Based on Fed economic projections, it should not have cut interest rates today.

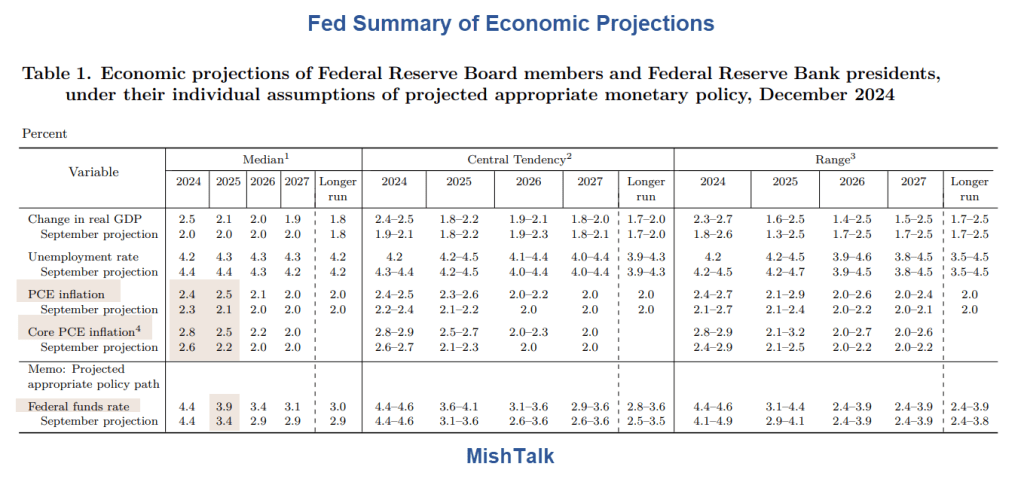

Lead image is from today’s Summary of Economic Projections (SEP) from today’s FOMC meeting.

Key SEP Projections

- PCE inflation for 2024: 2.4 percent up from 2.3 percent.

- PCE inflation for 2025: 2.5 percent up from 2.1 percent.

- Core PCE inflation for 2024: 2.8 percent up from 2.6 percent.

- Core PCE inflation for 2025: 2.5 percent up from 2.2 percent.

- Federal Funds Rate for 2025: 3.9 percent up from 3.4 percent.

Fewer Rate Cuts and More Inflation

The stock market did not take too kindly to the Fed’s message.

The Dow closed lower by 1,123 points (2.58%) The S&P 500 dropped 178 points (2.85%). And the Nasdaq declined 728 points (3.62%).

Self-Serving FOMC Statement

Please consider the final paragraphs of the Transcript of Chair Powell’s Press Conference Opening Statement December 18, 2024.

The Fed has been assigned two goals for monetary policy—maximum employment and stable prices. We remain committed to supporting maximum employment, bringing inflation sustainably to our 2 percent goal, and keeping longer-term inflation expectations well anchored.

Our success in delivering on these goals matters to all Americans. We understand that our actions affect communities, families, and businesses across the country.

Everything we do is in service to our public mission. We at the Fed will do everything we can to achieve our maximum employment and price stability goals. Thank you. I look forward to your questions.

This Fed does not follow the data, does not serve the public, and has singlehandedly destroyed the housing market with an unwise mix of QE to infinity and rate cutting madness.

Higher inflation expectations coupled with today’s interest rate cut makes little sense. Nonetheless, the Fed cut rates today with only one dissent.

Congrats to Beth M. Hammack, who preferred to maintain the target range for the federal funds rate at 4-1/2 to 4-3/4 percent.

On the Fiscal Front

Earlier today I asked Do You Have Any Faith that Sheriff DOGE Will Reduce the Fiscal Deficit?

I don’t.

And if Trump does follow trough with budget handouts and huge tariff hikes as promised, inflation will leap.

An Interactive Exercise: What Would You Do to Balance the Budget?

On December 4, I offered An Interactive Exercise: What Would You Do to Balance the Budget?

Trump is proposing at least $2 trillion in deficit-expanding, tax cut ideas. DOGE would need to come up with $2 trillion just to keep the existing deficits.

I balanced the budget. Team DOGE hasn’t and won’t. But my proposals have the same philosophical issue.

How the hell is DOGE going to do a damn thing when Republicans will have a smaller majority than they do now?

Balancing the budget with tariffs is economic silliness. For example, if Trump raised tariffs on China, trade with China would collapse to nothing meaning revenues raised = zero. But US prices would rise.

I am open to alternative ideas provided they are mathematically doable.

Please click on the above link and see if you can balance the budget.