 percent) below the revised February estimate of 1,549,000 and is 4.3 percent (±9.4 percent) below the March 2023 rate of 1,380,000. Single‐family housing starts in March were at a rate of 1,022,000; this is 12.4 percent (±12.5 percent) below the revised February figure of 1,167,000. The March rate for units in buildings with five units or more was 290,000.

Housing Completions: Privately‐owned housing completions in March were at a seasonally adjusted annual rate of 1,469,000. This is 13.5 percent (±11.0 percent) below the revised February estimate of 1,698,000 and is 3.9 percent (±13.5 percent) below the March 2023 rate of 1,528,000. Single‐family housing completions in March were at a rate of 947,000; this is 10.5 percent (±10.1 percent) below the revised February rate of 1,058,000. The March rate for units in buildings with five units or more was 502,000.

Note the huge margins of error in starts and completions. The data is heavily revised.

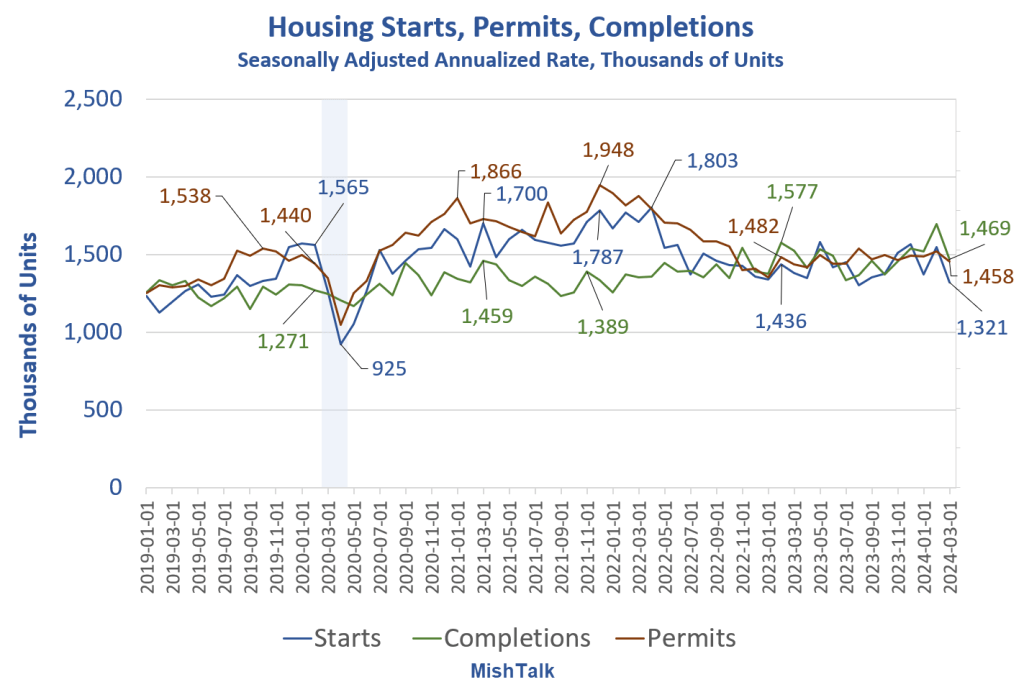

Housing Starts, Permits, Completions

Despite wild swings it appears as if nothing is happening. But the lead chart provides a better picture of the last year.

Multi-family construction has collapsed 42.2 percent since January 2023.

Looking back to April of 2022, multi-family construction plunged from 627,000 to 299,000. That’s a plunge of 52.3 percent.

It’s Been a Bloody Month for Bond Market Bulls

If you are a bond market bull, it’s been a tough month. US Treasury Yields from the New York Fed as of 2024-04-10

On April 12, I noted It’s Been a Bloody Month for Bond Market Bulls

Yields are higher still. I will do an update today, plus a look at mortgage rates.

Expect more housing weakness, even single-family.